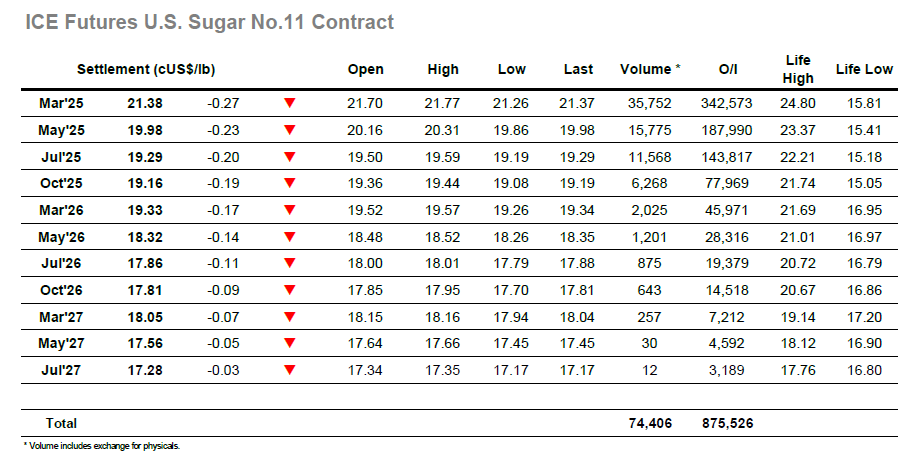

Early trading proved to be mixed as the market attempted to make a move u[ward but quickly failed, and on the heels of this the sentiment from yesterday took over with specs starting to explore lower again. It was not all one-way as the nature of participation led to some chopping around, though any moments of recovery were not sustained, and lows were recorded at 21.40 before the morning was through. With the lower trend in charge the US morning started without fanfare leaving the pattern to further extend, seeing more lower lows and lower highs on the intra-day chart with the price falling to 21.26. An extended period sat just ahead of these lows was of concern to longs with no intent to recover being indicated, though they received a minor boost through short covering that the move had halted, at least temporarily. Spreads were generally a few points softer against the lower flat price, but it was otherwise proving to be another featureless day despite the price movement. Closing activity remained in the upper 21.30’s with a March’25 settlement value made at 21.38.

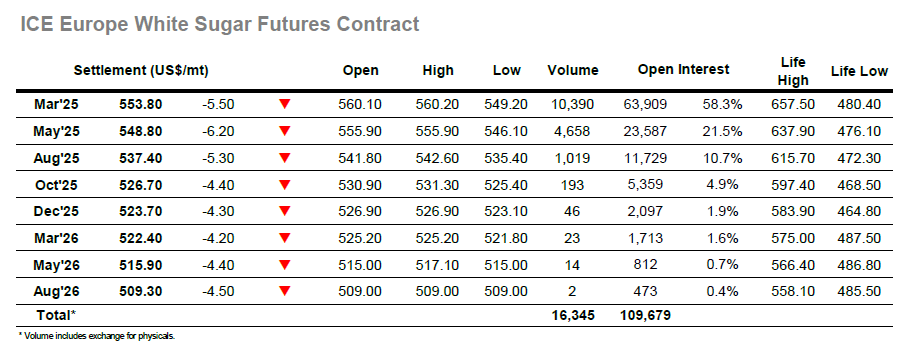

The sharp recovery from last week’s lows has now been forgotten and following an unchanged opening the market quickly looked to continue downward with the lower side providing he easiest path. This will not suit the funds who remain significantly long against the whites, however from the perspective of the smaller traders the opportunity to move the market was easily seized. Throughout the morning the price zig-zagged its way down to $551.40, with a continuation of the pattern into the afternoon dropping the price beneath $550.00. There seemed to be little chance of any reversal until some short covering kicked in and pinged the price back up through $555.00, though in keeping with the flimsy nature of the market activity today the rally halted soon after when the relevant positions had been close. This small rally pulled March/March’25 back towards $82, having earlier fallen back to $79, while March/May’25 pulled up from a $2.70 low to be trading higher at $5.60. The flat price continued towards the mid $550’s through the final hour leading the market to a calm close, with settlement at $553.80 leaving March’25 looking a little more vulnerable again despite the value being more than $10 above the recent low.