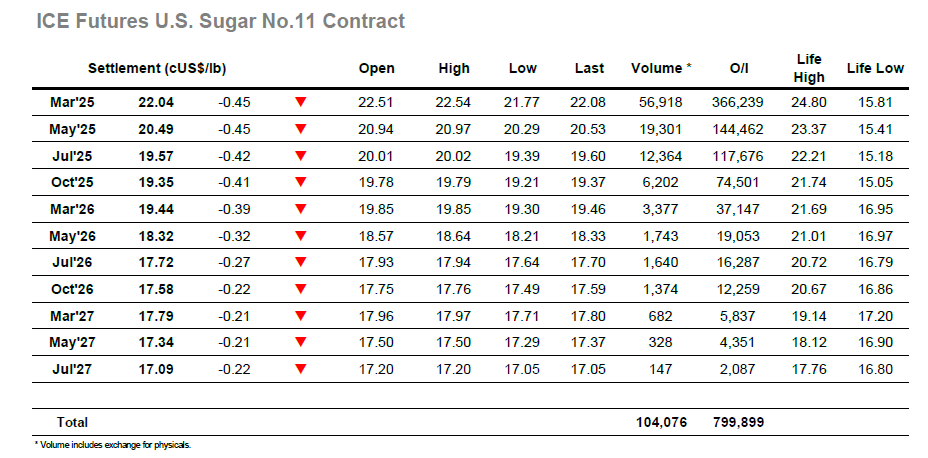

There was a familiar feel about trading this morning as the market made initial losses, with the lack of consumer buying interest at current levels consistently leaving the market vulnerable during the early part of the session. Unlike previous days there was no turnaround to this trend and through the rest of the morning the price continued to track lower with March’25 reaching 22.26 to once more be placed only a small way above the 22.15 low mark from September 30th. There soon followed a dramatic push lower as this support mark was tested and broken, plunging down through 22.00 and extending the loss to 21.77 despite volume across the 5 minute period being only just over 5.000 lots. That we didn’t see more long liquidation was a little surprising and with the plunge over as quickly as it had begun the market settled down to track either side of 22.00, allowing traders the opportunity to reassess. The sideways pattern endured through the following hours, and it was only the arrival of the final hour that drew a fresh effort to limit the losses as specs pushed the price back to 22.18. This was not sustained and as end of day liquidation occurred the market returned towards 22.00 on the call, with settlement at 22.04 leaving the chart looking vulnerable to additional downside pressure.

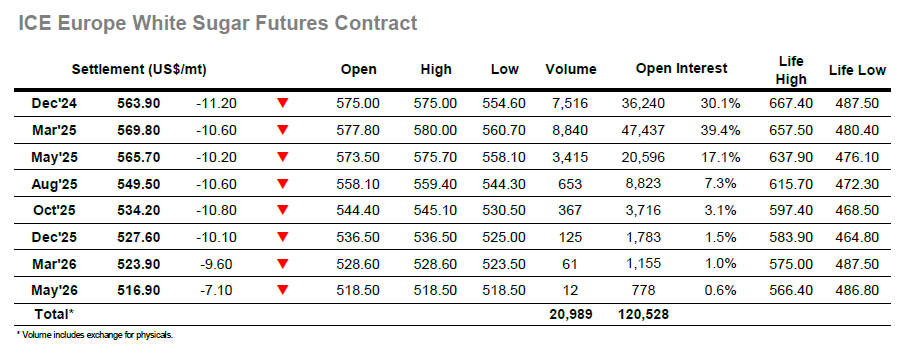

Dec’24 whites showed more positively yesterday, however that performance was forgotten as we resumed with trades back down in the lower $570’s. This seemed to set a trend from which the market could not recover and though volumes were low the rest of the morning saw the slide extend towards $565.00 and bring the recent lows back into view. There have been a few days on which that $564.20 level has survived, but that was not the case today with the early afternoon seeing the support tested and broken, leading to a quick fall which saw an additional $10 erased and lows at $554.60 before the market attempted to consolidate. To this end it was successful as a recovery to $566 preceded some prolonged range activity either side of $560.00, though longs will have been disappointed that this left the market appearing vulnerable. There were efforts to bring prices up a little further during the final hour, but these lacked the substance necessary to sustain and so prices were back in the $565 area as the close arrived. Spreads were weaker with Dec’24/March’25 settling at -$5.90, while the white premium recovered from a morning push down to $80 to end the session at $83.00. Dec’24 settled at $563.90, just beneath the former support which may prove important in the coming days.