Insight Focus

Another expected India tender supports higher urea prices. India is pausing DAP imports, but global demand may drive prices up. Potash prices have stabilised in Brazil, while ammonia markets await the November Mosaic-Yara contract.

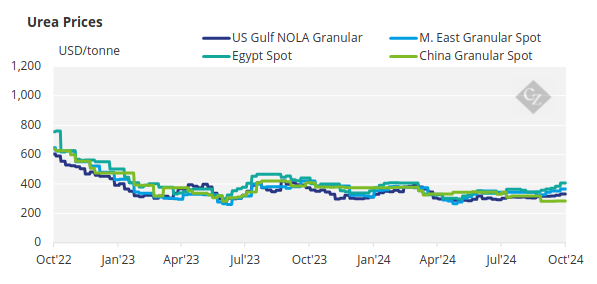

India’s Tender Fuels Urea Price Surge

India is rumoured to be entering the market with another tender imminently. However, most in the urea trade believe the announcement will likely be made sometime this week, ahead of the Diwali festival on October 31.

According to insiders, India will need an additional 1.5 million tonnes of urea before the end of January 2025. The previous tender, overlapping with the last one, led to disappointing results, securing only 566,000 tonnes.

It is expected that L1 prices in India this time will exceed USD 400/tonne CFR across the board, with no significant outliers. The market has reacted inconsistently, with prices rising in Southeast Asia due to limited availability.

A recent tender in the Philippines saw prices between USD 405-410/tonne CFR, up approximately USD 5/tonne from a previous tender. However, demand remains subdued in other regions, particularly Brazil, where a sanctioned cargo from Iran reportedly traded at USD 370/tonne CFR, while conventional urea supply is priced at around USD 385/tonne CFR.

Iranian producers are pushing for higher FOB prices, with the last reported sale at USD 322/tonne FOB. They are now aiming for closer to USD 330/tonne FOB, although there are currently no bidders at that level.

In Egypt, FOB levels have retracted to around USD 400-405/tonne FOB, with European buyers seeking a USD 20/tonne reduction. A Middle East granular urea cargo was reportedly sold at USD 390/tonne for full November shipment, but this transaction is yet to be confirmed.

Meanwhile, US Gulf barge prices have retracted slightly, with November prices at USD 330/short ton (USD 363/tonne) FOB, while October offers are lower, around USD 323-325/short ton (USD 356-358/tonne) FOB.

The outlook for urea prices in Southeast Asia appears stable to strong, mainly due to limited supplies. The Indian tender is expected to push up urea prices, and other markets may need to increase their offers to secure volumes.

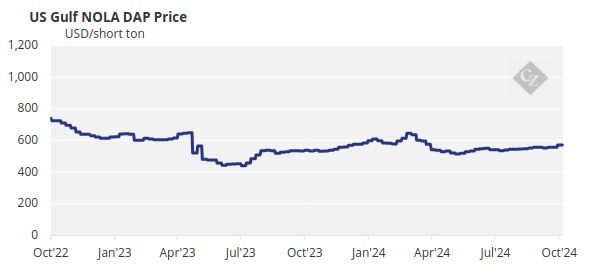

DAP Prices Set to Rise

In the processed phosphate market, India is taking a breather in anticipation of Diwali celebrations on 31 October. The most recent DAP sale, reported from Ma’aden in Saudi Arabia, was at USD 643-644/tonne CFR, while spot traders are offering closer to USD 650/tonne CFR. Forward offers are around USD 640/tonne CFR.

India’s DAP import prices have surged since May, with the benchmark price rising from a low of USD 510/tonne CFR on May 9 to USD 643/tonne CFR, a 26% increase. DAP stocks in India remain low, with September sales reported to be 50% lower than the same period last year.

Chinese DAP prices have fallen slightly for larger parcels, with some as low as USD 610/tonne FOB, though smaller sales in Southeast Asia are still at USD 625/tonne FOB.

In Brazil, suppliers are holding MAP prices at USD 635/tonne CFR, although market liquidity is limited. One supplier reported sales for November loading at USD 635/tonne CFR, with prompt supply tight. However, fresh bulk MAP sales to Brazil are expected to yield lower prices due to declining prices for TSP and SSP. Brazilian market participants have noted increasing downward pressure on MAP due to poor affordability.

The outlook for processed phosphate prices remains strong, with Morocco’s OCP managing supply, deepening production issues in North America, reduced exports from China, high demand in India and a looming 1-million-tonne DAP import tender in Ethiopia. These factors leave little room for those hoping for lower prices.

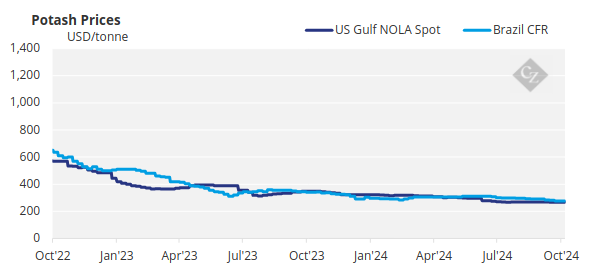

Brazil Stabilises Potash Prices

Brazil set the tone for the potash market this week, with prices holding firm, while producers are looking to Pupuk Indonesia’s latest tender to drive upward momentum in Southeast Asia. Delivered spot sales in Brazil remained stable this week, marking the first signs of price stability after a steady decline since May. Prices were assessed at USD 280-285/tonne CFR.

Producers are optimistic that prices have reached their lowest point, although further declines cannot be ruled out due to ample supply. The Pupuk Indonesia MOP tender has been the focus in Southeast Asia, with offers reportedly at USD 310/tonne CFR. However, there is still no consensus on current market levels.

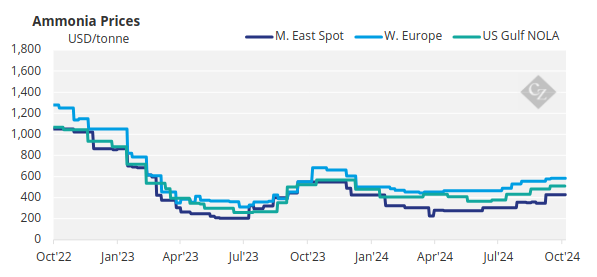

Ammonia Market Awaits Price Update

Ammonia markets have been quiet this week, with little trading activity and benchmark prices remaining unchanged. The market is awaiting price guidance from the Mosaic-Yara November contract, and many expect a rollover of the USD 560/tonne CFR price. The ammonia price outlook is expected to remain stable in the coming weeks.