Insight Focus

India’s urea tender has not spurred market activity. Processed phosphate prices are under pressure as India withdraws from the market. Potash prices in Brazil are recovering slightly amid favourable demand conditions, while ammonia prices remain stable in the Americas.

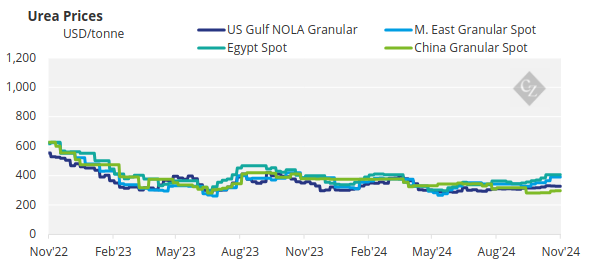

India Tender Fails to Boost Urea

The India tender, closing on November 11 with shipments required on or before December 25, has yet to stimulate the urea market. Despite an announcement by the Indian agency IPL requesting 1 million tonnes for shipment to India’s west coast, the market reaction has been muted.

Similar to past India tenders, urea prices have softened across the board, driven by slow demand in most regions outside of Brazil. Producers in Egypt and the Middle East have struggled to place their urea supplies, with Egyptian FOB levels dropping more than USD 25/tonne since early October, and Middle Eastern FOB levels decreasing by around USD 10/tonne.

An Indonesian prilled urea tender saw bids peak at USD 373/tonne FOB, though the producer set a minimum price of USD 400/tonne. However, market participants suggest that these price declines may be short-lived, as India may ultimately procure up to 2 million tonnes given the extended shipment window.

While sentiment remains bearish, India’s potential 1 million tonne purchase is expected to cushion any further significant price declines.

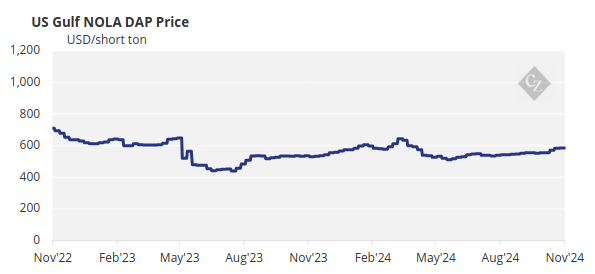

Phosphate Prices Under Pressure

Processed phosphate prices are under pressure, with India stepping back from the market as the Rabi season ends and Diwali celebrations begin. The main event in India this week was the fourth-quarter contract settlement on phosphoric acid between JPMC and CIL, priced at USD 1,060/tonne of P2O5, up from USD 950/tonne.

Market attention also turned to Ethiopia’s EABC purchase tender for 1.27 million tonnes of DAP. The tender attracted various offers, primarily from China, along with a few from Russia and one from Saudi Arabia. EABC’s recent preference for DAP over NPS marks a shift in procurement, as the importer historically sourced over 1 million tonnes/year of NPS from Morocco under an annual tender announced around August or September.

Notably, no Moroccan supply was offered in these DAP tenders. MAP prices in Brazil have shown a slight decrease from the assessed USD 635/tonne CFR price held steady for several months. Drought conditions and affordability concerns have dampened Brazilian farmers’ demand. For now, the outlook for processed phosphate prices remains stable, with limited near-term fluctuations expected.

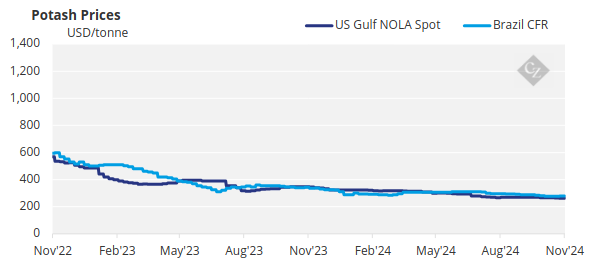

Potash Prices Rising Steadily

Potash prices in Brazil experienced a modest rise following months of decline, while prices remained stable in other regions amid a balanced market. Affordability remains highly favourable due to low prices and strong crop prices, especially in Southeast Asia where palm oil prices surged this week.

In Brazil, renewed market interest supported a slight rebound in potash prices to USD 280-290/tonne CFR. The market is expected to remain stable through the end of 2024 before potentially firming in Q1 on the back of strong demand.

Prices last week averaged a low of USD 283/tonne CFR, reflecting a 10% decrease from May’s initial declines. In Southeast Asia, attention turned to the recent 220,000 tonne standard MOP tender from PT Pupuk Indonesia.

Following the e-auction on October 25, prices are reported at USD 309-311/tonne CFR, around USD 9-11/tonne above current standard MOP prices in the region. Pupuk Indonesia’s previous tender in August, seeking 125,000 tonnes, was cancelled after offers of USD 303-304/tonne CFR were considered too high.

Instead, the company took optional volumes from a June tender at USD 299/tonne. Since then, average standard MOP prices have inched up from USD 282/tonne in August to USD 290/tonne this week.

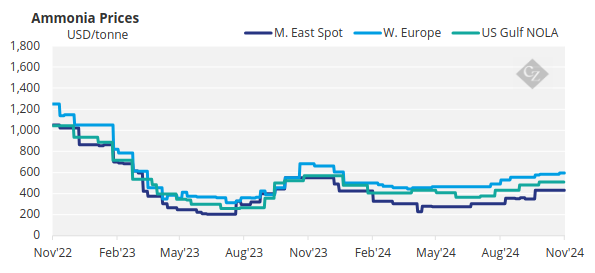

Ammonia Prices Stabilise

The Americas were the bright spot for the ammonia market as Yara and Mosaic agreed on a USD 560/tonne CFR rollover for November shipments into Tampa, aligning with prior market expectations. This price stability suggests that the regional market may be approaching its peak, given an improved supply outlook from Trinidad and the US Gulf.

Prices are expected to remain stable moving into November, as production outages near a resolution, reducing the likelihood of further increases.