Insight Focus

Supply chain strategies hinge on 2024 US presidential election results. Candidate policies will reshape trade and sustainability frameworks. Businesses must prepare for potential regulatory shifts affecting logistics and costs.

With the 2024 US presidential election only days away, businesses are paying close attention to how the candidates’ policies could influence the global supply chain. Whether Donald Trump or Kamala Harris wins the presidency, their approaches to trade, infrastructure and sustainability will have significant implications for how companies manage logistics, costs and international partnerships.

With industries still adjusting to post-pandemic challenges and evolving global trends, how will the election result impact the future of supply chains both in the US and further afield?

The Impact of Tariff Policies on Trade

Trade

Former President Trump has articulated a bold “America First” strategy, which includes implementing a 10% tariff on all imported goods and an unprecedented 60% tariff on goods imported from China. This dramatic increase in tariffs aims to protect US industries from foreign competition and to incentivise domestic production. Trump’s previous tariffs, which impacted over USD 370 billion in goods, would set a precedent for similar actions in a potential second term.

Shipping analysts predict that these new tariffs would push companies to rush imports from alternative countries, particularly in Southeast Asia and Latin America, to mitigate the effects of increased costs.

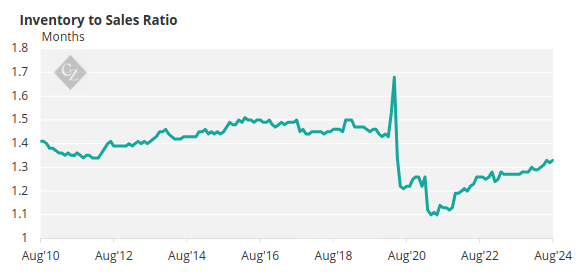

As detailed in our previous article on Trump’s Proposed Tariffs, US retailers have already begun increasing their inventories in anticipation of higher tariffs, as concerns about Trump’s potential victory mount. This proactive approach has contributed to rising import volumes, as companies aim to secure goods before potential tariff implementations.

Source: St Louis Fed

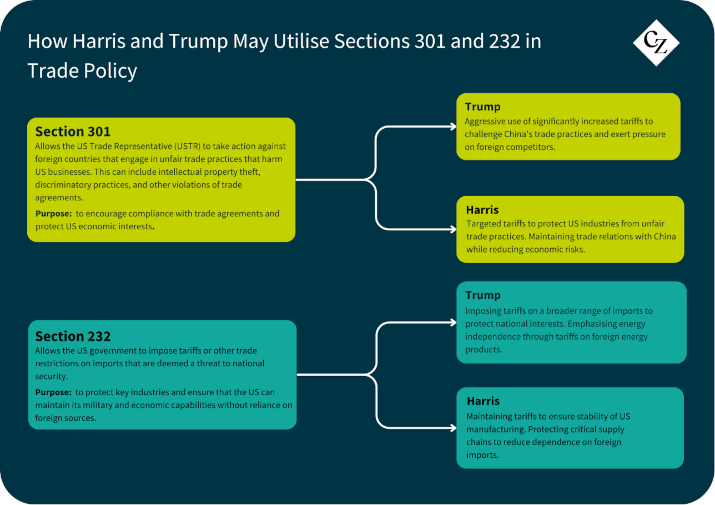

In contrast to Trump’s aggressive tactics, a Harris administration is expected to adopt a ‘de-risking’ strategy, which seeks to maintain tariffs while fostering a balanced relationship with China. Harris would likely continue the use of tariffs under Section 301 and Section 232, focusing on addressing critical issues such as intellectual property theft and forced labour without completely decoupling from the Chinese economy.

Diplomacy

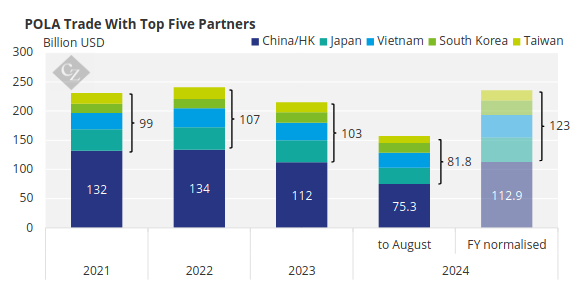

Trump’s proposed tariffs would likely escalate tensions with China, one of the US’ largest trading partners. Gene Seroka, Executive Director of the Port of Los Angeles, has noted that after Trump’s initial tariff actions, the share of POLA’s business tied to China fell from 57% at the end of 2022 to the low-to-mid 40s by mid-2024.

Source: Port of Los Angeles

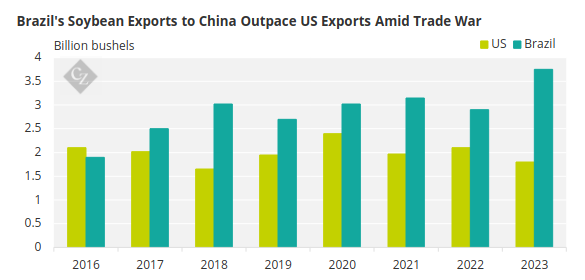

In this context, Brazil stands to gain significantly. The beginning of the US-China trade war marked a pivotal moment for Brazilian exports, with China quickly becoming the main destination for these goods.

By the end of 2019, China accounted for nearly 29% of Brazil’s exports, driven by key commodities such as soybeans, crude oil, and iron ore. During this period, Brazil emerged as a major beneficiary, especially in the soybean market, with 75% of China’s soybean imports sourced from Brazil by the end of 2018.

This trend is evident in how Brazil’s soybean exports to China have outpaced those of the US since the onset of the trade war.

Sources: USDA, Secex/Brazil

If Trump were to be re-elected, the likelihood of further escalating tariffs and trade tensions could intensify. This scenario would compel companies to further diversify their supply chains, thereby solidifying Brazil’s position as a critical trading partner for both the US and China.

Harris is also expected to prioritise multilateral trade agreements, revitalising frameworks like the Indo-Pacific Economic Framework (IPEF). This initiative aims to strengthen economic ties with key partners in the region, focusing on pillars such as supply chain resilience, tax reform and clean energy.

In foreign policy, a Harris administration would likely maintain and potentially escalate sanctions against Russia, building upon the Biden administration’s stance. Following Russia’s invasion of Ukraine, Harris would continue targeting over 4,000 Russian entities while adapting sanctions to counter third-country facilitators that support Russia’s economy.

Labour Versus Technology

A Trump presidency would prioritise the revival of traditional manufacturing industries like automotive, steel and energy, with a strong focus on bringing jobs back to the US. Trump’s economic vision relies heavily on deregulation to reduce costs for businesses and spur domestic production.

By lowering labour regulations and offering incentives for companies to return to the US, Trump aims to create a surge of blue-collar manufacturing jobs that cater to industries heavily reliant on lower cost, less technologically advanced labour.

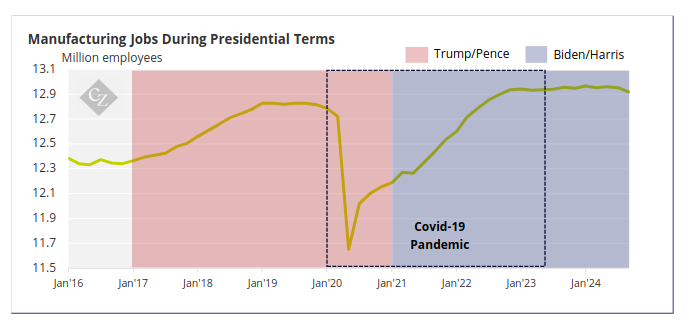

During his presidency, the US saw significant growth in manufacturing jobs, which continued to rise until the onset of the COVID-19 pandemic. This trend has persisted under President Biden, who has also focused on revitalising US manufacturing.

Source: US Bureau of Labor Statistics

In terms of labour policy, Trump’s approach would likely involve loosening rules around worker protections, which would reduce operational costs for businesses but also result in fewer benefits and lower job security for workers.

His past advocacy for right-to-work laws—which reduce the influence of unions—points to an emphasis on business flexibility over employee protections. For the supply chain, this could lead to lower labour costs, which would benefit sectors like logistics and warehousing that rely on a large, lower-paid workforce.

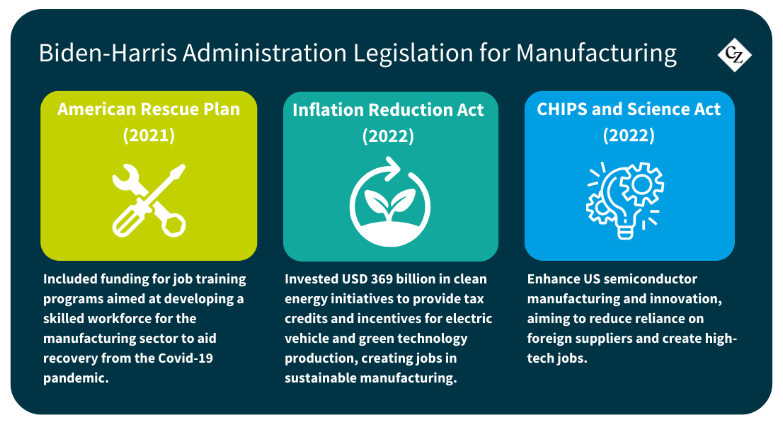

In contrast, a Harris presidency would continue the Biden administration’s emphasis on high-tech manufacturing and workforce development, with a focus on industries such as semiconductors, electric vehicles and clean energy.

Harris would build on initiatives like the CHIPS and Science Act, which has already provided billions of dollars in federal support to bolster US leadership in advanced technology sectors. For the supply chain, this would mean an increase in domestic production for key technologies that are critical to maintaining global competitiveness.

Harris’ labour approach would focus on upskilling the workforce and protecting workers’ rights. She would likely continue advocating for union support, wage increases and improved working conditions, which could raise labour costs for manufacturers and logistics companies.

For the supply chain, Harris’ policies could promote the localisation of high-tech manufacturing and a more skilled labour force. While labour costs may increase initially due to her emphasis on worker protections, companies may benefit from a more resilient and innovative supply chain in the long run.

Energy Policies Overlap

Fossil Fuels

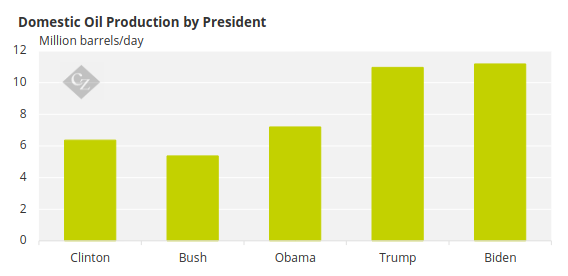

Fossil fuel production rose steadily under both Trump and Biden’s terms, driven by growing global demand and energy security concerns. During Trump’s first term, deregulation and a push for energy independence led to significant increases in oil and gas output. While Biden’s administration focused on clean energy initiatives, fossil fuel production continued to climb, partly due to market pressures.

Source: EIA

If Trump wins, his “Agenda 47” would expand domestic energy production by cutting regulations and fast-tracking approvals for oil, gas and coal projects. This move is expected to slow the shift to renewable energy, ease environmental protections and increase reliance on fossil fuels, which could impact supply chains focused on sustainability. Regulatory rollbacks at the Environmental Protection Agency (EPA) would likely result in more pollution-intensive manufacturing and a relaxation of clean air and water standards.

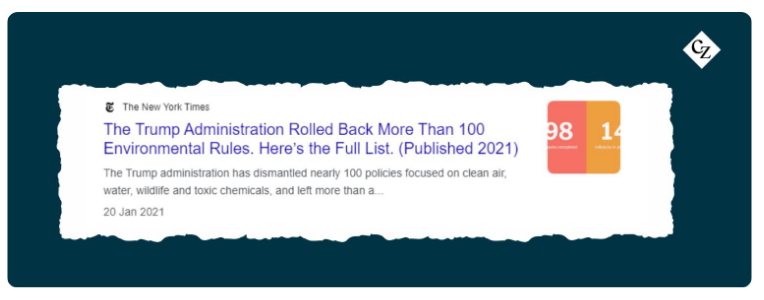

The New York Times previously released a list detailing 100 environmental rollbacks during Trump’s first term, highlighting the administration’s aggressive deregulatory approach. If re-elected, it could be assumed that similar actions could occur again, further compromising environmental protections and hindering progress towards sustainable practices.

For industries involved in energy-intensive manufacturing and logistics, this could lower operational costs in the short term but create greater environmental risks and public pressure, especially as global climate targets become harder to achieve.

Emissions Reductions

A Kamala Harris presidency would continue and likely accelerate the Biden administration’s focus on sustainability. Harris has pledged to achieve net-zero emissions by 2050, reduce greenhouse gas emissions by 50% by 2030, and promote significant investments in clean energy initiatives, including the USD 369 billion allocated in the Inflation Reduction Act. She aims to make electric vehicles 50% of new vehicle sales by 2030 and supports the rapid deployment of renewable energy while reinforcing US commitment to international climate cooperation through agreements like the Paris Accord.

Harris’s environmental agenda would likely strengthen the Environmental Protection Agency (EPA) by enforcing stricter emissions regulations and holding polluters accountable with measures like the proposed “climate pollution fee,” requiring companies to pay for their greenhouse gas emissions. These policies would encourage manufacturers to adopt cleaner technologies and prioritize sustainability in their supply chains.

Biofuels

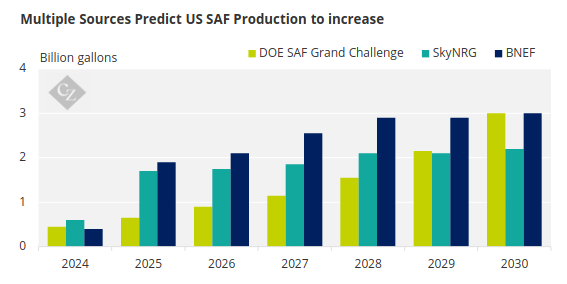

Additionally, under a Harris administration, sustainable aviation fuel (SAF) could see significant development, with increased investments aimed at reducing the aviation sector’s carbon footprint. This focus on SAF and similar technologies would support the industry’s transition away from traditional jet fuels, aligning the entire supply chain with global sustainability goals.

A key opportunity exists for corn and soybean producers to engage in this burgeoning market. By producing feedstocks for SAF, these agricultural sectors could not only contribute to cleaner aviation but also enhance their economic viability.

Source: ING

The Biden-Harris administration has expanded ethanol opportunities to benefit corn producers in the renewable energy transition, notably by approving year-round sales of gasoline with higher ethanol blends starting in 2025 for eight major farming states. Vice President Harris has emphasised her commitment to enhancing these biofuel opportunities to “boost high-quality job opportunities across rural America and enlist agriculture as a pivotal tool to fight climate change.”

Former President Trump also made notable advances in promoting biofuels during his administration. In 2019, the EPA and USDA announced agreement on the Renewable Fuel Standard that President Trump negotiated to support domestic ethanol and biodiesel production. EPA Administrator Andrew Wheeler praised Trump for his role in the deal.

The agreement aimed to expand biofuel requirements, ensuring over 15 billion gallons of conventional ethanol be blended into the nation’s fuel supply and streamlining the sale of E15 gasoline. In his current campaign, Trump emphasised his commitment to boosting ethanol production, declaring, “We won’t just increase ethanol production in our own country; we will make it our mission to export ethanol all over the world.”

Regardless of the candidate who wins the presidency, it looks like biofuel production will continue to receive significant support.

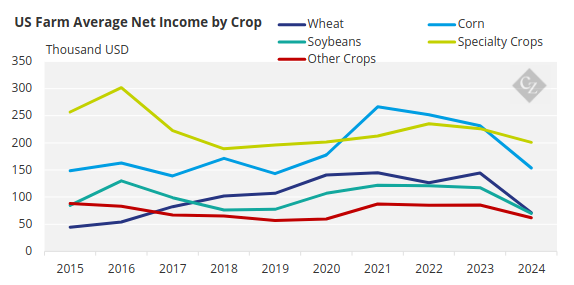

Trump and Harris’s Impact on Agricultural Policy

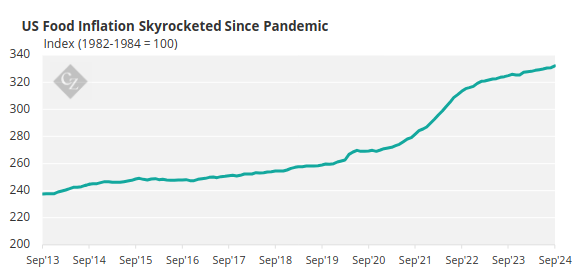

As discussed in one of our previous articles, US Farmers are facing tightening margins due to high debt burdens and the end of COVID-related disaster payments. While consumer food prices have surged, farmers are grappling with stagnating or declining income from key crops, coupled with skyrocketing operational costs. As crop prices for staples like corn and wheat continue to drop, the pressure on farmers intensifies, making agricultural policy a pivotal issue in the 2024 election.

Source: USDA

Donald Trump has long positioned himself as a champion for US farmers, but his record is marked by controversial decisions that could shape his future approach. During his presidency, Trump’s agricultural policies centred around deregulation, cost-cutting and a tough stance on immigration.

Labour

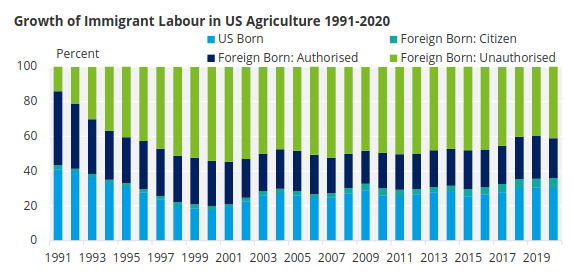

Trump’s hardline approach to immigration has raised concerns for farmers, as his administration conducted widespread raids on agricultural worksites, leading to the detention and deportation of hundreds of undocumented workers, particularly in poultry processing. While this crackdown resonated with his base, it has exacerbated labour shortages in farming communities that rely heavily on immigrant workers.

Source: USDA

If re-elected, Trump has pledged to continue following these policies, including mass deportations and tighter border control, though he hasn’t outlined specific plans for the H-2A visa program, which allows farms to legally hire foreign workers.

Harris’ approach to agricultural labour centres around reforming the immigration system to address the labour shortages that have plagued US farms. The Biden-Harris administration has expanded the H-2A visa program, allowing farms to recruit more foreign workers legally. Harris advocates for a system that balances strong border security with an earned path to citizenship for undocumented workers already contributing to the agricultural workforce.

Regulation

Another key element of Trump’s agricultural policy is deregulation. He has promised to roll back what he calls “burdensome and costly” regulations introduced under the Biden-Harris administration. These include environmental protections and labour safety regulations that he argues drive up costs for farmers. Trump’s approach is to slash regulations to lower input costs, which he claims will trickle down to consumers in the form of lower food prices.

Source: St Louis Fed

Harris, by contrast, is positioning herself as a champion of smaller farmers, offering incentives to help them compete against larger operations. She proposes increasing access to credit, land and markets for small and medium-sized farms. Additionally, she pledges to build new markets for farmers, while focusing on sustainable practices, with the Biden-Harris administration having allocated USD 20 billion to climate-smart agriculture under the Inflation Reduction Act.

Harris is also taking a direct approach to addressing rising consumer prices. She vows to pass the first federal ban on price gouging and has explicitly targeted the grocery, meat and poultry industries, accusing them of contributing to inflated prices. To combat this, Harris aims to expand competition within the food system by cracking down on unfair mergers and acquisitions involving major food corporations, with the goal of creating a level playing field for farmers and smaller producers.

Farm Bill

As for the Farm Bill, Trump has been supportive of maintaining strong safety net programs for farmers, such as crop insurance and dairy margin coverage. His campaign has hinted at strengthening reference prices for key commodities to ensure that farmers are protected from price volatility.

Although Harris herself has not taken a strong public stance on the farm bill, her vice-presidential pick, Governor Walz, brings significant experience in agricultural policy. His support for farm safety nets and rural development reassures stakeholders that a Harris administration would protect essential programs like crop insurance. Additionally, the Biden-Harris administration has backed increased funding for land-grant universities and research to enhance agricultural innovation, particularly in biotechnology and climate adaptation.

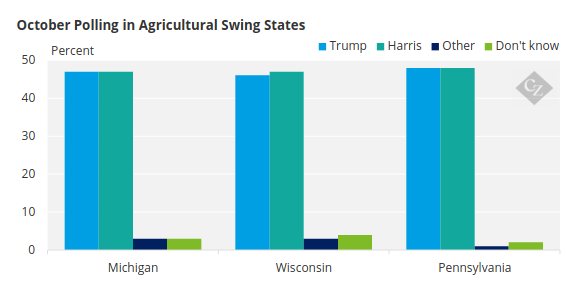

While Trump may hold a solid lead among rural voters, Harris is aiming to sway undecided voters in battleground states by focusing on creating equitable opportunities for smaller farms. This strategy is crucial, given that current polling shows the two candidates are neck and neck in key states such as Michigan, Wisconsin and Pennsylvania, with neither holding a lead beyond the margin of error.

Source: Redfield and Wilton Strategies