Insight Focus

Approval of the Fuel of the Future bill is positive for the biodiesel market. Projects for new plants and expansions should allow the production of 15 billion litres of biofuel by 2030. But does Brazil have enough soybeans, or will the feedstocks come from another source?

Biodiesel Booms in Brazil

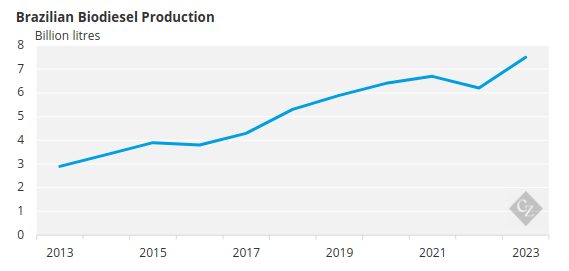

In recent years, the biodiesel market in Brazil has been growing at an accelerated pace. Between 2017 and 2022, production increased by 44%. Last year, there was a new leap in growth, with 7.5 billion litres, 20.9% more than in 2022.

Source: ABIOVE

Now, the market is preparing to expand even further due to an increase in demand driven by the Fuel of the Future bill, approved at the beginning of September by Congress.

The new legislation foresees an increase in the mixture of biodiesel in diesel from the current 14% to 20% by 2030, with an increase of one percentage point per year.

Even before the law was approved, the market was already moving. Companies like Be8 and Grupo Potencial, for example, announced investments in new plants worth more than BRL 3 billion last year alone.

The expectation is that at least 10 new factories will be opened in the coming years, accompanied by expansions of a series of plants. Investments worth around BRL 52.5 billion should be made by 2030, according to the Brazilian Association of Vegetable Oil Industries (ABIOVE).

Imports to Slow

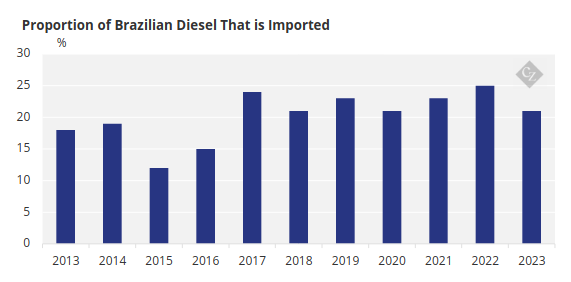

The increase in biodiesel production should serve the domestic market, reducing dependence on diesel imports. Today, the country needs to import between 20% and 25% of all the diesel it consumes.

Source: ANP

The expectation is that, with the entry into operation of plants currently under construction and the expansion of plants already approved by the Association of Petroleum, Natural Gas and Biodiesel (ANP), the country will be able to produce more than 12 billion litres of biodiesel already in the coming years.

To reach the target of 20% of the mix, as specified by the new law, it will be necessary to go further, reaching 15 billion litres in 2030.

“The market is confident, especially because several investments have already been announced and others are awaited, largely due to legal certainty and the increase in demand made possible by the new legislation,” says Daniel Amaral, director of economics at ABIOVE.

The increase in production capacity should also provide larger scale, bringing more interesting margins to the sector.

Business Opportunities Emerge

All this movement should impact the grain market. Today, soybean oil represents 74% of the raw material for biodiesel. The remainder is mainly made up of animal fat and fish oil.

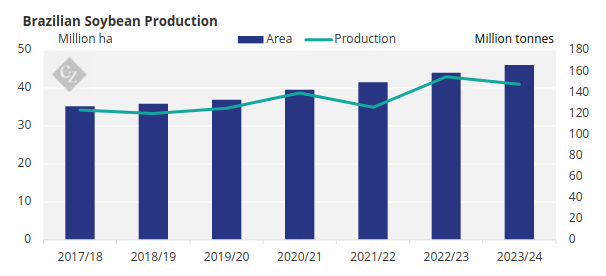

To be able to produce 15 billion litres of biodiesel, 38 million tonnes of soybean will be needed – almost double the current volume. It will also be necessary to crush more soybeans, bringing new business opportunities.

There will be no shortage of soybeans to manufacture biodiesel. After all, Brazil is the world’s largest grain producer and productivity continues to rise. Last year alone, there was a 15.8% jump in the average crop yield.

Source: Conab

The market, however, is betting on the diversification of oilseeds to reduce dependence on soy and animal fat. In addition to making biofuel production more sustainable, the use of a wider range of crops would bring another important advantage.

At the current rate, the market would be at risk of being flooded with soybean meal, which is obtained from crushing the grain during the oil extraction process. Using a wider range of crops could solve this problem.

This year, Embrapa entered a partnership with Bunge to develop new canola tropicalization technologies, which can be used to manufacture biodiesel. The aim is to adapt canola to the tropical climate, and the project began a few years ago.

At the same time, the Agronomic Institute (IAC) has been conducting a selection program for seeds with a high oil content from the macaúba palm tree. The work is the result of a partnership with the Fraunhofer Institute, a German research entity. The expectation is to increase the composition of biodiesel with these crops in the coming years.