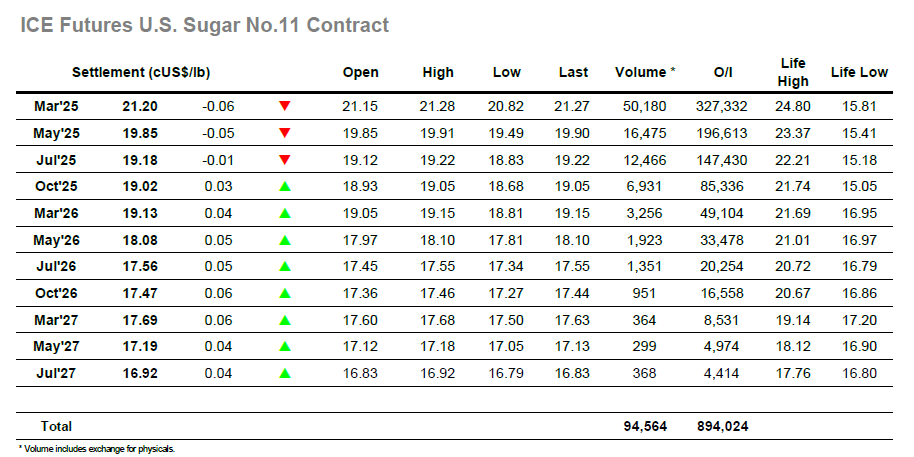

The market continued exactly where it left off with the post close pressure extending into today’s opening and sending March’25 quickly down to 21.04. March’25 then looked to hold ahead of 21.00 and did this successfully for most of the morning with all remaining calm until another spec push materialized and sent the price tumbling back towards the recent lows. As ever there was scale down buying as consumers continue to price opportunistically and so the move found support in the 20.80’s, where the market proceeded for the next few hours. Having made lows at 20.82 and without seriously threatening to test 20.70 there was a turnaround built upon short covering which saw prices fly back up through 21.00 and return to morning levels, and despite the recent tendency to keep trying lower the market is still refusing to break down in any significant way. Despite the tendency to continue testing the lows recently then final couple of hours proved relatively impressive with the recovery continuing on into the 21.20’s late in the day to show the market back into credit. Settlement was short of this mark at 21.20, concluding an interesting session with the broad parameters unchanged.

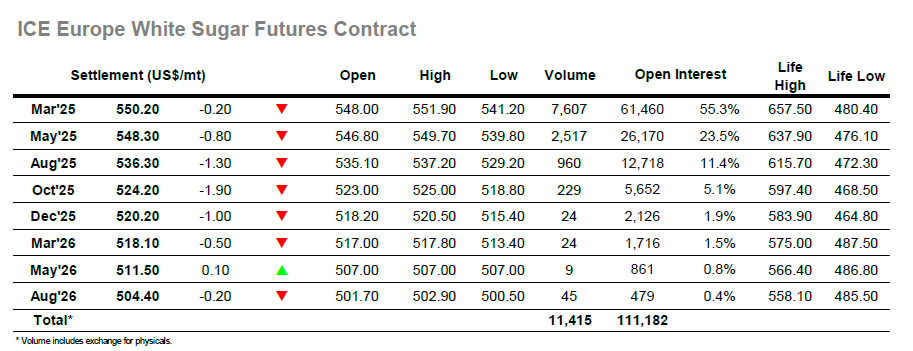

A lower opening was partially gathered and March’25 initially looked to hold the upper $540’s as best it could, though after a while we saw it crack and selling returned to take advantage of the vulnerability. The decline moved at a fair pace to fill in scale down pricing orders and extend to the $542 region before finding some heavier buying as would be anticipated with the recent lows only just beneath. Consolidation followed over the next three hours, during which time the market did print as low as $541.20, just $0.60c above last week’s mark, however it held firm and eventually there followed some position covering by traders to lead values into the range once more. While the initial rally was sharp the continuing progress proved to be a more even paced affair and took prices through this morning’s values and into a small credit, a solid reversal from the vulnerable position showing earlier this afternoon. White premiums were steady throughout as March/March’25 continued in then lower $80’s, while spreads followed a similar path and saw March/May’25 still near to $2.00. March’25 settled at $550.20, as the range endures for a while longer.