Insight Focus

The 2024/25 season got off to a strong start with record imports of liquid sugar and premix powder in October. But new rumours of food sanitation inspections are brewing.

2024/25 Season Off to A Strong Start

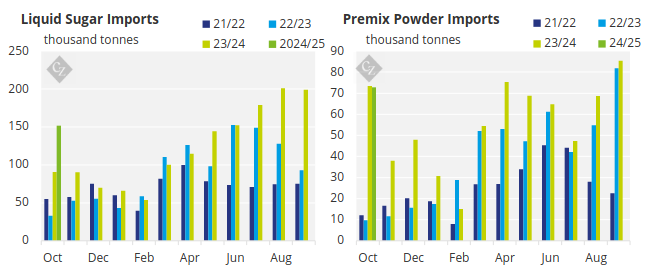

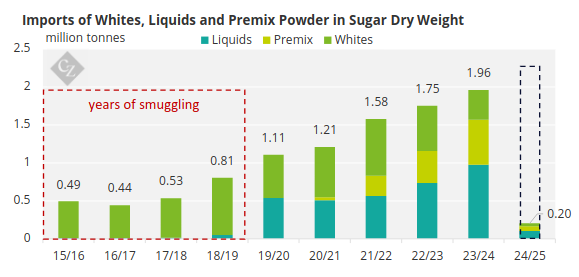

After the record imports of liquid sugar and premix powder in the 2023/24 season, 2024/25 got off to a strong start in October. China imported 152k tonnes of liquid sugar and 73k tonnes of premix powder in Oct 2024, 62k tonnes higher than same time last year.

If this continues, it could bring the total imports of white sugar (products) to more than 2 million tonnes in the 2024/25 season. This comes from both the higher availability of Thai sugar, and possibly higher demand from liquid sugar users, especially sugar refiners who are increasingly using liquid sugar as a feedstock alongside raw sugar.

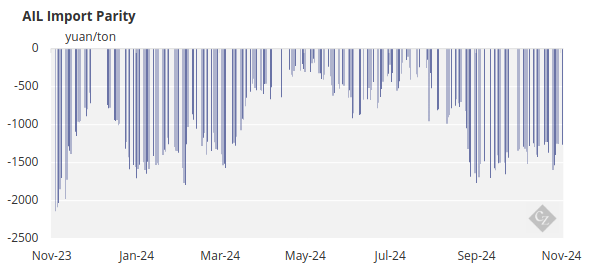

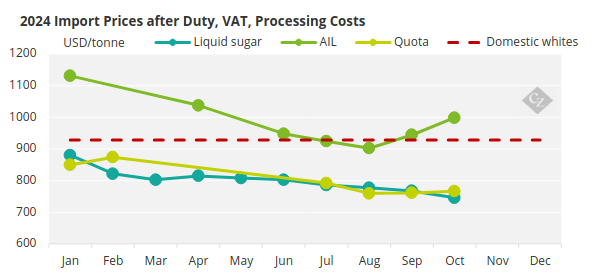

It’s understandable to use liquid sugar because Out Of Quota raw sugar import margins are still negative. Liquid sugar is the cheapest feedstock refiners can source without quota restriction. Like 2024, 2025 could be another challenging year for refiners to cover their raws demand, to feed their 14 million tonne refining capacity. This supports their demand for liquid sugar in the new season.

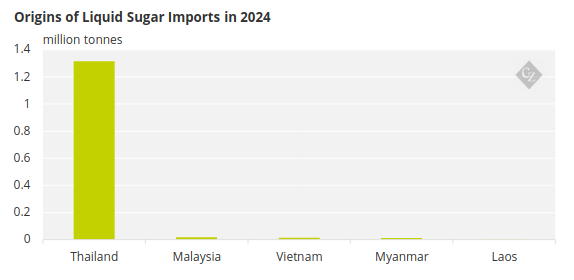

But policy remains to be the key risk. A new rumour emerged this month that liquid sugar could be under food sanitation inspections, which could slow down the flow as Thailand is the top one origin of liquid sugar. Domestic white sugar futures surged in response to the gossip but calmed down without further confirmation. We will continue to monitor the situation closely.

Until then, we think the flow should continue.