Insight Focus

Indonesia is considering placing a new levy on sugar imports to support its bioethanol program, but the government hasn’t yet provided full details on how it plans to finance this initiative. What will this levy mean for the sugar industry?

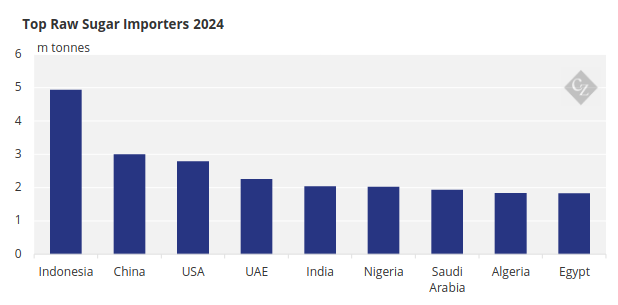

Indonesia, the world’s largest sugar importer, is considering introducing a new levy on sugar imports to support its bioethanol program.

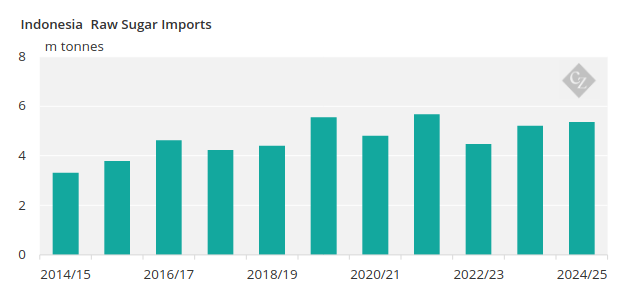

Given Indonesia’s reliance on imported sugar—around 5m tonnes annually—this potential policy shift could have significant implications for domestic sugar prices and the broader market.

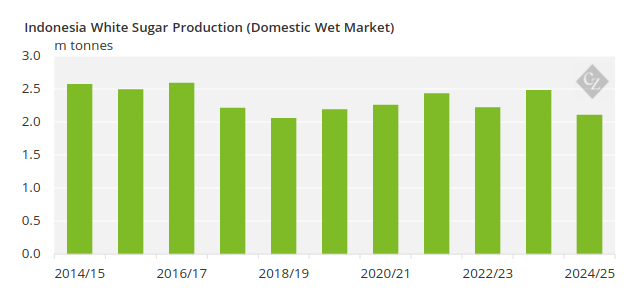

Despite growing demand from its expanding population and food and beverage industry, Indonesia’s domestic sugar production has remained relatively stagnant over the past decade, averaging around 2-2.5m tonnes annually in a good season. Indonesia is aiming to become self-sufficient by 2028 and have identified new sugarcane planting area in Papua.

The government is aiming to increase production to 3m tonnes a year by 2027. If this plan is successful, Indonesia will theoretically have more than enough land required for their self-sufficiency target for the wet market only.

However, until these self-sufficiency plans materialise, Indonesia remains heavily reliant on raw sugar imports to meet its current needs.

Currently, Indonesia imposes a 5% duty on sugar imports from Free Trade Agreement (FTA) partners like Thailand, Australia, and India, while non-FTA imports face a fixed duty of IDR 550,000 per metric ton.

Domestic sugar prices, typically between USD 850-950 per metric ton, are already significantly higher than global market prices, reflecting the country’s production-consumption gap.

If the government moves forward with the proposed levy, we could see domestic sugar prices rise even further, affecting consumers and businesses alike.

So, while the levy could help fund Indonesia’s bioethanol program, it risks putting upward pressure on domestic sugar prices. This is significant, given the government’s historical focus on controlling food inflation through cheaper world market imports.