Early activity saw the market trading either side of unchanged however once it got into its stride the movement focussed to the upside to see March’25 trading above 22.50 with less than an hour having elapsed. Fridays COT report showed an expected decline in the net speculative long position to 49,897 lots (-22,099) providing some capacity again amongst the smaller specs to play the long side should they wish, though recent sessions have shown that this is not necessarily the case. The market continued to hold steadily through into the early afternoon, but with no tangible interest emanating from the US there was a liquidation led decline to 22.03 before the picture levelled back out. The price returned to the mid 22.20’s where calm trading again took over, and it appeared with many traders travelling ahead of this weeks London sugar dinner that things were even quieter than they have been over the past two weeks. The final hours saw a continuing grind back up through the range with the uneventful session culminating in a close at 22.39 for March’24 and 1.69 points for March/May’25. With news still light and the market stuck to the centre of this months range the specs are likely to continue trying to probe higher though whether they have the necessary capacity to force a move remains questionable.

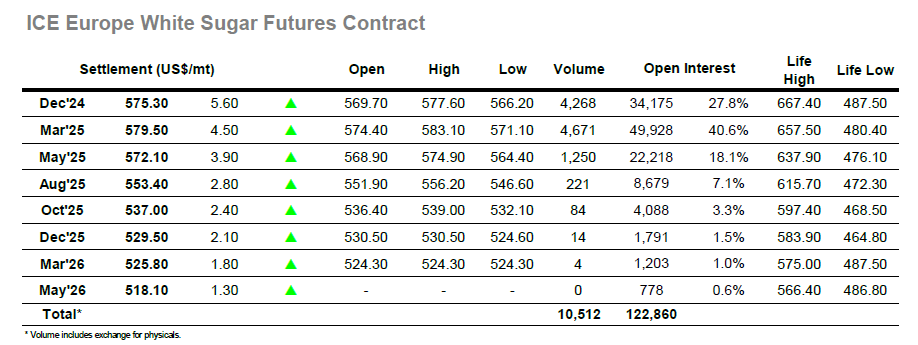

The early stages were generally positive as the market looked to build upon the return from last week’s lows, and across the first couple of hours Dec’24 climbed up to $577.60 to appear solid despite still sitting well within the confines of the Oct’24 trading band. The only hindrance to the recovery over the last few days has been the depth of buying interest and this was again proving problematic for the longs with the following hours seeing the price drift back into the lower $570’s where it sat against miniscule activity. There was some additional selling / long liquidation during the early afternoon which kicked the price back down into deficit at $566.20, but the lows were seen only briefly and as the day moved along the price returned to hold the lower $570’s once again. There were mild gains being shown for the white premiums, where activity was even lower than the for the outright, and March/March’25 moved beyond $86 intra-day while in the spread Dec’24/March’25 stabilised a little more to reach -$4.00. The mood remained positively and enabled the market to continue pushing upward during the final hour with an eventual Dec’24 settlement at $575.30 following some late position squaring, marking a positive conclusion to a slow day but with a lot of work to do if we are to mount a move to either end of the current range.