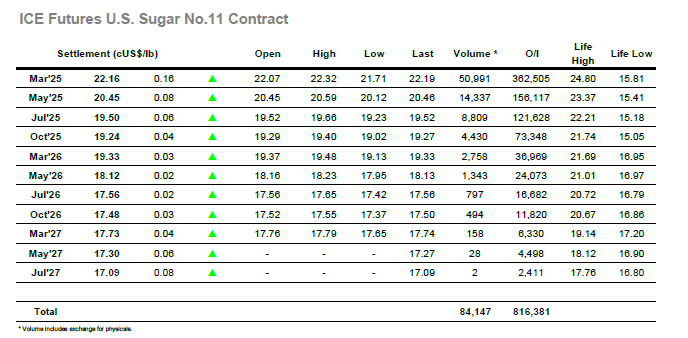

In the context of yesterday’s performance, the market was showing resilience as we opened north of 22c, and although the early buying faded away the market only dipped back to 21.97 and remained a reasonable distance from the recent lows. There was little change to the situation as the morning evolved with the calm consolidation being maintained, and the longs gradually found confidence from this to bring prices up to marginal new highs. This boded well for the busier afternoon period however the advent of the US day drew selling which changed the tone entirely and suddenly the recent 21.77 low mark was back in focus. Liquidation occurred from a few of the spec longs as this level was broken, however the reaction was minimal with no sell stops triggered and an equally paced recovery soon saw prices flirting with 22c again. A further test of the support followed but when this too proved unsuccessful the longs seized on the opportunity to drive prices back up and generate a more positive narrative. Fresh daily highs were registered at 22.32 ahead of a close at 22.16, leaving the market still anchored within a very marginally wider range as we move forward but with no sign of the current stalemate yet ending.

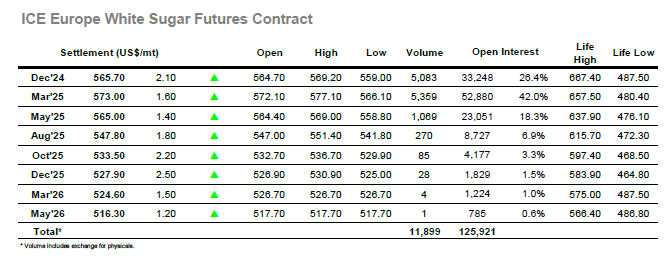

A wide opening range settled down into a period of marginally lower trading as the market struggled to find much traction following the pullback yesterday, though movements elsewhere were minimal and so it was the white premium which suffered with March/March’25 back down to the lower $80’s. By mid-morning prices had managed to pull back away from the lows and were sitting at a small credit as they followed the raws upward, but while this helped the perception there was a feeling that we were merely a passenger of No.11. Sideway trading followed which was only broken when nervous longs pushed prices back down in the afternoon, but though this led to session lows at $559.00 there was never any sign that last weeks $554.60 mark would be challenged. Instead, another period of “regathering” consolidation followed which eventually led to a short covering rally led by day traders, propelling Dec’24 up to $569.20 despite its previous apathetic prognosis. The gains were not maintained and so the final stages saw prices trading back into the range, Dec’24 ending with a modest gain at $565.70 to leave market parameters unmoved for another day.