Insight Focus

Urea prices decline as demand remains weak, with India driving the market. Phosphate prices are under pressure as India’s Rabi season ends. Potash and ammonia prices stabilise despite premium deals for ammonia.

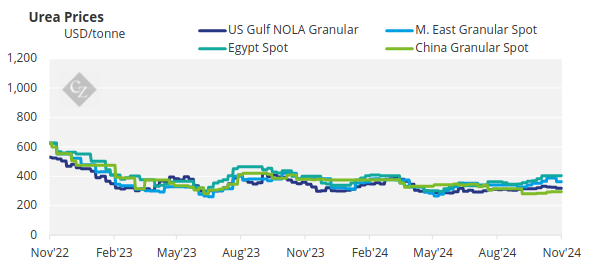

India Tender Drives Urea Price Decline

The recently announced India urea tender, closing on November 11 with a shipment deadline of December 25, seems to have caused a decline in urea prices.

Prices have pulled back across the board, with Brazil now reported to be offered at USD 345-350/tonne CFR, down from last week’s range of around USD 370/tonne CFR. Slow demand, coupled with a significant number of urea vessels (around 1.5 million tonnes) heading to Brazil by December, has dampened the market.

The Middle East’s return for Brazil business is now at USD 325-330/tonne FOB. This situation is favourable for buyers in India, and it will be interesting to see the price discovery process on November 11. Industry insiders had predicted the L1 price to be between USD 370-380/tonne CFR just a couple of weeks ago.

Given the recent price retraction, it is now possible that the L1 price could settle in the low USD 360s CFR, or even below USD 360/tonne CFR.

In the US, net imports of urea for July-September totalled just 93,000 tonnes, including cross-border trade with Canada. July-September urea imports were 485,000 tonnes, down 115,000 tonnes year-on-year.

Russia was the leading supplier with 149,000 tonnes, followed by Saudi Arabia and Qatar with 98,000 tonnes and 85,000 tonnes, respectively. Urea exports for the same period reached 392,000 tonnes, up 140,000 tonnes from last year. Canada was the largest recipient with 187,000 tonnes, followed by Chile with 114,000 tonnes and Argentina with 38,000 tonnes.

The Ethiopian Agricultural Business Corporation (EABC) will close a tender on November 19 for the import of 200,000 tonnes of granular urea on an FOB basis. Imports from January to October stood at 659,000 tonnes, up 8% (51,000 tonnes) compared to the previous year and higher than the 456,000 tonnes for the same period in 2022. Egypt was the largest supplier with 353,000 tonnes.

Turkey, a major importer of urea, imported 1.98 million tonnes from January to September, a 24% drop (623,000 tonnes) from the previous year but still higher than the 1.63 million tonnes imported in the same period in 2022. Iranian-origin products accounted for 1.1 million tonnes, down 12% (114,000 tonnes) year-on-year. As of November 6, 2024, China’s total domestic urea inventory stands at 1.37 million tonnes, with more than 1.5 million tonnes of off-site reserves.

Despite this, the Chinese government continues to restrict urea exports. At a recent domestic agriculture urea conference, it was noted that agricultural urea usage in China was 39 million tonnes, while industrial use was 21.5 million tonnes, with an additional 7.3 million tonnes expected to come from new capacity in 2024. China’s total urea capacity now stands at 82 million tonnes, with an operating capacity of around 80%.

The outlook for urea prices is currently bearish unless markets outside of India step in.

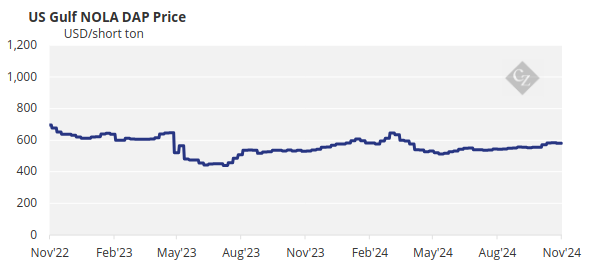

Phosphate Prices Stable Amid Limited Availability

Spot prices for DAP were largely steady this week, despite increased downward pressure from weak demand and poor affordability. Limited availability, however, continued to provide support. Ethiopia’s EABC has reportedly made awards for around 195,000 tonnes of DAP supply from China under its October 28 tender for 1.27 million tonnes DAP.

Further cargoes are still under negotiation. The EABC’s recent tenders mark a shift from NPS to DAP imports. Historically, EABC has imported more than 1 million tonnes of NPS annually from Morocco, with supply typically agreed through an annual tender announced around August-September. Notably, no Moroccan supply has been offered in the DAP tenders.

Ethiopia’s additional DAP demand is adding support to a tight market, especially as demand from key import destinations remains slow. Sources noted that remaining availability for Q4 export sales from China will now be very limited, particularly from Yangtze River ports. Spot export prices for DAP from China were assessed higher this week at USD 610-615/tonne FOB, up from USD 604-615/tonne, as limited export availability drove offer prices higher.

Pressure for lower DAP prices in India persisted, with demand slowing as the Rabi procurement season winds down. For now, spot prices for DAP in India remain stable at USD 634-638/tonne CFR, based on the latest business, although most deals were closer to the lower end of the range.

This week, Saudi Arabia’s Ma’aden reportedly sold 110,000 tonnes of DAP to three buyers in India for around USD 635/tonne CFR for November delivery. MAP prices in Brazil have held steady at USD 635/tonne CFR, a price maintained over the past three months.

The outlook for processed phosphate prices is one of pressure and decline, although limited availability will prevent significant price erosion.

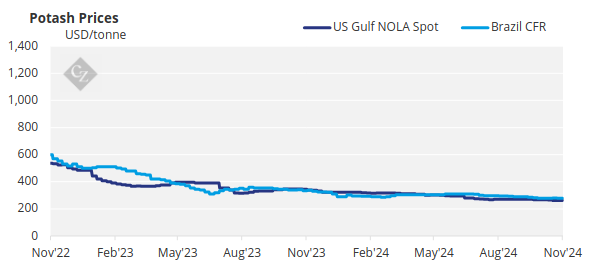

Potash Prices Hold Firm

Global potash prices remained relatively stable this week, outside of China, amid market speculation over proposed production cuts by Belarus. Belarusian President Alexander Lukashenko’s proposal of a 10-11% output cut in collaboration with Russia raised some concerns, though many market participants remain sceptical that this will come to fruition.

Fertilizer company stocks saw notable increases following the news. In Brazil, MOP prices held steady at USD 280-290/tonne CFR after gaining USD 5/tonne at the high end of the range last week. Interest in the Safrinha season is beginning to rise, although prompt sales remain slow. Potash prices in Brazil have dropped 77% from a record high of USD 1,210/tonne CFR in April 2022, following Russia’s invasion of Ukraine.

In the first 10 months of 2024, gMOP prices have fallen from an average of USD 315/tonne CFR to a low of USD 283/tonne CFR. Pupuk Indonesia’s recent MOP import tender took centre stage in the Southeast Asian market, with prices expected to settle at USD 302/tonne CFR.

The tender awards are anticipated to provide fresh market insight, as prices have been relatively stable over the last six weeks. Global MOP spot prices are expected to remain stable through the remainder of 2024, with a potential uptick in early 2025 due to seasonal demand and favourable affordability.

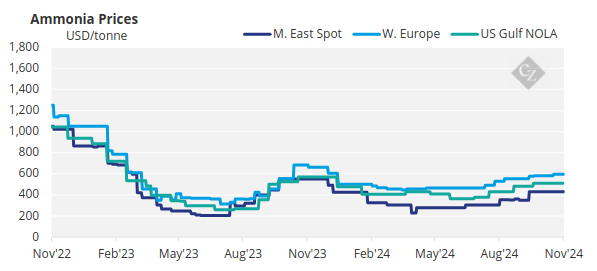

Ammonia Prices Steady Amid Premium Deals

The majority of ammonia benchmarks remained unchanged this week, with the supply-demand outlook more balanced compared to previous months. However, new business in North Africa was conducted at a premium to last done.This included a transaction in Algeria, where Yara purchased two spot cargoes totalling approximately 30,000 tonnes at USD 572.50/tonne FOB, up USD 12-13/tonne from the last transaction, marking the highest price seen this year.

Despite improved output in Trinidad and the US Gulf, and the return of Algerian producer Sorfert after a several-week turnaround in October, outages at Fertial and AOA in Algeria this month suggest that major supply length will not materialise in the short term, despite buyers in NW Europe being unwilling to pay over USD 600/tonne CFR.

The outlook for ammonia prices is balanced, with some market participants believing that the peak has already been reached in many markets.