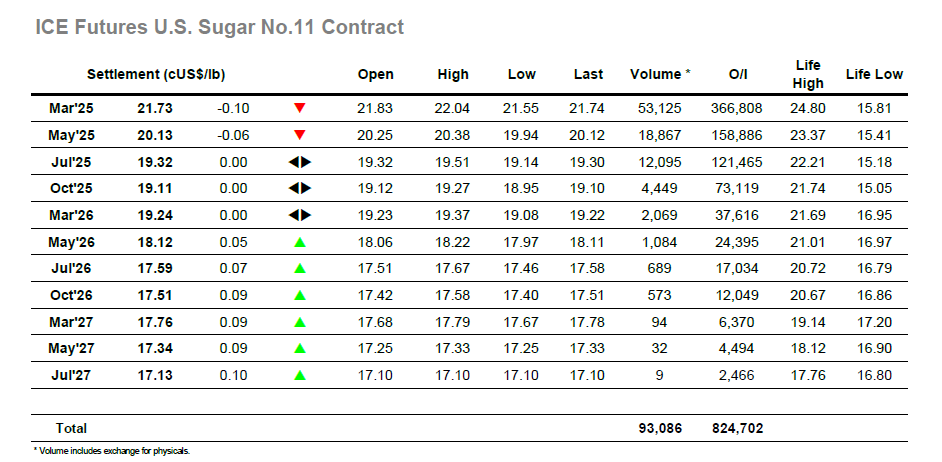

The market chopped wither ide of overnight values through the early part of the day however there was limited volume changing hands and the continuing quiet made it difficult to generate momentum in either direction. As a result, the price was little changed through to late morning at which point some light pressure started to be applied from traders keen to test down to yesterday’s lows. It had the desired effect with slightly more aggressive selling following in line with the start of the US morning to break beneath yesterday’s mark and trade to 21.55, though with stops still absent and no sign of longs panicking out it was quickly followed by a sharp corrective rally which extended into credit and a daily high at 22.04. Much like the downward move there was no follow-on momentum generated on the recovery and so the market settled back down, sitting calmly within the range to extend the current tedium for another session. There was a dip back into the 21.60’s later in the afternoon though it didn’t lead to any new pressure upon the lows and instead the final hour played out calmly to leave marginal lows in place for nearby prompts. March’25 settled at 21.73 while March/May’25 was a few lower at 1.60 points as we move to the middle of the week still looking for the trigger which may bring some more decisive movement.

Dec’24 continues to struggle to find any real momentum and so the morning trading pattern which saw price action to both sides of last nights $563.10 closing mark was largely expected. The picture only enlivened around noon when a small push to fresh daily lows again ended well above the monthly low mark before the resultant short covering rally drew in some day trader long interest to shoot prices up to $568.50 and stand some $9.50 above the daily low. Were it not for some Dec’24/March’25 rolling the volume would have been even more paltry than we saw, with the flat price understandably seeing light interest again as things settled back to sit in the range. There was some selling through the afternoon which pushed valued back down to the lower end however it was meaningless in the wider scheme of things with Dec’24 only a dollar lower as we moved through the final hour. Position squaring left values settling a couple of dollars down with Dec;24 at $561.20, while Dec’24/March’25 closed at -5.80 and the March/March’25 arb at $88.00 to leave parameters unchanged for yet another day.