Insight Focus

The 2024/25 National Sugar Conference has just come to an end. Most participants expect an increase in Chinese sugar production of one million tonnes. Some agencies disagree.

The 2024/25 Sugar Conference was held from October 30 to November 2. One of the highlights of the meeting was the sugar output for the new season. Interestingly, different agencies have come to the opposite conclusion after conducting surveys of sugarcane fields. But they all have at least one thing in common: the 2024/25 season remains a year of increased production.

The 2024/25 Season Starts with An Optimistic Outlook

The sugar production cycle in China is from October to September of the following year. For the 2024/25 season, the harvest and processing of sugar beet has been kicked off by the northernmost Hulunbuir Shengtong Sugar Industry on September 12, four days earlier than last year.

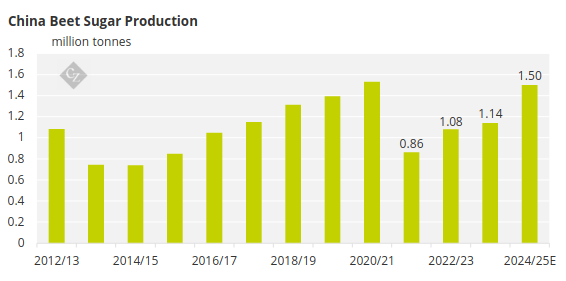

So far, all 25 beet sugar mills in Xinjiang and Inner Mongolia that plan to operate have started. Beet sugar production should increase significantly in the new season, with COFCO Sugar, which owns eight Xinjiang beet sugar mills, saying its sugar beet acreage is at a record high.

Another sugar mill in Inner Mongolia said that this year’s sugar beet volume is the highest in its history, expected to be more than three times that of last year. However, Inner Mongolia had a rainy month in September, which was not conducive to sugar accumulation and sugar beet harvesting. This was also validated at the conference, when Inner Mongolia’s beet sugar production estimate was revised down to 700,000 tonnes from 750,000 tonnes.

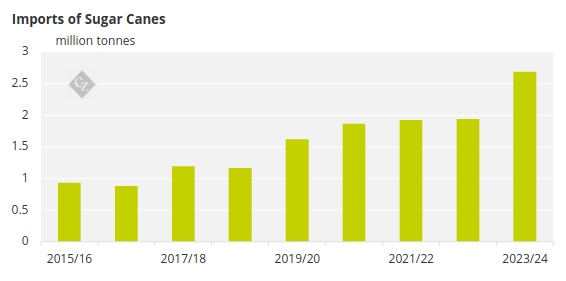

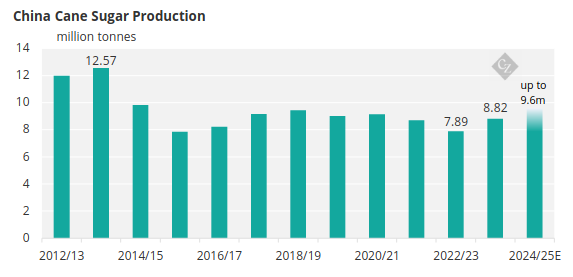

The first sugar cane mill has also started production last week, four days earlier than the previous year. The sugarcane produced by the sugar mill is sourced from neighbouring Laos, marking the official start of cross-border transportation of sugarcane in the 2024-25 season. In recent years, the amount of sugarcane transported across borders has increased year by year, reaching 2.7 million tonnes in the 2023/24 season, making up for the decline in local sugarcane production in Yunnan province, the second largest producing region, due to weather and substitution.

In the new season, the mainstream market estimate for cane sugar production is around 9.5 million to 9.6 million tonnes, despite the impact of typhoon Yagi. This brought the total production of beet sugar and cane sugar to 11 million tonnes, an increase of about 1 million tonnes year-on-year.

Record 2023/24 Sugarcane Prices

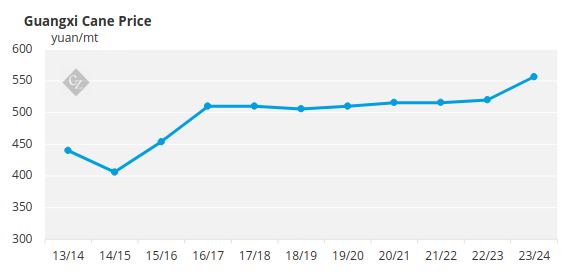

The optimistic outlook for sugar production in the 2024/25 season is mainly due to the increase in sugarcane area in Guangxi and improved field management with the support of sugar mills.

Although the 2023/24 season was a downward cycle for sugar prices, mill’s average selling price was 6,493 yuan/tonne, up 222 yuan/tonnes year-on-year. And Guangxi mills achieved 6588.35 yuan/tonne, so the second settlement of sugar cane was launched. Farmers got an extra income of 298 million yuan, and the purchase price per tonne of sugarcane exceeded 550 yuan/tonne ($78/mt), setting a new record.

Despite this, due to the constraints of arable land and competition from alternative crops, we think an optimistic outlook for future cane sugar production in Guangxi is around 10 million tonnes, even with high sugarcane prices.

China Still Needs to Import Sugar, But Not in A Hurry

This means that China still has a shortfall of 5 million tonnes of sugar to import this year. This is mainly for the import of raw sugar, as well as the fast-growing import of liquid sugar and pre-mixes. This will be discussed in a separate report.

But seasonally, this means that China has plenty of domestic sugar to consume until the first half of next year and may not need to import raw sugar in the coming months. In particular, the current import margin of AIL imports is in the deep negative range, making it unfeasible.