Insight Focus

The government has proposed to extend first compliance period’s allocation for one year. The extension brings the compliance period into line with the 2027 start of CBAM. Analysts say additional supply is ‘unambiguously’ bearish.

Proposed Delay in Compliance Period

The UK ETS market regulator has proposed delaying the start of the second compliance period of the market by one year, to allow the new annual allocation plan to sync with the start of the UK’s carbon border adjustment mechanism (CBAM).

Market sources and analysts say this move will extend the current surplus of permits for another year and is bearish for the market in the short term.

The market’s first compliance phase was originally intended to operate from 2021 to 2025, with the second phase starting in 2026 and running through to 2030. But the decision to launch a CBAM in 2027 would require a second adjustment to free allocations in the UK market.

The UK ETS currently hands out around 32 million free allowances a year to energy-intensive, trade-exposed industries such as iron and steel, cement and aluminium. This free issuance of permits is set to decline over time as the UK ETS follows a long-term trajectory to zero emissions.

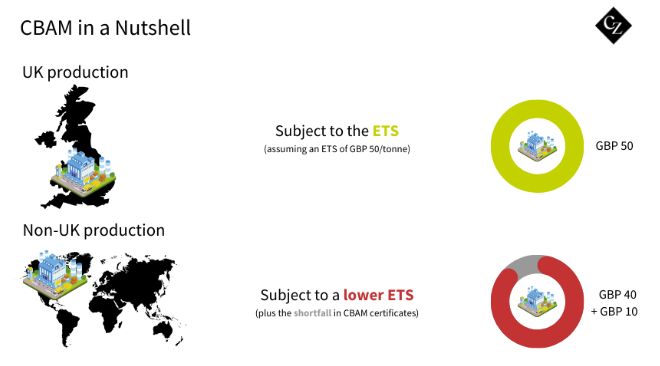

However, the launch of the UK CBAM complicates this trajectory. CBAM will require importers of energy-intensive materials from countries without a carbon price to pay for the carbon emissions embedded in those goods’ production. It will also mean that UK-based producers no longer require protection from international competition in the form of free UKAs.

The government’s decided that rather than carry out two successive adjustments to the free allocation programme – one in 2026 as part of the review of the market before the second compliance period, and another in 2027 to reflect the introduction of CBAM – it would be better to simply extend the first compliance period by a year and adjust allocations in 2027.

The government published a consultation document in late September and is seeking responses until October 11.

Market Reactions and Future Outlook

Analysts have judged that the proposed delay to the second compliance phase represents a short-term increase in supply, since the government appears to be proposing a similar free allocation in 2026, rather than a reduced cap in line with the 2030 goal of a 68% cut from 1990 levels.

Extending the current allocation by one year is “unambiguously bearish” for the UK ETS market price, one UK analyst said last week, as the extension represents an “aggregate increase to supply”.

The regulator also auctions UKAs every fortnight, and the 2024 schedule foresees a total of 69 million allowances being sold. This gives a total supply of 101 million UKAs in 2024, compared with 2023 verified emissions of nearly 97 million tonnes.

Other market stakeholders pointed out that while the delayed start to the second phase may be bearish in the short term, it will mean that the adjustment in 2027 is even steeper than originally planned, and that supply will fall by more than previously expected.

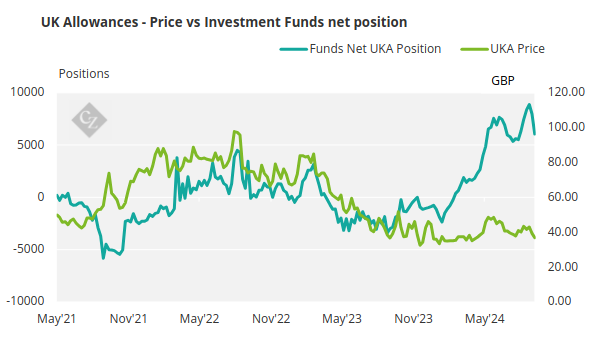

UKA prices peaked at just over GBP 50/tonne in June as traders anticipated ambitious policies from the incoming Labour government. However, they have since been falling as there have been no UK ETS-related statements or policy initiatives announced since the summer election.

Nevertheless, prices are currently viewed as having support from speculative buyers in the low- to mid-GBP 30s, evidenced by weekly position data, which shows investment funds holding on to their record long positions, while also taking on new protective shorts in the last week.