Insight Focus

Baku Finance Goal set the aim of USD 300 billion a year in climate finance by 2035. Developing countries branded the outcome a “joke” after seeking USD 1.3 trillion per year in funding. UN carbon markets are now fully operational after final building blocks were agreed.

Baku Climate Summit Ends in Controversy

The annual UN climate summit held this year in Baku, Azerbaijan, staggered over the finish line in the early hours of Sunday with an agreement on climate finance that the world’s developing economies furiously branded “a joke” and “an insult”.

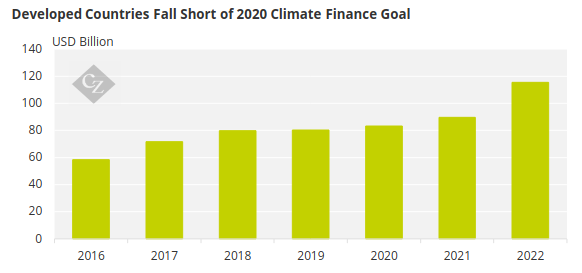

Delegates from more than 190 countries spend two weeks negotiating over a successor to the 2009 Copenhagen Accord, which pledged rich countries should deliver USD 100 billion a year in climate finance to the developing world by 2020.

Source: OECD

The updated Baku Finance Goal sees an uprated commitment of USD 300 billion a year by 2035, with a promise to engage in discussions over how to raise this to USD 1.3 trillion a year.

The agreement taps developed countries to provide this money from both public and private sources, and it also “encourages” emerging economies like China to contribute to the flow of funding. It also opens a pathway for other innovative forms of finance to be considered in the future, such as levies on international travel and even carbon markets.

The deal was put together over behind-closed-doors talks on Saturday night and Sunday morning. The agreement was hurriedly gavelled through by the host country chair despite protests from the likes of India, Cuba and Bolivia, who afterwards said they had not been given a chance to register their opposition to the deal before it was adopted.

COP29 Approves UN Carbon Markets

Despite the late controversy, one of the main successes of COP29 was the agreement to operationalise UN-sanctioned carbon markets that should trigger a wave of investment after nine years of work to develop the architecture and legal parameters of the system.

The first market, known simply as Article 6.2, enables bilateral government-to-government trades in carbon reductions under terms and standards agreed by the counterparties. Agreements in Baku finalised the arrangements over how countries will issue and transfer credits between themselves.

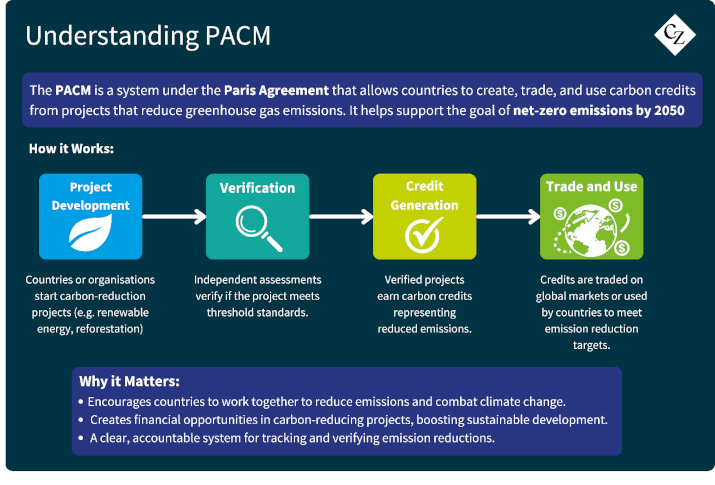

The second, formally called the Paris Agreement Crediting Mechanism (PACM) is a regulated market administered by the UN that enables private sector participants to develop carbon-cutting projects that earn UN-issued carbon credits.

These Article 6.4 Emission Reductions, as they’re known, will be eligible for use by countries to set against their Paris emission goals, but may also act as credits for companies making voluntary commitments to reduce their greenhouse gas footprints.

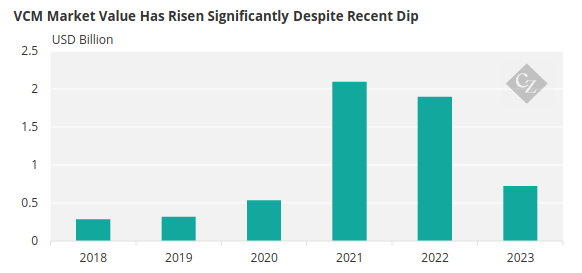

Already a long list of projects is awaiting approval by the 24-person panel that operates the PACM. The first trades are expected next year. Stakeholders are already asking what these new Paris mechanisms will mean for the voluntary carbon markets (VCM), which have enjoyed all the attention of market participants for the last six years.

Source: Ecosystem Marketplace

It’s likely that standards organisations like Verra, the Gold Standard and others, who develop methodologies governing the accounting of VCM carbon reductions, will submit their methodologies to the UN for formal approval as PACM methodologies as well.

This should widen the choices available to investors when it comes to picking a system in which to operate. They can choose between the UN-backed PACM, which offers markets at both government and private sector levels, or the VCM, which is likely to service entities that do not feel the need to adhere to the highest perceived standards.

Uncertainty Over UN Carbon Standards

With the ink barely dry on the decisions made in Baku, it’s far too soon to identify any trends, but much will depend on whether, and how quickly, countries move to adopt the UN standards.

Given that every UN-sanctioned carbon credit a host country sells adds to its shortfall against its own Paris goals, it’s not guaranteed that all host countries will move wholesale into the Paris marketplace.

The outlook is further clouded by an extremely complicated legal and technical process through which countries must pass in order to generate and sell PACM carbon credits. On the sidelines of the negotiations, one topic frequently being discussed was the growing need for insurance products to protect stakeholders against reversals in this new market.