Insight Focus

Urea prices face pressure with unsold December cargoes. Phosphate prices dip slightly, constrained by tight supply. Potash remains stable with potential increases ahead, while ammonia markets stagnate amid unclear pricing.

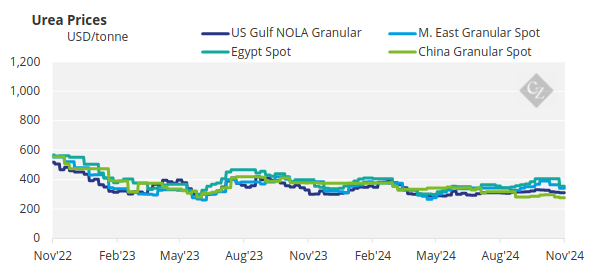

Global Urea Market Weakens

The India urea tender, as on several occasions in the past, has brought a negative sentiment to the world markets with prices correcting downwards everywhere. India on its own cannot carry the global urea market.

Liquidity in NOLA/US is low, and the Europeans are starting to look forward to the Christmas holidays. Currently the Brazilian market is saturated with incoming urea vessels as well as ammonium sulphate from China filling inventory.

Paper trade is showing weakness with January Brazil CFR traded at a low USD 320/tonne CFR with physicals to follow at the same level. Middle East physicals are around USD 330/tonne at best with pressure building on finding a home for December cargoes.

Dangote of Nigeria is said to be conducting a tender for three urea cargoes for December shipment with last done around USD 330/tonne FOB. Iran has lowered its urea price ideas again this time back to USD 305/tonne FOB, bids are still way lower than this level, as previously advised. During the week the highest bid in was heard at USD 290/tonne FOB. Today USD 270/tonne FOB bids have emerged, and it is reported that Iran is sitting on 300,000 tonnes of inventory to be cleared.

Egypt has been quiet this week after trading up from USD 337/tonne to USD 366/tonne FOB. With shorts now covered, traders look to see if they can encourage forward sales, but European buyers are slow to bite, and Turkey is focused on cheaper offers that can be found from Iran.

Looking to the east, the Australian and Thai markets are coming to a close with low seasonal demand, if any. Reports are that the inventory situation in Thailand is precarious. Inventories in Australia are also reported to be building with incoming contract vessels. Issue is that warehouses are now supposed to be made ready for the processed phosphate import season.

The December onward outlook for the urea price is bearish unless demand picks up in major markets.

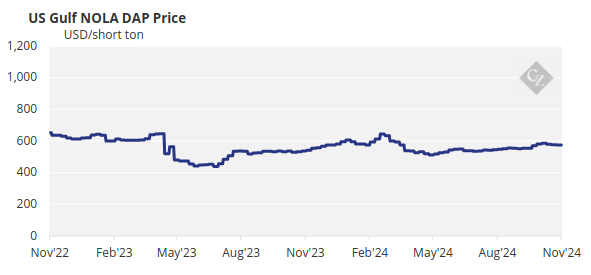

Phosphate Market Steady Amid Tight Supply

The processed phosphate market has been relatively quiet this week except for increased activity in Australia securing MAP 10-50 from China for the upcoming season.

Latest prices heard are around the USD 580-5 FOB level whilst MAP 10-50 to other markets are quoted at around the USD 540/tonne FOB level. Australian prices typically command a premium over other markets, with the latest 11-52 prices reported at USD 610-615/tonne FOB.

China now appears to be tight on new exports, having participated heavily in Ethiopia, Iran and Bangladesh in addition to the MAP cargoes to Australia. MAP prices in Brazil are carved in stone at around USD 635/tonne CFR, a price that has stood firm for the past four months. There is little indication that the MAP price in Brazil will see much downward decline due to tight supply.

India on the other hand has been quiet this week with prices estimated to be around the USD 635/tonne CFR level. At this price, the importers are officially losing around USD 100/tonne based on the current Maximum Retail Price and the NBS. However, the Indian government in a circular dated September 20 has promised to cover these losses. India has secured around 2 million tonnes of DAP for Q4 arrival.

Price upside and downside both seem limited as tight supply offsets limited demand and affordability concerns. However, many market participants expect some downward correction, particularly as phosphates prices remain high compared with downstream agricultural commodities and other fertilizer nutrients.

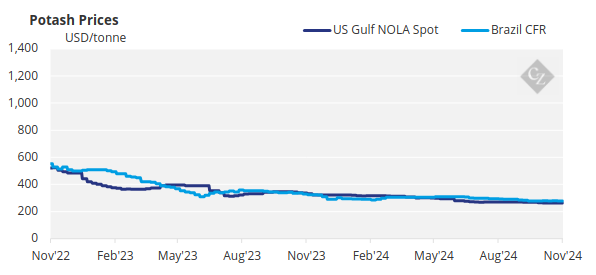

Potash Market Stable with Upward Bias

Potash benchmarks across global markets remained broadly stable this week, although there was a growing expectation of modest upward price momentum in the weeks ahead. China’s domestic potash prices increased marginally to an average of RMB2,480/tonne (USD 342/tonne) FCA up from RMB 2,450/tonne (USD 339/tonne) FCA last week.

Market sentiment remains positive despite China Customs releasing the January-October MOP import figure of 10.3 million tonnes – an 11% increase of the record volumes from 2023. Although the China contract is set to expire at the end of the year and Chinese imports continue to rise, it is unlikely that Chinese importers will enter into a new agreement in the near term, especially with the expectation of higher global prices in the first quarter of 2025.

In India, the MOP market remains relatively quiet as products steadily enter the region for the Rabi season. Southeast Asia saw limited price movement this week, following a minor increase of USD 2/tonne CFR at the high end of the range previously after Pupuk Indonesia settled its latest tender at USD 302/tonne CFR.

Bids and offers in the region between buyers and sellers were still widespread as producers continued to push for higher prices. Brazilian import prices held steady at an average of USD 285/tonne CFR as additional offers for January loading emerged in the range of USD 290-300/tonne CFR. Anticipation for strong demand for the new season has begun, despite the current high stock levels.

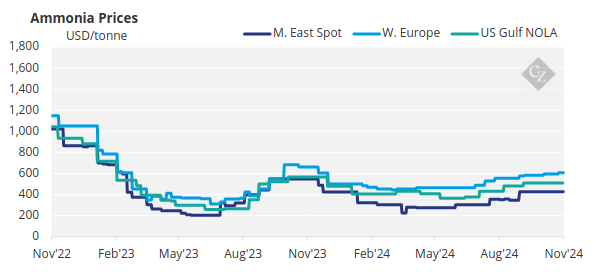

Ammonia Market Stagnant Amid Uncertainty

Ammonia trade was almost non-existent this week with pricing on contract deliveries kept confidential, creating some confusion as to where prices might head over the next couple of weeks. However, producers in the east are producing at full speed combined with lack of demand, so price declines might be expected. In the absence of new deals, bids or offers, prices are assessed as stable in all regions.