Insight Focus

Extreme weather is impacting wheat production, while Russia may slow exports. China’s economic issues could cut demand, and US wheat exports face pressure from a strong dollar and geopolitical tensions.

Wheat Prices Decline Amid Supply Concerns

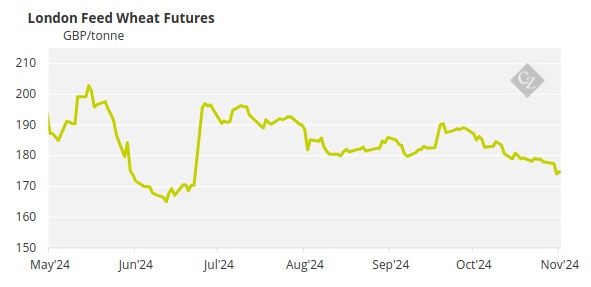

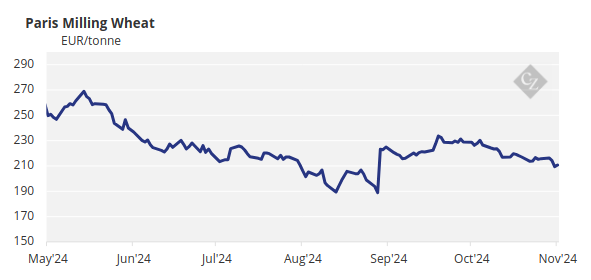

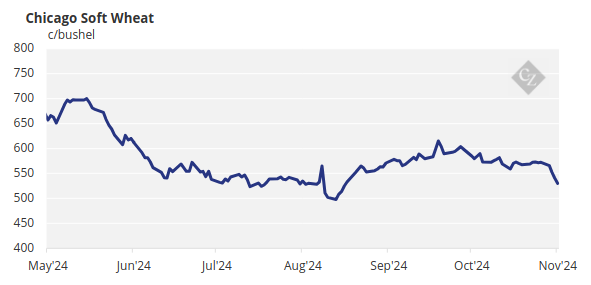

The wheat market has experienced a general downward trend over the last six months, as shown in the charts below. News of diminishing global wheat stocks have failed to dampen the enthusiasm of bears as Black Sea wheat continues to be abundant in supply, cheap in price and pressing all other exporters that need sales, such as the US.

Looking towards the end of 2024 and into 2025, there are 3 interesting nations that could influence price movements, but not necessarily all in the same direction.

Three Nations to Watch in 2025

Russia

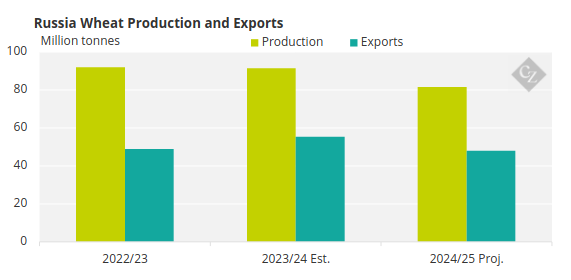

The world’s largest wheat exporter has been shipping in record volumes despite a smaller crop than last year, suggesting that exports will reduce by 8-10 million tonnes this year to below 48 million tonnes. At the current rate, it seems inevitable that Russian shipments will need to slow down into the new year.

Weather has adversely impacted the ongoing planting season for the 2025 harvest, with production forecasts struggling to surpass this year’s 81-83 million tonnes crop. Russia’s war in Ukraine continues to drag on, and the impact heading into 2025 remains unclear.

Source: USDA

China

The world’s largest wheat producer, consumer and importer is showing signs of financial stress. Last week, the Chinese government unveiled a massive stimulus package of around USD 1.4 trillion to help firm up the economy. However, there appears to be little evidence that it has reassured market concerns.

The question of whether wheat demand and imports will decline due to further economic troubles will be closely watched by the market.

The US

The US has voted in its next president, Donald Trump. The impact on agricultural markets is already showing, but could worsen:

- A rising dollar is putting pressure on US wheat prices.

- A potential peace plan for Russia’s war in Ukraine could ease anxiety and reduce prices for Black Sea exports if successful.

- Talks of a trade war with China could reduce overall commodity values, as China feels the economic pinch while US exports seek other buyers.

Market Challenges Amid Weather, Trade and Geopolitics

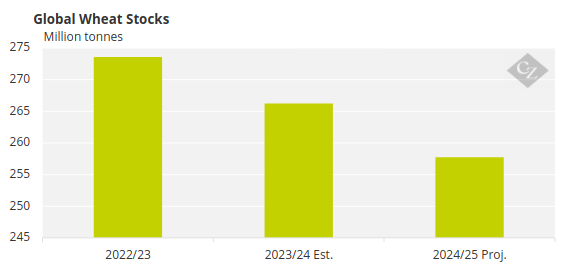

Wheat producers in Russia and other key regions continue to face significant challenges due to extreme weather conditions in many major wheat-growing areas. Global wheat stocks, which have been steadily declining year on year, currently show no signs of being replenished by the 2025 harvests.

Source: USDA

Russia may need to slow its export pace, but whether other countries like Australia can fill the gap in early 2025 remains uncertain.

China’s economic troubles could reduce demand for wheat, while President-elect Trump’s potential trade policies might create further pressure on wheat prices. His proposed tariffs could widen the trade gap between the US, China, and Europe. The strengthening of the dollar following Trump’s election victory may benefit some exporters, particularly in the Black Sea region, but will likely have a negative impact on the US, which has been exporting wheat at a fast pace since harvest.

Trump’s influence on easing the ongoing conflict in Ukraine will be crucial to watch, as it may impact the stability of Black Sea exports. Additionally, his stance on Middle East tensions and potential conflicts could have significant consequences for the wheat market in 2025.