Insight Focus

Raw sugar futures prices traded between 22-22.6c/lb over the past week. Speculators opened 24,000 lots of short positions. Both the No.11 raw sugar futures curve and the No.5 refined sugar futures curve have weakened.

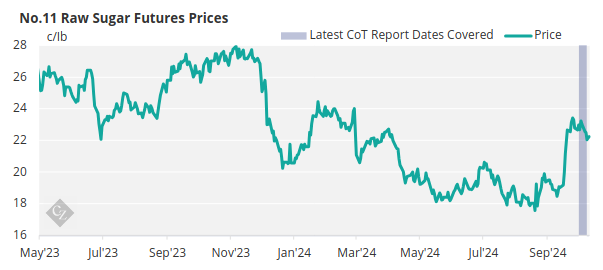

New York No.11 Raw Sugar Futures

The raw sugar futures market traded between 22-22.6c/lb, before closing at 22.2c/lb on Friday.

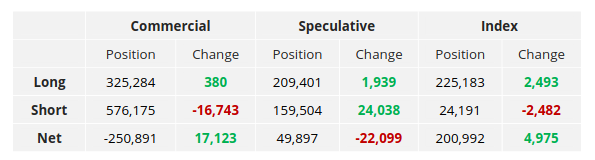

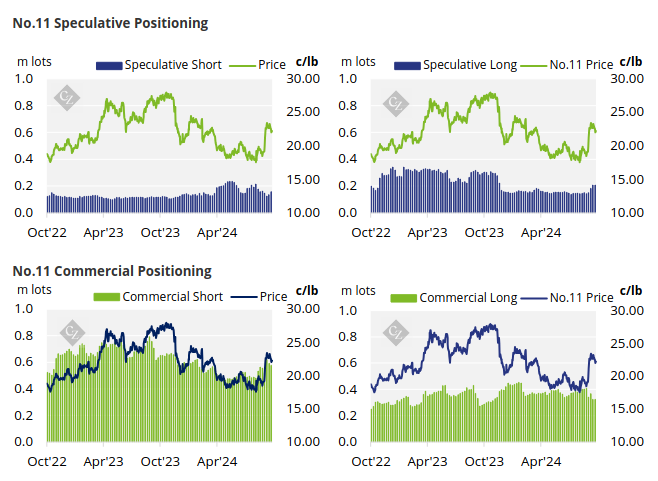

Over the past week, producers and end-users have taken contrasting actions in the sugar market. Producers closed out 16,700 short positions. Whereas end-users opened a minimal number of long positions adding just 380 lots of longs.

No.11 Commitment of Traders Report (8 October 2024)

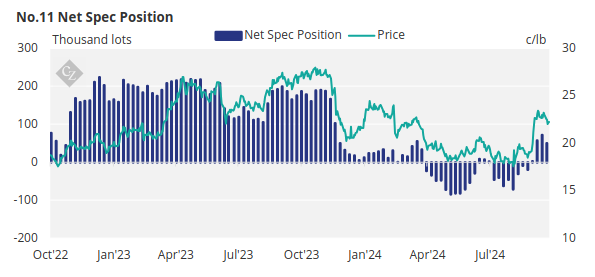

Speculators have added heavily to their short position, opening 24,000 lots of shorts over the past week. They have further opened just under 2,000 lots of long positions.

This has brought the net spec position down to 49,900 lots.

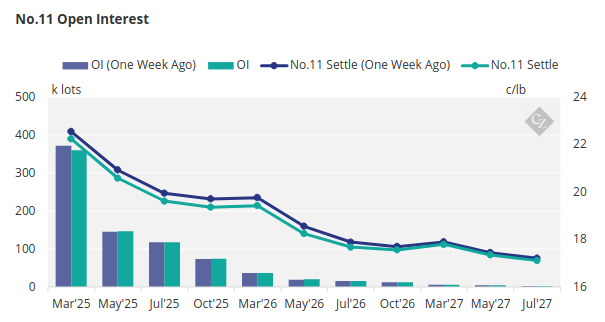

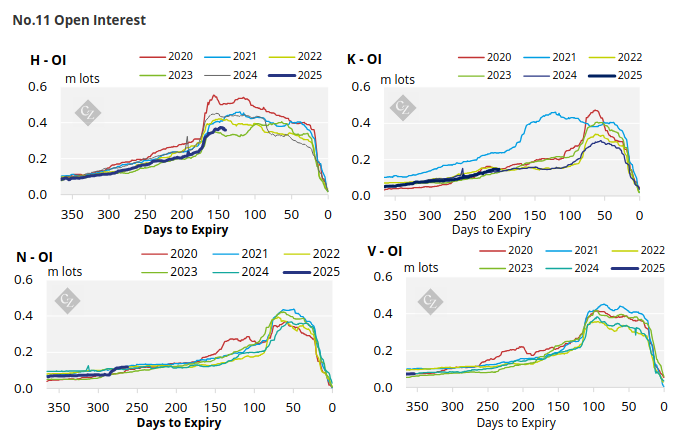

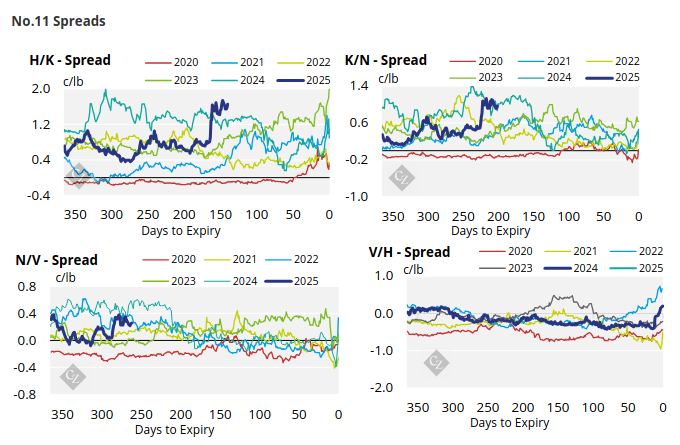

The No.11 futures curve has weakened across majority of the board and remains in backwardation.

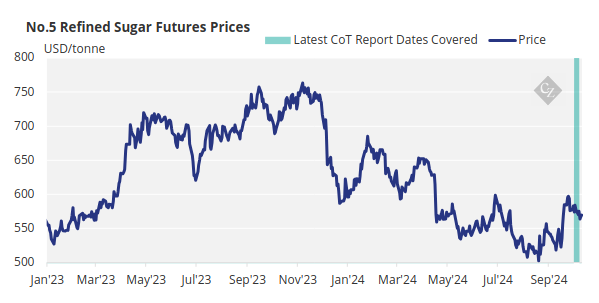

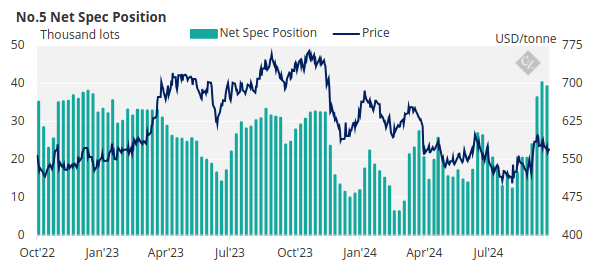

London No.5 Refined Sugar Futures

The No.5 refined sugar futures traded between USD 563-575/tonne and closed at USD 569.7/tonne on Friday.

Speculators closed out 1,000 lots of long positions, bringing the net spec position to 39,200 lots.

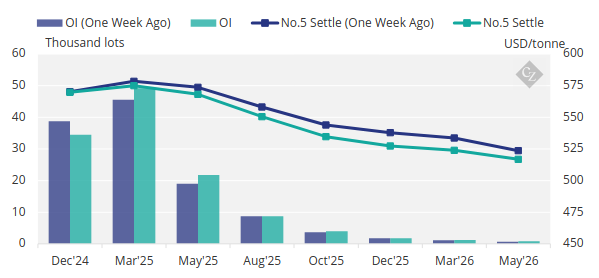

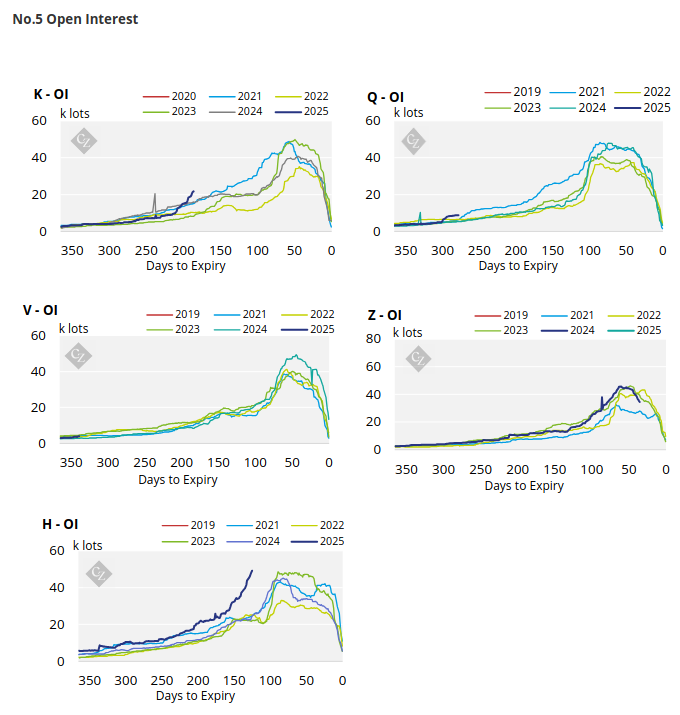

No.5 Open Interest

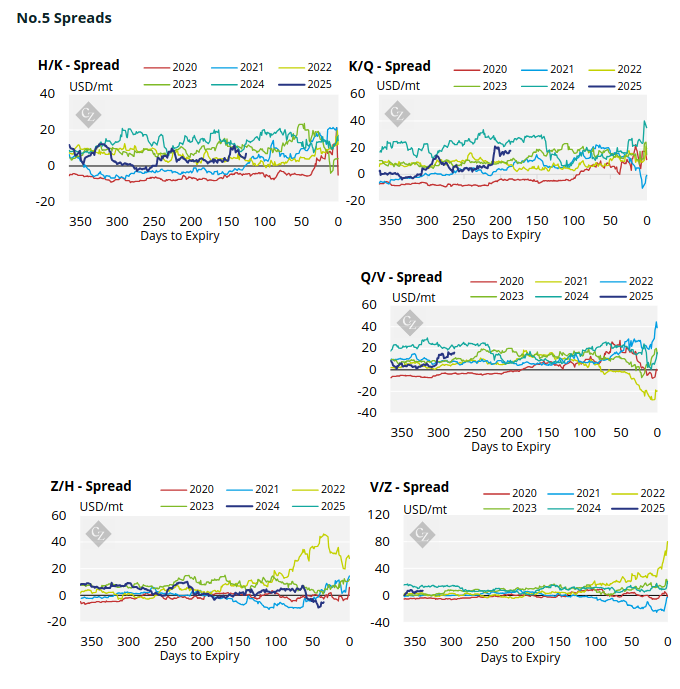

The No.5 refined sugar futures curve followed a similar trajectory to the No.11 and has weakened across the board.

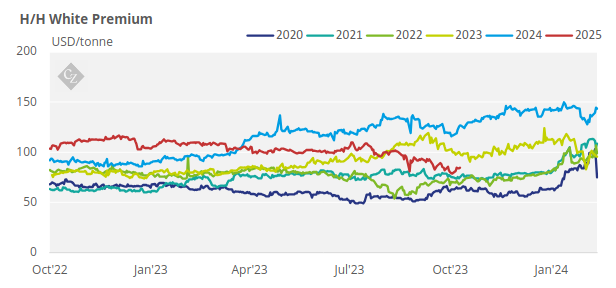

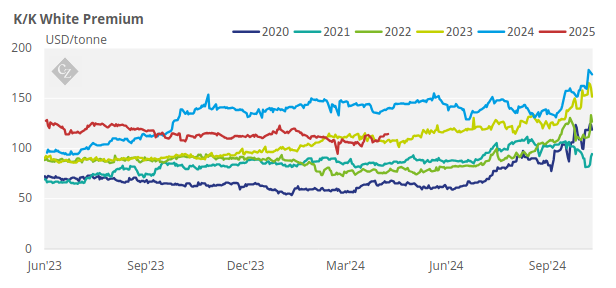

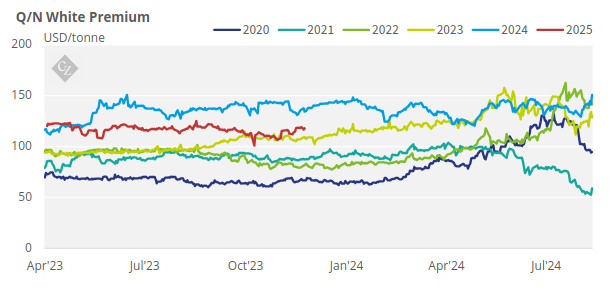

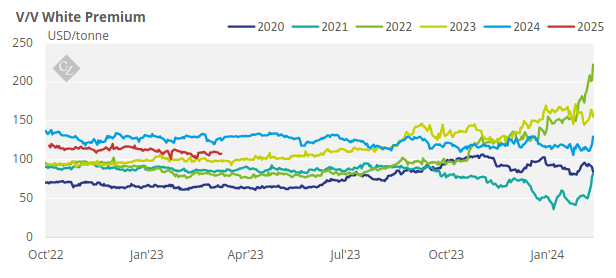

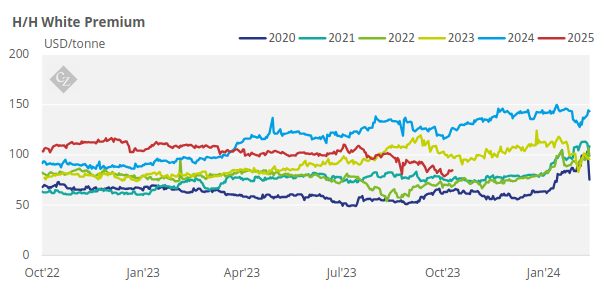

White Premium (Arbitrage)

The H/H white premium traded between USD 81-85/tonne and closed at USD 84.7/tonne on Friday.

Many re-export refiners need around USD 105-115/tonne above the No.11 to profitably produce refined sugar. The current white premium is below this level, signalling to toll refiners to slow their operations.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix