Insight Focus

And end-of-week rally boosted corn and wheat prices. Driven by strong US sales and lower stock expectations, a cold front in Europe may support wheat, while favourable South American weather could limit upside. We expect further consolidation for corn within the current range.

The December WASDE report is scheduled for release this Tuesday, with the market anticipating lower ending stocks for US wheat as well as globally. For corn, US stocks are expected to decline due to stronger demand, while global ending stocks are projected to remain unchanged.

While expectations of lower stocks for both corn and wheat have already been factored into prices, there is potential for a typical “buy the rumour, sell the fact” reaction, which could result in a negative week—unless the WASDE surprises with a tighter balance than anticipated.

Estimates for Russian wheat production for the new 2025/26 crop range between 80 and 85 million tonnes, driven by reduced acreage and poor crop conditions. This would mark a decline from the current crop of 92 million tonnes and represent a three-year low.

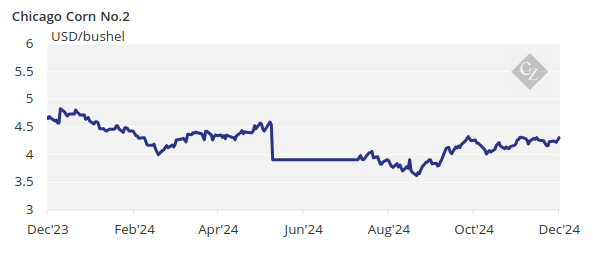

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 3.90/bushel with an upside bias. The average price since September 1 is currently running at USD 4.16/bushel.

US Sales and WASDE Expectations Boost Grains

An end-of-week rally lifted corn and wheat prices, driven by strong US weekly sales and expectations of lower stocks in the December WASDE report, due this week.

Last week began on a negative note for both corn and wheat in Chicago and Euronext. However, US corn sales published last Thursday showed a 63% increase week-on-week, and polls regarding the December WASDE pointed to expectations of lower stocks, triggering a rally that extended through Friday and resulted in weekly gains.

In addition to US corn sales, exports out of Ukraine published last Friday showed a 13% week-on-week increase, with year-to-date exports running strong — 36% higher. This further fuelled expectations of lower stocks in the December WASDE report.

The French corn condition was rated 75% good or excellent, unchanged week-on-week and compared to 82% at the same time last year. Harvesting in France is 94% complete, up five points week-on-week, and is now catching up with last year’s level of 99% and the five-year average of 98%.

Ukrainian corn has now been fully harvested. Russian corn is 93% harvested, with an average yield of 5.27 tonnes/ha compared to 7.17 tonnes/ha last year. In Brazil, summer corn planting is 65.1% complete, up from 60% at the same time last year, with crop conditions reported as favourable by CONAB.

Rains are forecast again in centre south Brazil and Argentina which will continue to favour corn development. For corn in Chicago, we expect further consolidation within the current range of USD 4.15/bushel to USD 4.30/bushel.

Lower Wheat Stocks Provide Support

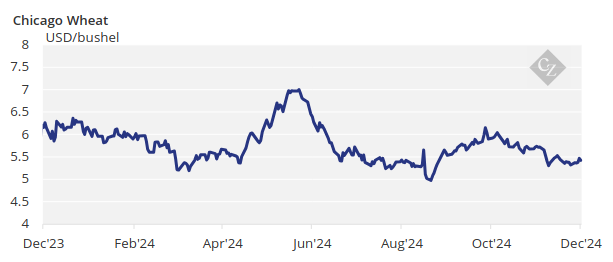

Wheat prices recovered on both sides of the Atlantic due to concerns about the quality of Russian wheat and expectations of lower stocks to be published this week in the December WASDE report.

The Australian Bureau of Agriculture raised its 2024/25 production forecast to 31.9 million tonnes, an increase of just 100,000 tonnes from its previous estimate. However, this represents a 23% increase from last year and a 20% rise compared to the 10-year average.

Winter wheat planting in Russia is now complete, but conditions remain poor, with only 64% rated as good or excellent compared to 96% last year. Additionally, last year’s harvest is still not fully complete, with 98.9% finished.

Winter wheat planting in Ukraine has finished. In France, winter wheat planting is 96% complete, up from 87% at the same time last year. The crop is rated 86% good or excellent, down one point week-on-week but up from 77% last year.

This week, the US is expected to have favourable rains again, benefiting wheat development. Europe is receiving a cold front together with rains across the whole continent, including the Black Sea area.

Beyond this week, we move now to the potential impact of the cold front in Europe, which could affect wheat and provide support to prices. On the other hand, South American weather remains ideal, which should cap any significant upside.