Insight Focus

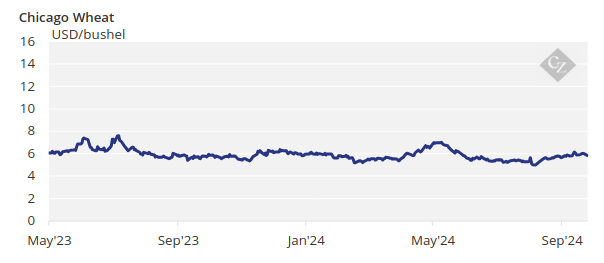

Corn faces downward pressure, while wheat strengthens. Market risks from Eastern Europe and Russia are priced in. Attention will shift to South American planting, with potential Russian export cuts likely to support prices.

Despite expectations, Chicago corn prices moved in the opposite direction to European grains, given the strong US harvest progress and crop conditions compared to the worsening situation in Eastern Europe and Russia, where corn and wheat yields are declining as the harvest progresses. As a result, Russia’s Ministry of Agriculture met with grain exporters last Friday to discuss the possibility of lowering export quotas.

With the October WASDE not cutting production as much as anticipated, the market’s attention remains on Eastern European corn production and Russian wheat production, though the latter is becoming less important as harvesting nears completion. In France, despite expectations of a larger corn crop, the delayed harvest pace is now a key area of concern.

The recent correction in corn prices should be sufficient, given the ongoing risks in Eastern Europe, Russia, and now France. As the European and US harvests conclude, the focus will shift to planting progress in South America, where Brazil is facing very dry conditions. Any reduction in Russian exports in the coming days could also be a key supportive factor for the market. We believe the downside for corn prices is now limited, and some risk premium is justified for European corn.

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 3.90/bushel. The average price since September 1 has been USD 4.11/bushel.

Corn Prices Fall as US Harvest Advances

The week began positively, particularly for wheat, as the ongoing dry conditions in Russia and the Black Sea region continued to pose an upside risk. However, good progress in the US corn harvest and a less supportive October WASDE report led to a negative shift later in the week. Corn ended the week down in Chicago and unchanged on Euronext, while wheat finished higher across all regions.

On the corn front, the October WASDE reduced ending stocks for the old crop to 1.76 billion bushels, down from 1.81 billion bushels previously. However, this reduction had already been factored in after the quarterly stocks report as of September 1 confirmed this figure. The lower carry is primarily due to higher consumption, including for ethanol, with a minor contribution from reduced imports and slightly higher exports, which only accounted for a 4-million-bushel change.

Despite the lower old crop carry, new crop production was increased by 17 million bushels, driven by a slight yield increase to 183.8 bushels per acre from 183.6 bushels per acre. Overall, the new crop carry was reduced by 58 million bushels, but since the market had already priced in a lower old crop carry and had not expected higher new crop production, the reaction was negative.

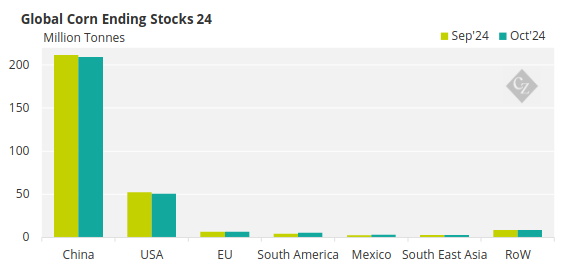

Global corn ending stocks were reduced by 1.83 million tonnes, with Russian production revised down by 500,000 tonnes to 13 million tonnes, and Ukrainian production lowered by 1 million tonnes.

Source: USDA

In the US, 64% of the corn crop is rated as good or excellent, unchanged from last week and compared to 53% last year. The US corn harvest is 30% complete, versus 31% at the same time last year and the five-year average of 27%.

In France, 78% of the corn crop is rated as good or excellent, down 1 percentage point from last week and compared to 83% last year. Harvest progress in France is slow, with only 6% complete, compared to 44% at this time last year and the five-year average of 40%. In Russia, 44% of the corn harvest is complete, with yields averaging 4.46 tonnes/ha, down from 5.94 tonnes/ha last year.

Corn planting in Argentina is 18.6% complete, while summer corn planting in Brazil is 25.9% complete, compared to 26.8% at the same time last year.

Wheat Markets Supported by Supply Concerns

On the wheat front, the October WASDE adjusted old crop carry to 696 million bushels, down from 702 million bushels, based on the September 1 quarterly stock report. New crop production was reduced, despite an increase in harvested acres, as yield dropped to 51.2 bushels per acre from 52.2 bushels per acre. Imports were raised by 10 million bushels, matching the increase in demand. New crop carryout was lowered by 16 million bushels.

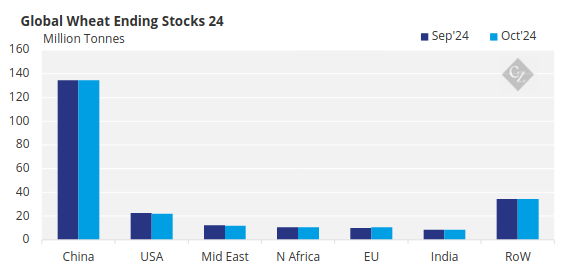

Global wheat ending stocks remained unchanged at 257.72 million tonnes, though Russian production was revised down by 1 million tonnes to 82 million tonnes, Ukrainian production increased by 600,000 tonnes, and Brazilian production was lowered by 500,000 tonnes.

Source: USDA

The Russian government held a meeting with grain exporters, stating its intention to bypass international traders, though details of the plan remain unclear. There is a risk that export allowances may be reduced, which could support the market. Estimates for Russian wheat production range from the government’s 84 million tonnes to 81 million tonnes from some private analysts.

In the US, the spring wheat harvest is now complete. Winter wheat planting is 51% complete, in line with last year and the five-year average of 52%. In Russia, 93% of the wheat harvest is complete, with yields averaging 3.01 tonnes/ha, down from 3.37 tonnes/ha last year. In Ukraine, winter wheat planting is 59% complete, compared to 54% last year.

In the US, dry weather is expected across the Corn Belt. In Europe, rains are forecast for the west, while the east remains dry. Brazil’s Centre-West region received some light rains last week, but the forecast for this week is for hot and dry conditions, except in the south where rain is once again expected. Cold and dry weather is forecast for Argentina.