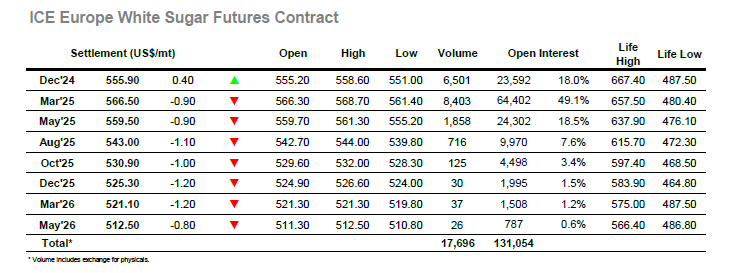

With no obvious overnight physical activity to bring hedge lifting the market immediately slipped lower with March’24 nudging along in the 21.80’s through the early morning. Another drop to 21.66 followed as smaller traders pressed the short side, however their volume was insufficient to challenge the underlying support and before the morning was out the market returned to sit in the 21.80’s. Interest was lacking from all but the smaller specs, something which was reflected in the poor volume, and as trading moved into the afternoon the price continued to track along within the morning range without threatening to escape. Across the next few hours there was a continuation of this pattern, and it was only during the final two hours of trading that prices worked outside of the early range and looked to move into credit. March’25 made it up to 22.01 before faltering with the March/May’25 spread out to 1.63 points in the process, though during the final 30 minutes there was some position squaring which sent the price back a small way. This left March’25 settling marginally lower at 21.90, a neutral close which leaves market parameters unchanged as we await the outcome of the US election.

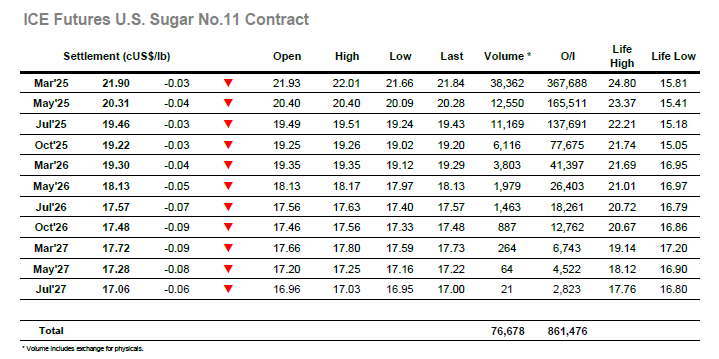

Having dropped back to $563.00 on the opening the market looked to stabilise and the losses reduced to just a couple of dollars. By mid-morning, the market started to wobble again, and another new set of daily lows were registered, taking the market ever closer to the $560.70 initial support level. The lows did not remain for long and there was a short covering rally which followed and sent the price back within touching distance of unchanged. This set the tone for the flat price across the rest of the session as a series of moves saw prices yo-yo around the range with a small afternoon widening to a daily low at $561.40. Meanwhile it was the spread doing all the heavy lifting in terms of volume as rolling continues ahead of next week’s expiry, with the differential moving back to -$8.80 at one stage before dropping back beneath -$10 later in the afternoon. The later afternoon saw a move to new daily highs with March’25 briefly touching $568.70 but they were not sustained and the close arrived with prices back to a small net deficit. The final minutes passed quietly to leave March’25 settling at $566.50 and the picture unchanged for yet another day.