Insight Focus

The US soybean industry faces high supply shortages. Analysts missed factors like plant maintenance delays and robust global demand, leading to current issues. As new capacity emerges, monitoring the soybean meal futures curve will be crucial for predicting shifts in market dynamics.

Misjudging Supply and Demand in the US Soybean Market

The US soybean processing industry is currently struggling to meet domestic and global demand for soybean meal, resulting in increased volatility in cash and futures markets. As new crop supplies from South America are set to come online in the next six months, traders are questioning why the supply and demand dynamics are often miscalculated. What are they missing in their assessments?

The most significant miss comes from the college of agricultural statisticians and forecasters (they will go unnamed), as well as public equity analysts— particularly those covering major oilseed processors like Bunge Limited and Archer Daniels Midland—who uniformly projected excessive US soybean meal supplies due to an expansion of US crush capacity.

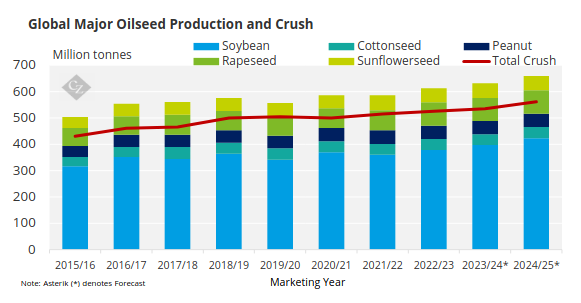

The analysts also predicted that the normalisation of Argentine soybean production and resulting product (meal and oil) availability for global markets following an epic drought two years ago would prevent US export competitiveness. To be fair, October marks a significant increase in US crush capacity for the 2024/2025 crop year, which began on October 1 and will continue through September 30, 2025.

Source: USDA

Consequently, the narrative surrounding soybean meal supply and demand, with this additional capacity coming online, will continue to evolve in the coming months.

The US soybean meal market needs the additional capacity right now as the conclusion to the 2023/24 product marketing year features all the signs of a market with demand overwhelming supply: an inverted futures curve, a nearly empty futures market delivery window, and a sharply inverted physical basis (more on this later).

The analysts’ excess supply of US soybean meal for domestic and global consumers is not here today and, in my opinion, will not manifest itself any time soon (if ever) even with new US crushing capacity coming online.

Tight Soybean Supply Persists

How do I know? Our company, White River Nutrition, serves domestic and global consumers from our Eastern Corn Belt plant (Seymour, Indiana) and Western Corn Belt plant (Creston, Iowa), so we have a pretty good feel for nearby supply and demand, although not anywhere close to the feel that the behemoths mentioned above have. I can tell you that demand significantly outstrips supply. Our nearby meal supplies are tight, and we receive daily calls from those seeking spot and fourth-quarter supplies, which we often cannot fulfil.

Current profit margins necessitate that we operate our facilities at maximum capacity, constrained only by our uncomfortable soybean ownership situation due to our farmer customers’ dissatisfaction with current futures and physical prices—an issue plaguing the entire US soybean processing and export industries.

For those interested parties who do not participate in the commercial trade, the go-to source (for us fundamentalists) for insight into US soybean meal supply and demand is the futures trade at the CME.

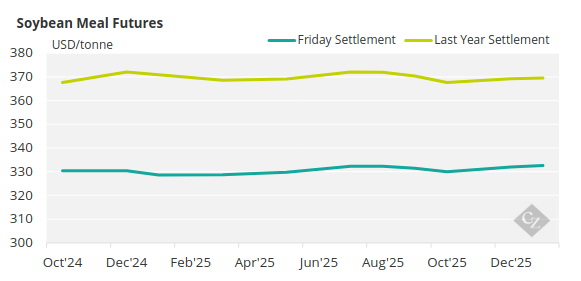

Let’s look at the CME’s soybean meal futures cure in its entirety. For us fundamentalists, the shape of the curve puts the balance between supply and demand into perspective like no other public source can reliably do. Look at the entire futures curve which is detailed below with Friday’s settlements (teal) and last year settlements (green):

Source: CME Group

The nearby October soybean meal contract is priced higher than the following December futures contract—a scenario we refer to as “inverted” in the agricultural world and “backwardated” in trading circles in Houston, London and Geneva. This situation is a classic indicator of a supply shortage.

The flat curve all the way through 2026 (at USD 330/tonne) suggests the agricultural behemoths and large-scale speculative traders who have the financial wherewithal to reshape the soybean meal curve into a carry structure have abstained from doing so for the time being. They would typically do so by selling nearby futures and buying deferred futures — a mountain of soybean meal strategy.

A year ago, the October to December spread was in a carry, known as “contango” in trading hubs, indicating an excess of nearby supplies that necessitated a discount to future prices. A logical conclusion is that the expansion in crush capacity for the 2023/24 marketing year was ultimately outpaced by demand at the end of that period, resulting in the inversion we observe this year compared to the carry situation from last year.

The second place for us fundamentalists to search for a dependable view on supply and demand is the home for excess supplies of agricultural commodities: the delivery window at the CME. The soybean meal delivery window remains nearly empty with a very paltry tonnage that Cargill continues to dribble into the window (not sure on that strategy which has been going on for about a year).

There are 126 shipping certificates available for anyone’s purchase. These purchasers must be able to use soybean meal from Cargill’s Sioux City, Iowa plant and I suspect they will not be there very long given a couple of recent production developments. More on this later, but the US physical trade continues to hear about start up operational issues from the new plants.

Factors Behind Supply Shortages and Analyst Misses

We have established that demand has outstripped supply as we approach the conclusion of the 2023/24 marketing year. And considering that the 2024/25 marketing year, which commenced on October 1, is characterised by extremely limited available supplies in the US soybean meal market—evidenced by an inverted curve and a nearly empty delivery window—let’s examine the factors that have led us to this point and contributed to the forecast errors made by analysts.

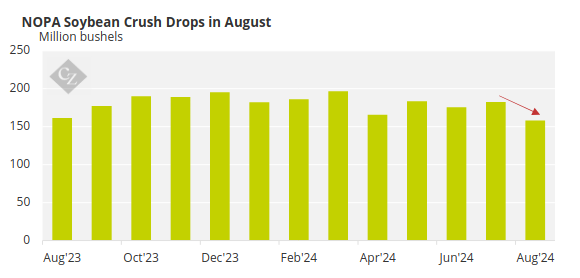

The “you have got to be kidding me” moment for the analysts occurred three weeks ago when the National Oilseeds Processing Association (NOPA) reported its members’ crush rate for August, which turned out to be the lowest for August in seven years.

Source: NOPA

The average of the college of analysts’ estimates for the August crush was 171 million bushels; the reality was 158 million bushels. This was an enormous forecast miss with even the most conservative analyst’s estimate overstating monthly crush by 4 million bushels.

Based on my best estimates, several factors contributed to this discrepancy:

- The renewable diesel industry’s used cooking oil scandal flooded the US vegetable oil market with cheap foreign imports, driving domestic soybean processing margins below breakeven for many higher-cost producers.

- The US soybean industry had its first chance to conduct serious seasonal maintenance without economic penalties, as lower summer margins reduced the pressure to rush repairs, unlike previous summers of strong profitability.

- Management extended maintenance timelines, as commercial teams calculated that it was better to prioritise long-overdue repairs over rushing production at low margins.

Aging Infrastructure and US Soybean Capacity

Which brings us to another point: how many analysts have put a random variable into their US soybean meal production models that takes into consideration the relative age of our industry (that impedes predictable crush rates at nameplate capacity)?

While US crush capacity may increase by 5.5% this year (according to the USDA’s current forecast) with new facilities coming online, this is contingent on legacy plants—operated intensely over the last four years due to strong margins—not experiencing breakdowns like older plants, as highlighted by a significant operational miss reported by ADM last week:

Do what? Take a plant down in the middle of harvest? You kidding me? That, my friends, is no way to run an agricultural business of any sort. We serve our farmer customers all year long but their peak need for our grain receiving services is at harvest. This would only be done if management could not see that one coming — if they could, someone has some explaining to do.

As the Reuter’s story highlights, the US export sector is super tight, and values at key soybean meal export corridors (PNW and Gulf) remain sharply inverted (backwardated) and in need of spot supplies (and White River Nutrition can’t help).

Unexpected Global Demand and Surging US Exports

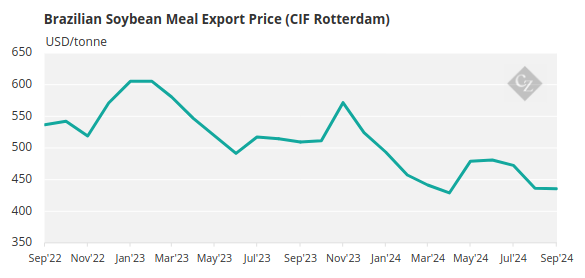

This brings us to the second miss for the college of analysts: global demand for US soybean meal, highlighted in the USDA’s most recent Oilseeds: World Markets and Trade. This demand has unfolded even as US prices remain at premiums to the largest (Argentina) and second largest (Brazil) soybean meal origins.

Source: World Bank

Look at the price chart above and the demand graph below:

Source: USDA

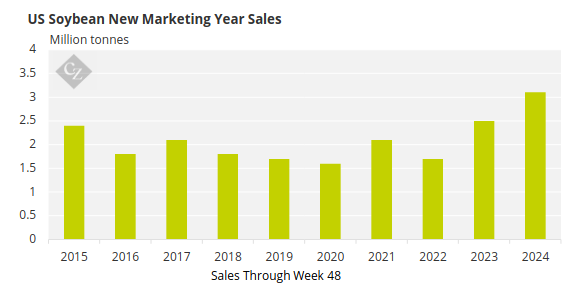

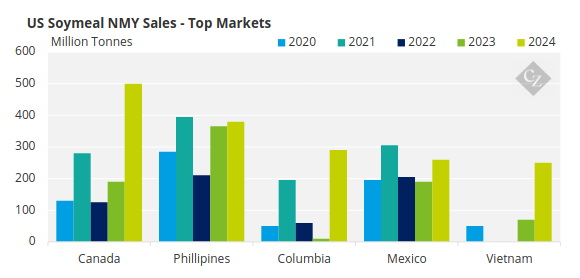

The USDA forecasts US exports up a blistering 9.4% in the coming 2024/25 marketing year led by Canada after a phenomenal 2023/24 year.

Source: USDA

Huh? Wait. What? Canada? Yes. Canada.

Did the college of analysts see that one coming? If any analyst did, congratulations. If you had asked me to name the sources of the largest growth in international demand for US soybean meal, I would have gotten close on numbers two through five, but in no way would I have guessed that Canada would be number one.

Soybean meal export growth for the US in the coming years is the KEY factor for the industry’s economic well-being and I predict that the USDA, the college of analysts, and those of us operating soybean processing plants will get surprise export tonnage increases month by month, quarter by quarter, and year by year.

I briefly touched on the Argentine soybean production returning to average and the Brazilians producing a good crop, so the US soybean meal export pace is happening in the midst of record global soybean supplies (and our chief competitors having soybean supplies and crushing capacity).

There is currently no shortage of feedstock supply from major soybean processing regions, which has compelled global consumers to purchase US production. Two years ago, during the severe Argentine drought, the situation was quite different; now, it has changed significantly.

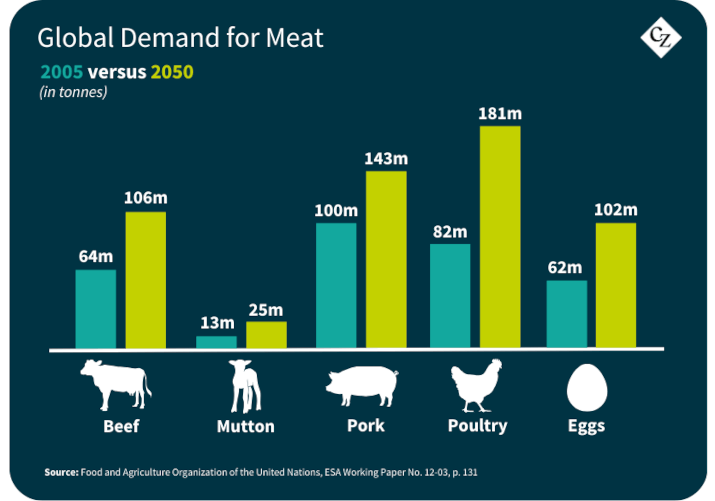

For those of you who read my articles regularly, you know that my thesis for investing in and expanding our US soybean processing industry is twofold:

- There are going to be more people in the world tomorrow than there are today. These new inhabitants of the planet and the ones who are already here will continue to eat more protein every year, primarily in the form of chicken, eggs and fish which require more soybean meal to feed.

- The major oversight among analysts—particularly those focused on large equity firms—has been an excessive emphasis on US renewable diesel policy and its impact on sustainable profitability. They have overlooked the fundamental driver behind the critical expansion and profitability of the US soybean processing industry: the growing global demand for meat.

Future Market Monitoring Strategies

Moving forward, I suggest closely monitoring the CME’s soybean meal futures curve and delivery window, both of which are easily accessible and updated around the clock on the CME’s website. These indicators will provide evidence of the expected surplus of US soybean meal in the futures market, which is the second area where it will become apparent. The first area is in the physical basis, but that information is less accessible unless you actively participate in the physical markets.

Crop production for our competitors in Brazil and Argentina is just getting underway, and monthly Oilseeds: World Markets and Trade reports are also easily accessible via the USDA’s website and provide useful insights into those origins’ supply and demand factors.

A crop shortfall in either location this year will keep already hot demand for US soybean meal even hotter. I doubt we will see the soybean meal mountain during the 2024/25 marketing year, but we remain vigilant, as a hungry world is poised to welcome the new US capacity.