Insight Focus

The shipping industry is bracing for new Trump tariffs. Chinese manufacturers are stockpiling goods and rerouting shipments to avoid tariffs, which may disrupt global shipping. US ports are experiencing record volumes as companies rush to move goods before tariffs take effect.

While the shipping industry is still assessing the potential impact of Donald Trump’s election, there is growing interest among stakeholders in the policies the new US President will implement. Although the full effects of the Trump Administration on shipping and logistics won’t be clear until after the presidential handover on January 20, some measures could produce short-term results.

Tariffs and Trade War Fears Drive Shipping Demand

As a consequence of Trump’s election promises, many shipping and economic analysts anticipate a rapid increase in tariffs, with the first import duties potentially taking effect by January 29. This is expected to prompt a surge in demand as shippers rush to avoid the new tariff regime.

But while Trump’s rhetoric on trade raised concerns about the future of free trade, some analysts believe that fears of a harsh tariff regime may be exaggerated.

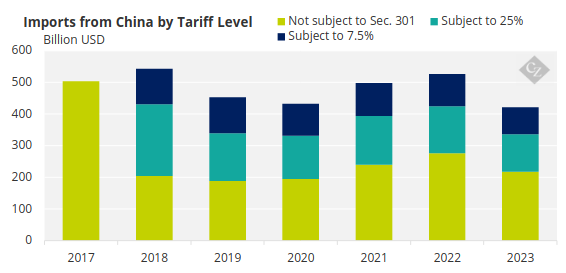

The key difference between Trump’s current approach and that of his previous administration is the broader geographical scope of his proposed tariffs. While his policies during his previous presidential term focused primarily on China, the new tariffs may target a wider range of countries.

Source: Tax Foundation

The primary concern here is the potential for reciprocal tariffs on US exports in response to the new import duties, which could lead to a full-scale trade war.

US Ports See Record Volumes Amid Uncertainty

According to analysts, the next few weeks will be critical. If shippers believe that tariffs could rise to a level where the viability of their goods is threatened, we may see a significant spike in demand on the Pacific routes to both the East and West coasts of the US. This could occur despite the looming threat of a strike on the US East Coast in January.

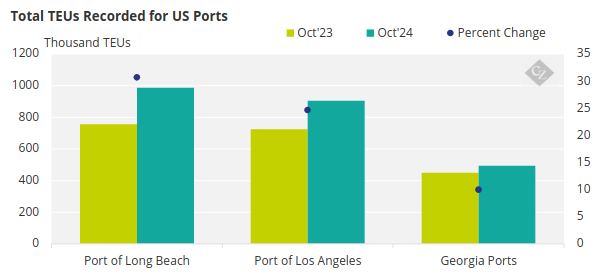

While it’s difficult to definitively attribute the recent surge in port activity to the US election, several of the country’s largest ports have reported significant increases in cargo volumes in recent months. Notably, the Port of Long Beach in California had its busiest month ever in October, handling 987,191 TEUs, and nearing the 1 million TEU milestone.

Similarly, the Port of Los Angeles, also in the San Pedro Bay, exceeded the 900,000 TEU mark for the fourth consecutive month, recording 905,026 TEUs in October. Meanwhile, Georgia Ports saw a notable year-over-year increase, with 494,261 TEUs processed in October—an increase of more than 45,000 TEUs, or 10%, compared to the same month last year—marking its third-highest October volume on record.

Blank Sailings and Freight Rate Fluctuations Expected as New Tariffs Loom

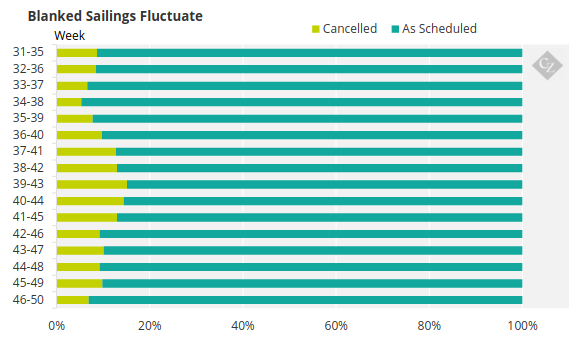

Freight forwarder Dimerco, using data from Drewry Shipping Consultants, reported that between the end of October and mid-November (weeks 43-47), 70 blank sailings were announced out of 692 services—significantly higher than the 46 blank sailings during weeks 30-34, out of 691 services.

The increase in the number of blank sailings may signal trade uncertainty and reflect ocean carriers’ efforts to manage their schedules in response to an unpredictable future.

Source: Drewry

Alvin Fuh, VP of Ocean Freight at Dimerco Express Group, stated, “We anticipate that ocean freight rates—whether for long-haul or intra-Asia shipments—will experience significant fluctuations, swinging dramatically between highs and lows as we approach Christmas and the New Year.” He also noted that Chinese New Year (CNY) could coincide with the first date when new tariffs might be enforced.

Chinese Manufacturers Build Strategic Inventories

The election of Donald Trump is expected to significantly accelerate shifts in global trade patterns, particularly as China and other countries prepare for the implementation of sweeping protectionist measures under his administration.

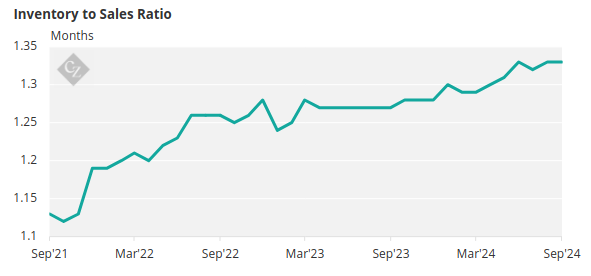

As Trump’s inauguration on January 20 nears, Chinese manufacturers seem to take proactive steps to mitigate the potential impact of US tariffs. One of the primary strategies being employed by these manufacturers is the creation of “strategic inventories.”

These inventories are designed to help companies circumvent the anticipated tariffs by stockpiling goods in advance of any potential duty increases. By building up large quantities of products, manufacturers hope to ensure they can continue supplying goods to global markets without being hit by the additional costs of tariffs.

This move is particularly significant for high-volume export goods like electronics, machinery, and consumer goods, which form a large part of China’s trade with the US.

Source: St Louis Fed

Additionally, some manufacturers are taking a more creative approach to minimise the tariffs’ impact. In some cases, Chinese exporters are re-routing shipments through other countries. By shipping goods through third-party nations, they can obscure the country of origin, thus avoiding US tariffs that are specifically targeted at Chinese-made products.

This tactic has been more common in industries like textiles, electronics and automotive parts, where goods can be easily relabelled or repackaged before entering the US.

Peter Sand, Chief Analyst at Xeneta, notes that the buildup of these strategic inventories could have significant implications for global shipping and logistics. “These inventories could come into play as the new administration’s policies take shape,” Sand explained, pointing out that large stockpiles of goods may be held in ports or warehouses, waiting for the right moment to be shipped.