Insight Focus

The Chinese-controlled Chancay port in Peru has attracted attention from Brazil. Cargo flow, however, depends on improving Brazilian transport infrastructure. Source: Conab

COSCO Megaport Could Benefit Brazil

A new Megaport under construction 80 kilometres from Lima, Peru, could provide a new outlet for Brazilian grains exports. The port of Chancay, owned by the Chinese state-owned company COSCO Shipping occupies an area of 280 hectares, with berths almost 18 metres deep to receive large ships. It is scheduled to be opened in November by President Xi Jinping.

The Brazilian government is already preparing measures to facilitate trade with Peru. In September, Brazilian farmers embarked on a journey to Peru. In March, it was the turn of representatives of the Brazilian government, such as Planning Minister Simone Tebet, to visit the neighbouring country.

One of the first measures to allow efficient trade between both countries should be the installation of customs in Tabatinga, in Amazonas, which borders Peru. Improving transport infrastructure to Peru is also on the agenda. Initially, the vision is that there is room to increase exports to the neighbouring country, and from there to China.

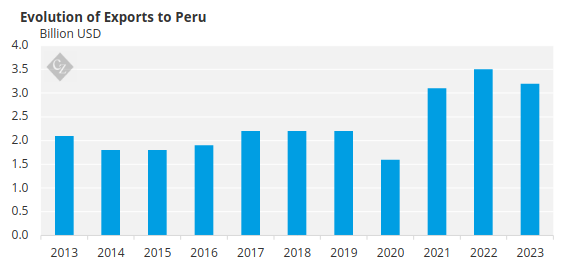

Source: Comex

A New Export Hub?

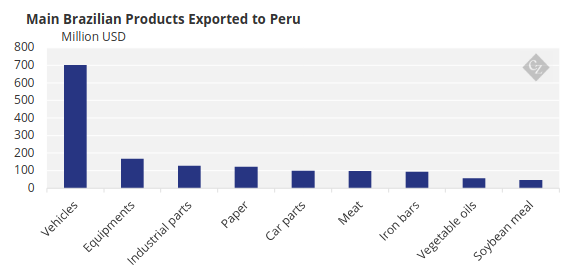

Today, exports to Peru total around USD 3.2 billion per year, 52% more than 10 years ago. With the new port, one of the main objectives for the Brazilian government is to boost the sale of agribusiness products, such as meat and vegetable oils, which correspond to 5% of total exports to Peru.

Source: Comex

But perhaps an even greater challenge is taking advantage of the new route to China to transport the main stars of Brazilian exports, such as soybeans.

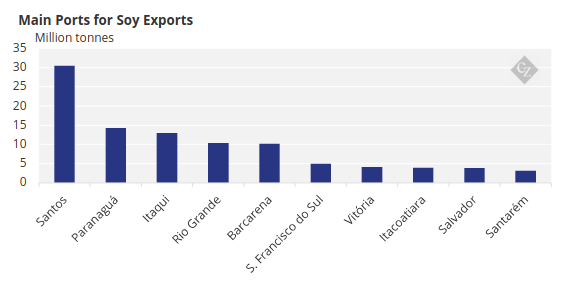

Today, soy exports are concentrated in the ports of Santos, which experience frequent congestion, Paranaguá and Itaqui, in Maranhão.

Source: Conab

One of the main advantages of the new logistics corridor, which will enable exports across the Pacific, is the travel time of ships. Instead of 45 days, the cargo could arrive in China in 15 days.

“Crossing the Pacific from end to end also has benefits, as it will not be necessary to pass through regions like Africa, where conflicts can intensify,” says economist Derek Scissors, from the American Enterprise Institute, who specializes in Chinese global investment and global trade.

Brazilian Logistics Pose Challenge

But, for this alternative to be worthwhile, the logistical cost needs to be interesting. And that’s where the challenge gets bigger.

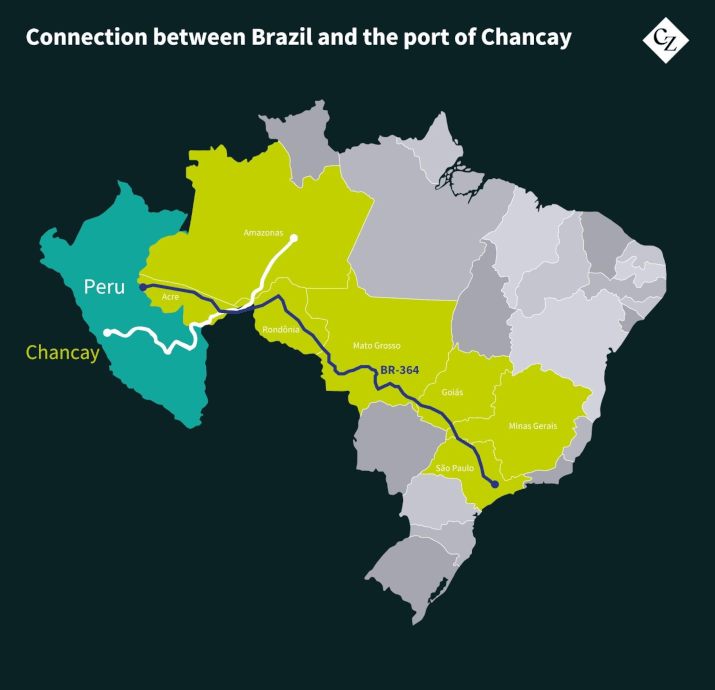

Today, there are few transport alternatives between the Central-West, the main grain producer in the country, and Peru. One of the main routes is BR-364, which runs from São Paulo to Acre, on the border with the neighbouring country, with several sections in disrepair.

The plan is to transfer part of the road management to the private sector. The government is expected to auction almost 500 kilometres of the highway, in Goiás and Mato Grosso, next year, when the bidding notice for the stretch between Porto Velho and Vilhena, in Rondônia, should also be launched.

The critical point in the flow of agricultural production in the Centre-West, however, is the railway system, which has been advancing at a slow pace.

Conceived in the 1950s, the Central-West Integration Railway, Fico, which will cross the cerrado almost to the border with Peru, only came to fruition in 2021. The first section, between Goiás and Mato Grosso, should be completed in 2028.

But with the port in Chancay almost complete, further investment in Brazilian infrastructure to create transport links could come from China. “Now, there is a new important asset, which is the port of Chancay, and China is interested in promoting exports through the Pacific,” says Hsia Hua Sheng, professor of international corporate finance at Fundação Getúlio Vargas. “In this context, it is important to improve the transport system in Brazil, something in which China can be a partner.”

Chinese interest in Brazilian infrastructure has already revealed itself in the form of financing. In June this year, the National Bank for Economic and Social Development (BNDES) signed a contract with the China Development Bank (CDB) for a loan of USD 800 million for infrastructure and agricultural projects. BNDES also intends to evaluate a new CDB credit line of USD 710 million.

New loans for the development of transport infrastructure are not ruled out. “Everything will depend on understanding between both parties, but there is room for this type of compromise,” says Sheng.