Insight Focus

PTA and MEG futures were hit by the sharp decline in crude prices, before a partial recovery Friday.

Asian PET resin export prices also looked to be heading down further before a modest reversal.

PET resin prices are currently at the mercy of a highly volatile crude market.

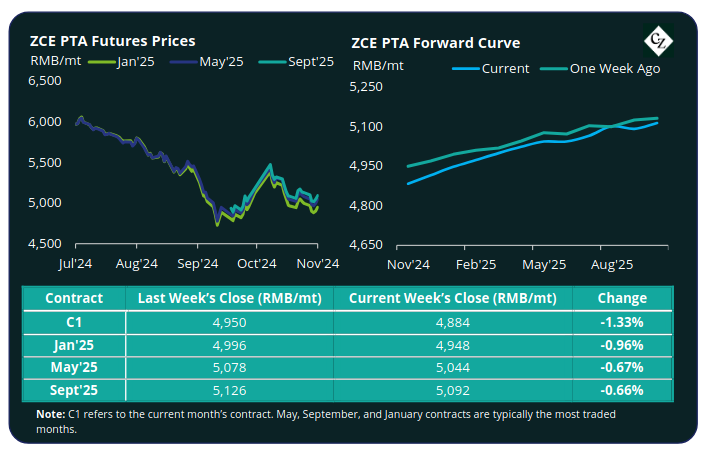

PTA Futures and Forward Curve

PTA futures fell by around 1% last week largely driven by declining upstream costs resulting from slide in oil prices.

Crude oil prices experienced substantial volatility through the week, with prices down sharply on Monday before edging marginally higher on Friday. Brent crude oil prices were down around 1% to USD 73.5/bbl on Friday.

The PX-N spread narrowed by around USD 7/tonne, with the average weekly PTA-PX CFR spread also decreasing marginally to around USD 76/tonne.

PTA and polyester operating rates were relatively unchanged. Any improvement in PTA SD fundamentals is constrained by supply pressure from high port inventories, and a slowdown in buying activity from polyester plants.

The PTA forward curve kept a slight contango, with the Jan’25 premium increasing to RMB 64/tonne over the current month’s contract; May’25 with a RMB 160/tonne premium.

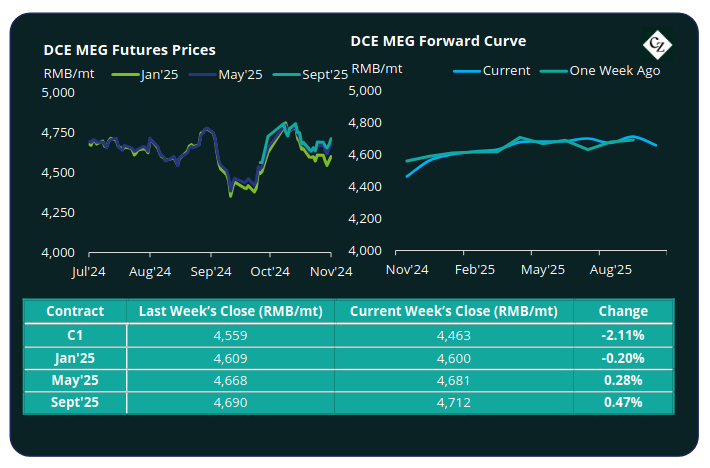

MEG Futures and Forward Curve

MEG futures also lost ground, particularly near-term contracts, with the current month falling 2%, although the main Jan’25 contract was down just a fraction of a percent.

East China main port inventories decreased by around 7.7% to 574k tonnes, offtake remains historically low for this part of the season.

Whilst seep sea arrivals in October were moderate, imports are expected to increase substantially through the remainder of Q4.

Overall, MEG fundamentals are likely to be relatively balanced with high polyester operating rates combined with unplanned outages and scheduled plants maintenance supporting the SD outlook.

The MEG Futures forward curve flattened, with only a modest upward curve through the next 12-months. The Jan’25 contract held a RMB 137/tonne premium over the current month; the May’25 contract a RMB 218/tonne premium.

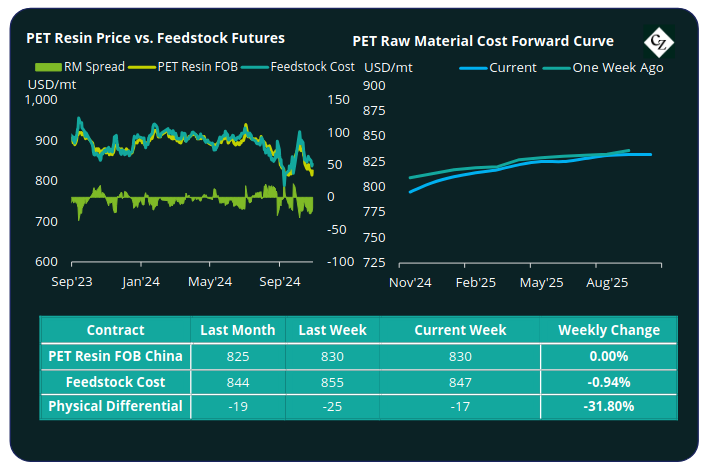

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices ended the week just USD 5/tonne below the previous week’s close, with an average price of USD 825/tonne by Friday.

PET resin prices had followed the slump in upstream costs down to around USD 815-820/tonne before recouping losses on the rebound in raw material prices later in the week.

The average weekly PET resin physical differential against raw material future costs kept flat at negative USD 20/tonne last week. By Friday, the daily differential had improved slightly to negative USD 17/tonne.

The raw material cost forward curve has steepened slightly through 2025. Jan’25 now holds a USD 14/tonne premium over the current month, May’25 USD 29/tonne and Sept’25 USD 36/tonne

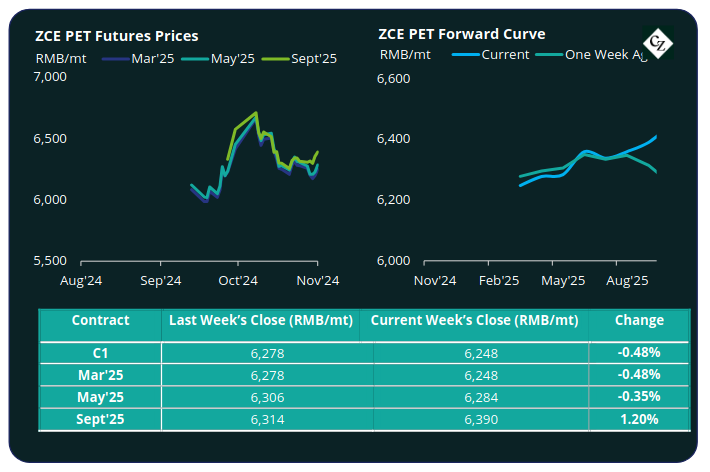

***NEW PET Resin Futures and Forward Curve

PET Resin Futures showed modest declines of less than 0.5% with the Mar’25 contract, the first contract month of these new futures, decreasing to RMB 6248/tonne (USD 877/tonne, down an equivalent of USD 5/tonne) by Friday.

The average weekly premium over Raw Material Futures increased by USD 2-3/tonne to USD 22/tonne. By Friday, the daily premium was USD 20/tonne, continuing to keep within a tight range since launching at the end of Aug.

The PET Resin Futures forward curve has steepened over the last week, playing catch-up to last week’s changes in raw materials, with May’25 showing a USD 13/tonne premium and Sept’25 a USD 28/tonne premium, over the main Mar’25 contract.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

After recent price falls, some buyers were hoping that a weaker price trend would continue, seeking sub-800 USD/tonne prices.

However, the bump in prices late last week highlights that in the near term, Asian PET resin export prices are going to be primarily led by crude oils prices.

PET resin fundamentals continue to be constrained by oversupply and weaker off-season demand, as a result market prices are currently highly exposed to crude volatility and macro-sentiments.

With the current news cycle focusing on increased tensions and retaliatory strikes in the Middle East some of the war premium in the crude market that was lost the previous week is likely to come back on.

In addition to the Middle East conflict, short term sentiment around next Tuesday’s US election and rumours of market intervention by OPEC+ will also compound price volatility through the PET resin chain.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.