Insight Focus

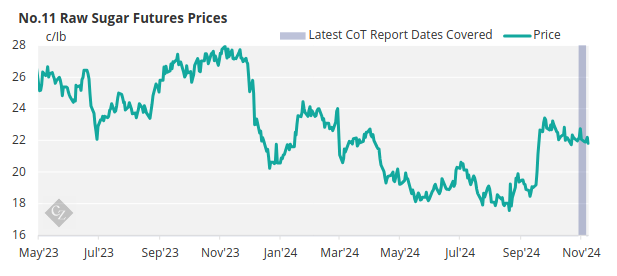

Both raw and refined sugar futures have remained stable over the past week. Speculators continue to lack strong conviction, opening 1.5k lots of short positions. What can we expect from the commercial participants?

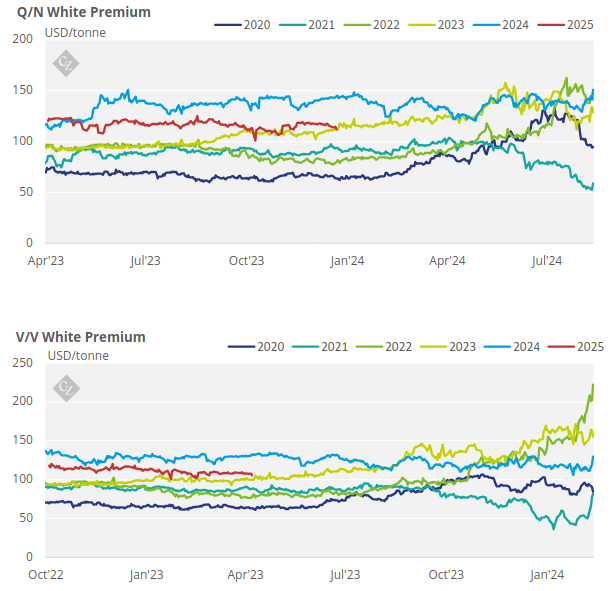

New York No.11 Raw Sugar Futures

Over the past week, the No.11 raw sugar futures traded sideways, hovering around 21c/Ib.

Starting with commercial participants, they’ve been active this past week, adding to their positions.

Consumers opened 9.6k lots of long positions, taking advantage of the recent sideways trend. On the producers’ side, they have added 3.5k lots. However, with prices below their preferred levels, there’s little incentive for them to hedge at this point.

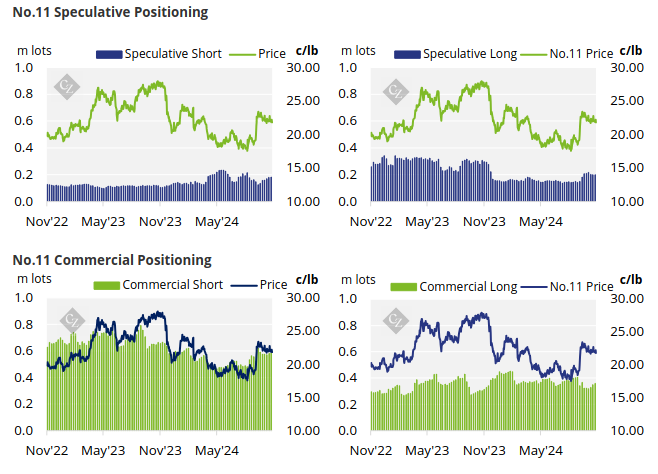

Turning our focus to speculators, their positions reflect a lack of strong conviction; they opened 832 long positions alongside 1.5k lots of short positions. Consequently, net speculative positions have decreased to 19.2k lots long.

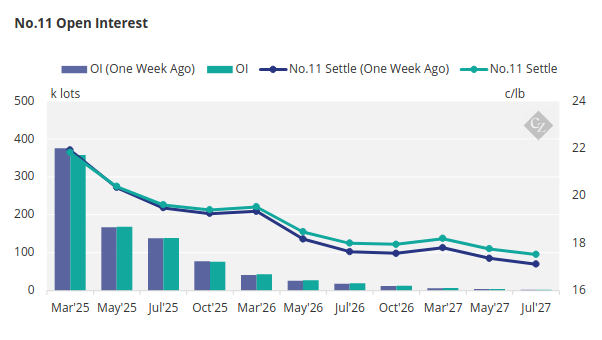

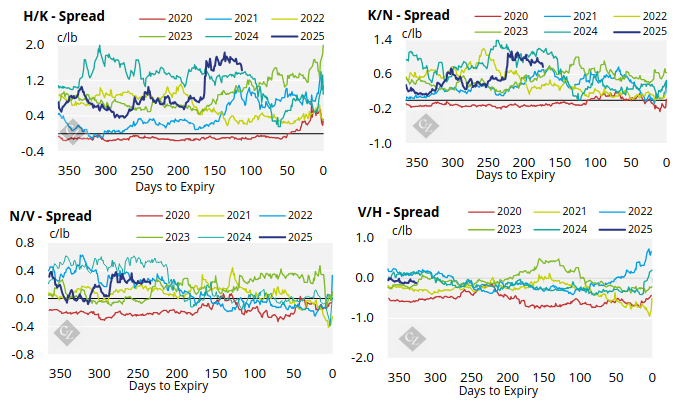

Finally, the No.11 forward curve has become increasingly backwardated over the past week, especially in the nearby contracts, reflecting current tightness in the raw sugar market.

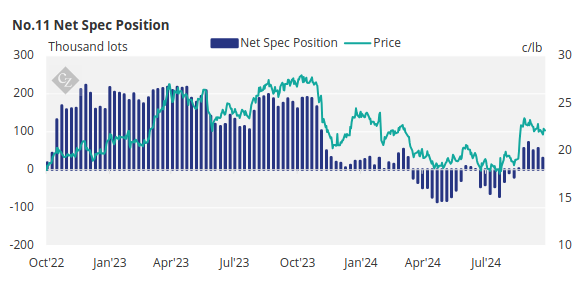

London No.5 Refined Sugar Futures

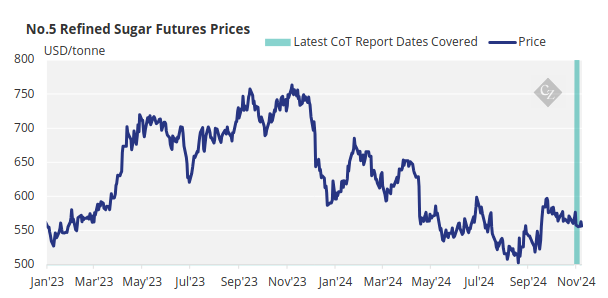

Following a similar trajectory to the No.11, the No.5 refined sugar futures has traded sideways in the past week, closing at 556USD/tonne last Friday.

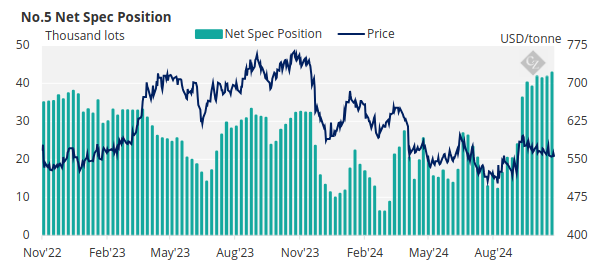

That being said, speculators have opened around 1.1k lots of long positions, bringing the net spec position up to 42.9k lots.

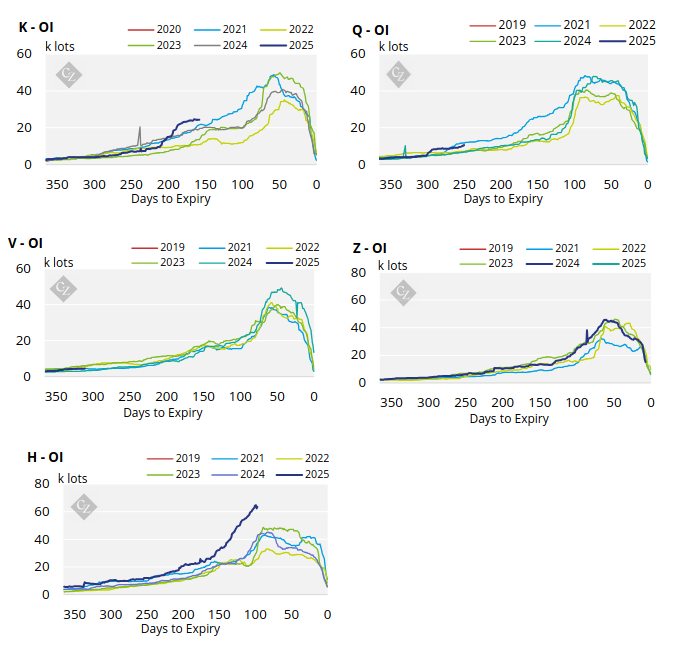

No.5 Open Interest

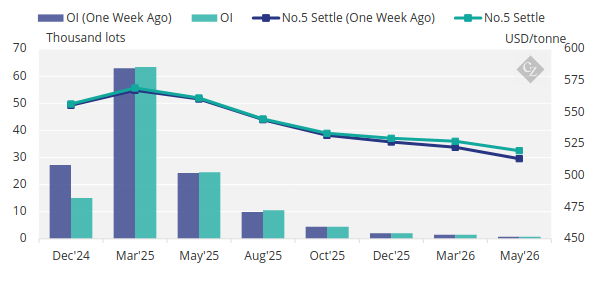

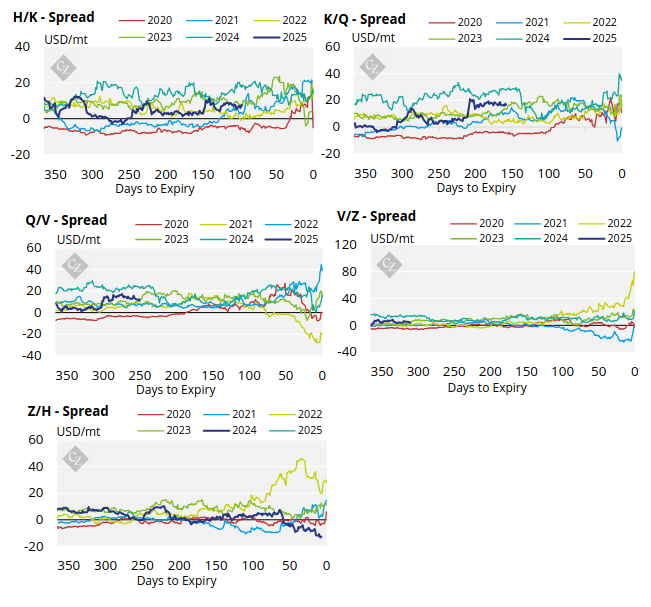

In line with the stable price movement, the No.5 refined sugar futures curve has flattened slightly over the past week.

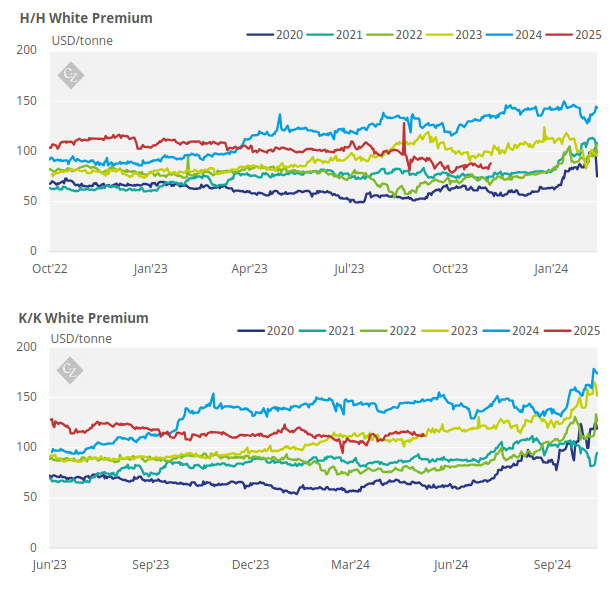

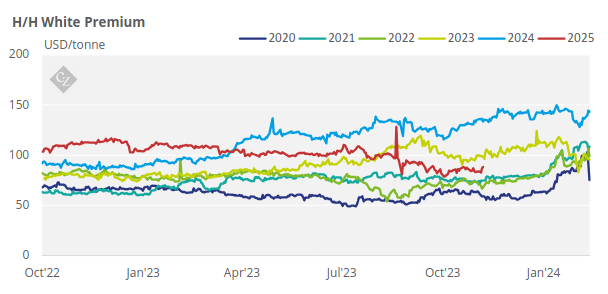

White Premium (Arbitrage)

Many re-export refiners need around USD 105-115/tonne above the No.11 to profitably produce refined sugar. The current white premium is below this level, signalling to toll refiners to slow their operations.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

With the No.11 and No.5 making similar moves, the H/H white premium is currently trading between 85-88USD/tonne.

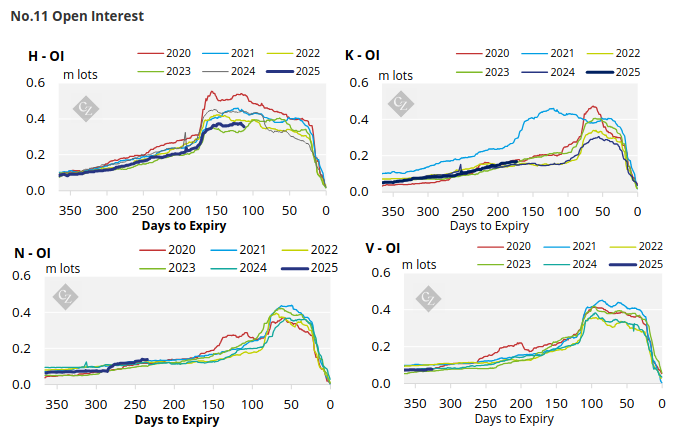

No.11 (Raw Sugar) Appendix

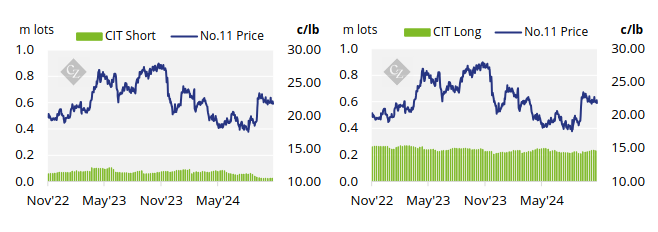

No.11 Index Positioning

No.11 Spreads

No.5 (White Sugar) Appendix

No.5 Open Interest

No.5 Spreads

White Premium Appendix