Insight Focus

The world’s population might peak earlier than previous forecasts suggested. This could mean sugar consumption peaks earlier than expected, and at a lower level. What does this mean for the sugar industry?

Almost everyone in the world eats sugar. The size of the world’s population is therefore a major determinant in overall sugar consumption.

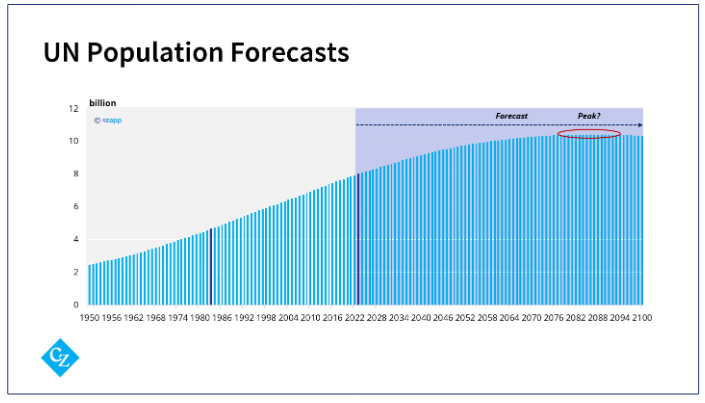

We last discussed this as the Dubai Sugar Conference in February 2023. We used the UN’s population projections to examine what might happen to global sugar consumption for the rest of this century. The UN’s projections “medium fertility estimate” at the time forecast that the world’s population would peak at around 10.4b people in the 2080s.

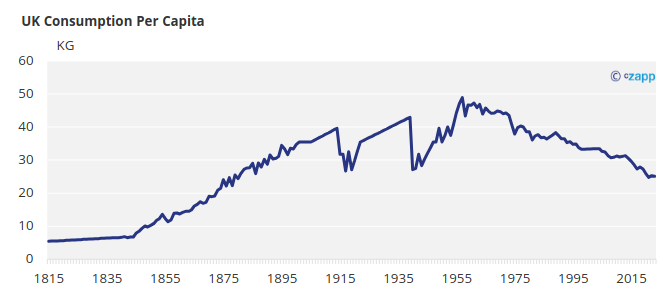

Global per capita sugar consumption today is around 22kg a year. We also know that consumption in almost all higher income countries has far exceeded this level in recent decades but is now falling. For example. UK sugar consumption peaked at around 50kg/year in the 1950s and is today close to 25kg/year.

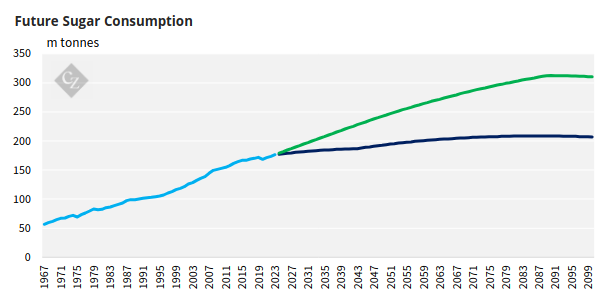

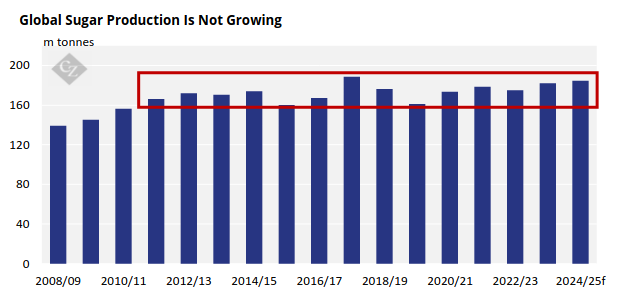

If we assume global per capita sugar consumption will stabilize this century somewhere between 20-30kg/year, we can broadly assess that global sugar consumption will peak at some point in the latter half of this century between 210 and 310m tonnes. Global sugar production today is close to 180m tonnes, which indicates the scale of the investment the sugar industry requires in the coming years.

But what if the population projections underpinning this analysis are wrong?

Recent analysis carried in the Financial Times suggests that the UN are underestimating the speed at which fertility is collapsing across a range of countries. If this is indeed correct, we may be better off using the UN’s “low fertility estimate” as our base case for population projections. In this scenario, the world’s population peaks at around 9b people in the 2050s. That’s three decades earlier than under the medium fertility estimate.

If we apply our 20-30kg/year per capita sugar consumption range, this suggests global sugar consumption could peak between 180-270m tonnes in the next 3 decades. You might have spotted that the lower end of this range is close to current global sugar production levels.

Of course, we shouldn’t just concentrate on the lower end of the range. The upper end of the range also suggests that the global cane and beet sector will still need to invest heavily in production expansion in the coming decades to produce enough sugar to feed the world.

However, in the coming decades the sector may also increasingly find growth opportunities emerging in new products. After all, cane and beet aren’t just food crops. They can be energy crops too. We expect an increase in interest from the sector in using sucrose to make ethanol, sustainable aviation fuel, bioplastics and other fermentation products. These products can help the world reduce its carbon emissions and also preserve the cane and beet sector’s future.

If you’re interested in understanding how your business can start to diversify its income from sugar into other products, please contact us.