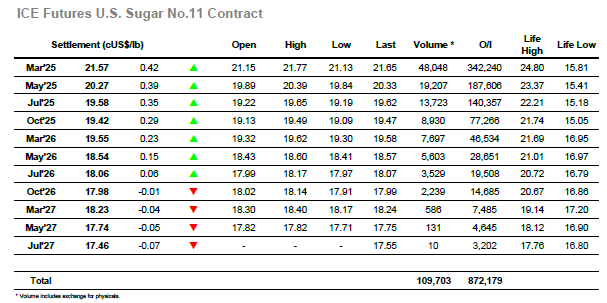

Following a week of struggle which has seen prices working back down through the range this morning’s unchanged opening would not have been expected to illicit much confidence, however some light buying did emerge to post modest gains and run against the current sentiment. This in turn drew a little more interest through from smaller traders which pulled the price up to 21.47 by mid-morning, more than 30 points above last night’s closing value despite the volumes being modest at best. These gains were maintained through the rest of the morning and with specs and smaller traders now playing the long side (and covering any recent shorts) the early afternoon saw a more concerted effort to energise the upside which resulted in highs at 21.77. The flat price rally provided a shot in the arm to spread values with March/May’25 reaching back to 1.39 points, although these highs were partially erased soon afterwards as the flat price slipped back into the range. Support was found in the intra-day chart near to this morning’s highs, and having dug in there was another push upward which ended a few points shy of session highs. The final couple of hours proved to be slow as prices consolidated quietly, with only some end of day position squaring to be found. March’25 settled at 21.60, a strong gain in context of recent sessions but still on low volume and likely to leave the market stagnating within the range as we approach the Thanksgiving holiday.

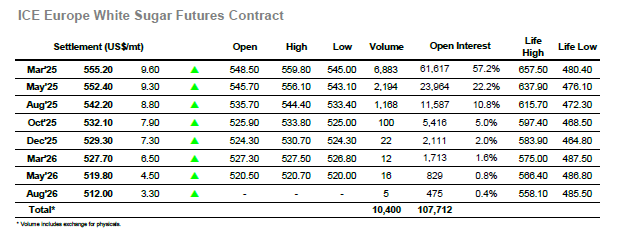

The market quickly rose this morning with a pause in the upper $540’s proving to be a staging post on the way through to the $555.00 area, with small traders looking to generate as much momentum as possible against a backdrop of very limited selling. With growers not looking to price at the lower end of the range resistance remained limited into the afternoon and so the rally was able to continue ahead to a session high mark at $559.80 before the buying dried up and profit taking kicked in, though in the context of the wider sugar world it meant little. The profit taking dropped prices back down into the range however the mood was more positive and with specs/funds being given the opportunity to improve the valuation for their sizable long holding some buying returned which allowed for consolidation at the upper end of the range through the later stages. The longs will have been concerned that the rally did not lead to much recovery for spread and white premiums values, which saw March/May’25 ending at $2.80 and March/March’25 at $79.70, something to be watched should the market continue to try and push back up the range. March’25 settled at $555.20, a solid showing which stabilises the market within the range for a while longer.