Insight Focus

Domestic sugar prices have traded between INR 35,200-36,000/tonne. export margins are positive for both raw sugar and refined sugar. Cane crushing has started this month.

Introduction

India, the world’s second-largest producer of sugar, aims to blend 20% ethanol in gasoline by 2025.

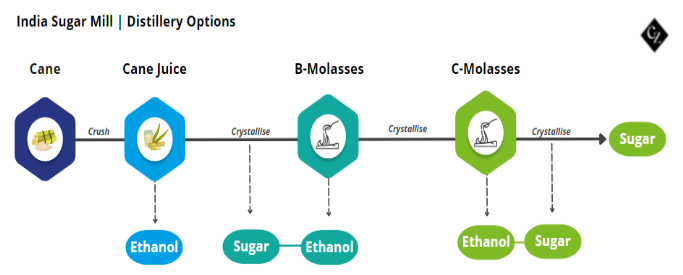

This ethanol will be made from sugar cane and various grain feedstocks, which means many Indian mills now have a choice about how they use the sucrose in the cane. We will show the choices they are making in this report.

Maharashtra Sugar Imports/Exports

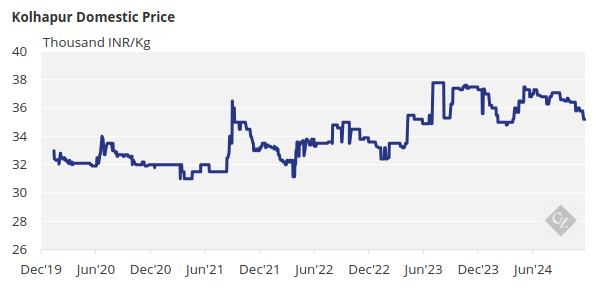

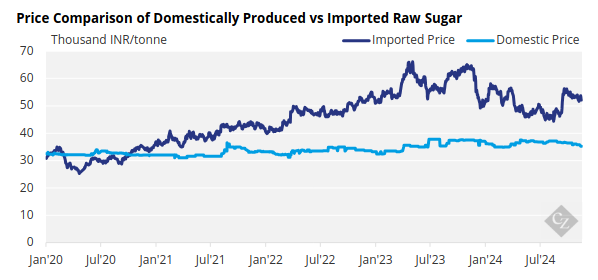

Over the past month, domestic sugar prices have been trading between INR 35,200-36,000/tonne.

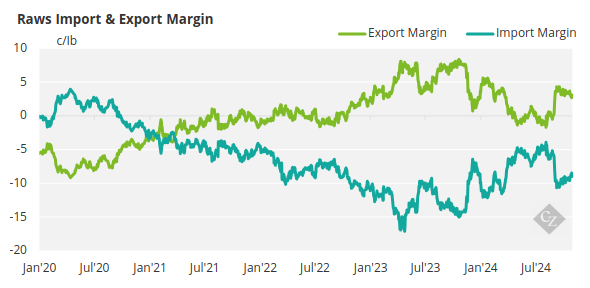

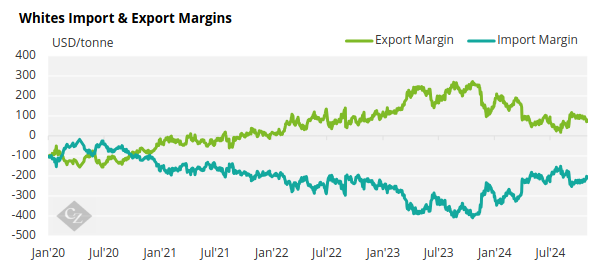

The export margin is positive with mills being able to earn 3.2c/lb over the domestic market if they were able to export today.

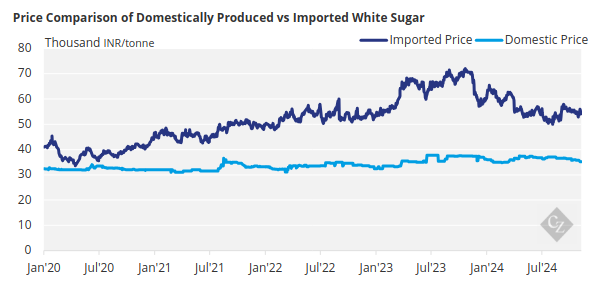

It’s a similar story for refined sugar margins, which are also positive, and mills would earn USD 64/tonne over the domestic market if they were able to export today.

The government hasn’t authorised sugar exports for the upcoming 2024/25 production season. Therefore, the above discussion remains theoretical. The government is unlikely to authorise any exports until it has a clear idea of sugar stock levels to ensure sufficient supply for domestic consumption as well as the ethanol blending program.

Furthermore, cane crushing has commenced in some parts of India, as regions like North Karnataka were expected to start crushing from November 15. Cane crushing has been delayed in Maharashtra, one of the major cane growing regions, due to the local elections.

Ethanol vs Sugar

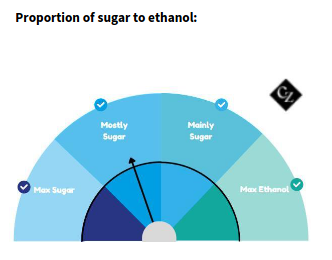

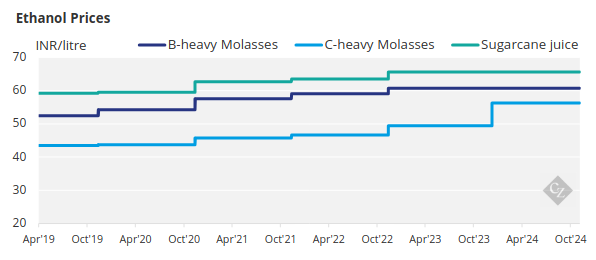

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies. The Indian government has strongly hinted at raising the ethanol prices which would be welcomed by the industry, as prices for corn-based ethanol have been raised several times but the same is not true for cane-based ethanol.

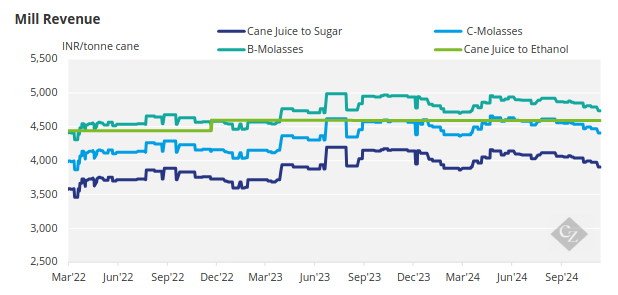

Earlier in the year mills were incentivised to use C-molasses instead of B-molasses and cane juice. All feedstock restrictions on ethanol production were lifted in August – mills can produce ethanol from any cane feedstock.

The revenue generated by the mills based on the type of feedstock used can be seen in the chart below:

Here are the current prices paid for ethanol by feedstock:

Appendix