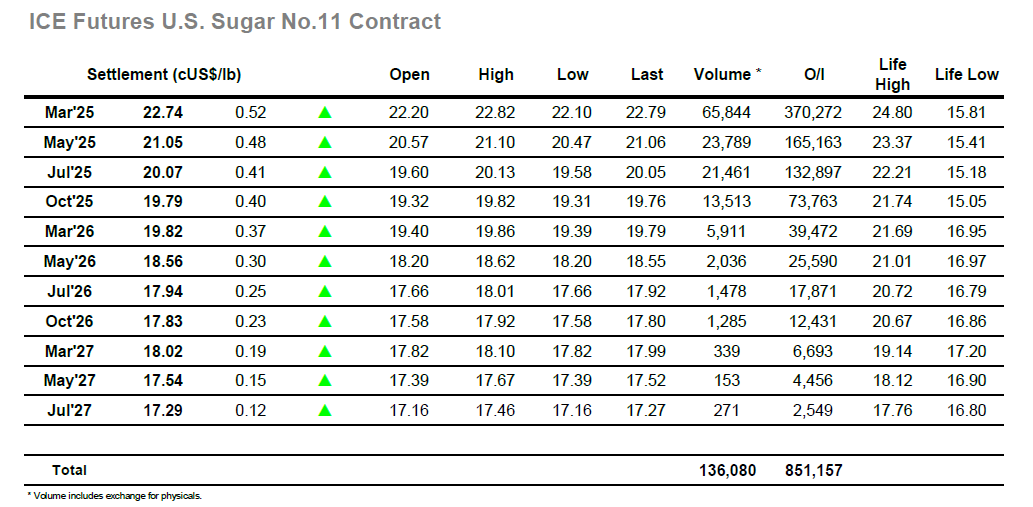

After trading broadly sideways so far this week, the market finally showed some directional conviction today. Mar’25 No.11 futures opened fairly flat, with very little to report on for the first 30 minutes or so though from there things began to take off. Strong buying saw prices steadily rally through the morning, briefly spiking through 22.8c/lb, up 60-points on the open. By lunchtime this upwards drive had run out of steam, consolidating just beneath the day’s high. With the US coming online, stronger selling allowed for some retracement, eroding back down toward 22.5c/lb with a few hours of trading to go. Momentum then picked back up again into the close retesting the 22.8c/lb resistance reached earlier in the day, before going on to settle at 22.74c/lb, up 54 points on the day. With this the HK spread strengthened by 4 points to break back through 170 points premium.

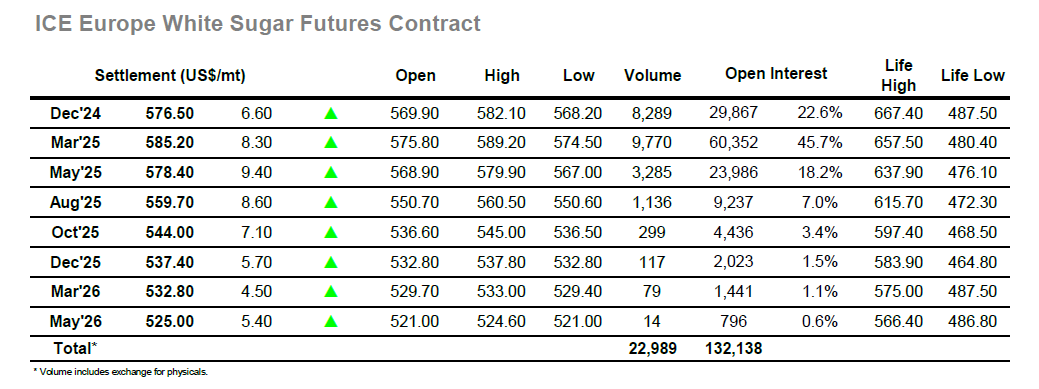

Like over on the raws, and after trading sideways for much of the previous week, No.5 prices opened the day positively quickly gapping up (and then back down) 4USD/mt very quickly after open before settling into a concerted upwards drive over the next few hours. Aside from a small breather around 576USD/mt in the mid-morning, prices tracked confidently up toward the day’s high of over 582USD/mt before momentum ran out. Closing out the morning trading, and into the afternoon, proceedings began to look a little more negative, with more concerted selling allowing prices to drift back down toward 575USD/mt over the next several hours. A second push higher over the remaining few hours saw buying back up to almost 580USD/mt before a very late flurry of selling gave back some of these gains to settle the session at 576.5USD/mt. As a result, prices moved almost 7USD higher of the course of the session and adjusting the recent momentum over the previous month from a slight downtrend to more of a sideways channel.