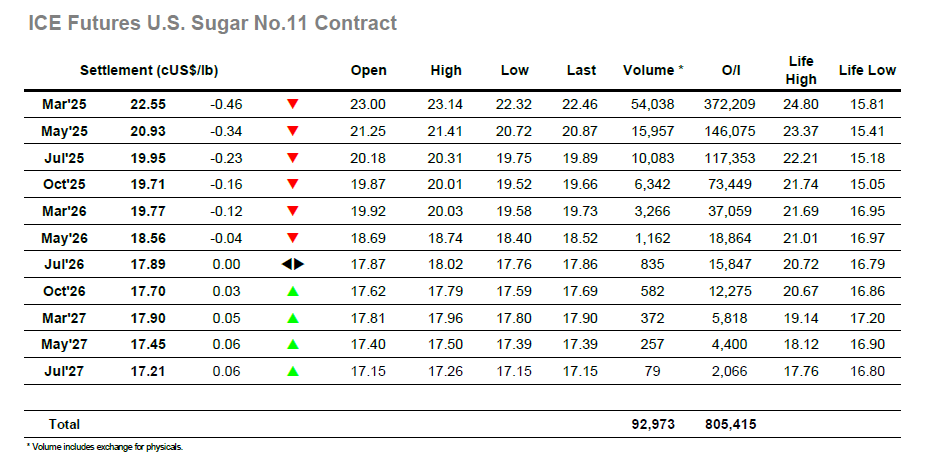

March’25 was just a single point lower as we got underway, however there was a lack of any notable buying through the early part of the day and so values drifted down to sit near to 22.80. Fridays COT report showed a modest growth in the speculative long holding to stand at 71,996 lots, pretty much in line with expectations with the live situation likely to be similar having seen the market broadly sideways over the past three sessions. Specs did show some desire to perk the market up at the end of the morning and highs were recorded at 23.14, however there was no depth to their efforts and liquidation followed and sent values back into the morning range. Having failed to work upwards some weakness emerged through the afternoon and long liquidation will have been a factor as the price slipped back by some distance to a low at 22.32, though a lack of consumer pricing interest will also have played its part with volumes light considering the scale of the movement. Spreads too took a hit, with March/May’25 falling back to stand at “only” 1.58 points, still a huge premium which acknowledges the physical picture. There was a bounce away from the lows during the final couple of hours, though values continued to show a sizable loss, with settlement at 22.55 as we play back down the range of the last few days.

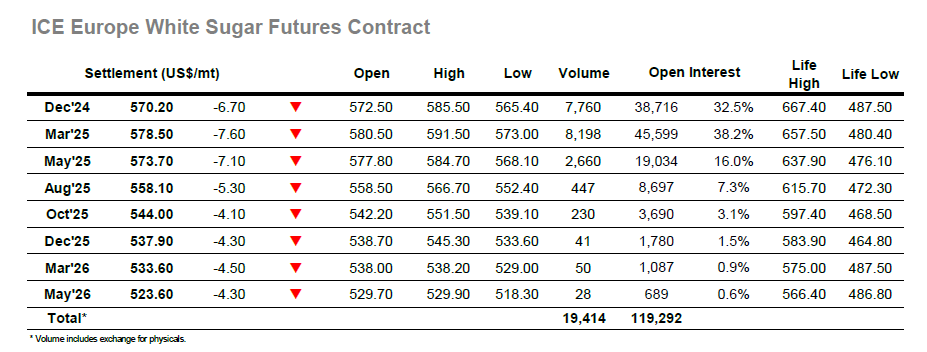

There was some selling for the opening which immediately knocked Dec’24 down beneath $570.00, though these losses were reduced in part as the price looked to consolidate around $573.00. This weakness outstripped that for No.11 and sent the March/March’25 white premium down beneath $77, however that was recovered with a degree of interest across the later morning as the market climbed up into the $580’s and took the premium above $80 in the process. There was a lack of fresh news and so the market was left to flit around again within similar parameters to those seen through last week with the specs dominating the flat price direction. This saw values diving back through this range during the afternoon to lows at $565.40, but though volume was respectable this was in large part doe to the Dec’24/March’25 spread which saw almost 4,600 lots change hands. The later afternoon did see prices move away from the lows as some short covering took place with Dec’24 settling almost $5 above at $570.20. Last weeks low at $564.20 provided initial support, but unless that breaks a continuation of the current trading band seems the likely short-term route.