Insight Focus

PTA futures moved lower last week following weaker crude values. PET resin export prices also followed suit, averaging USD 790/tonne by Friday. PET resin and raw materials futures hold a similar forward premium of USD 15/tonne to May’25.

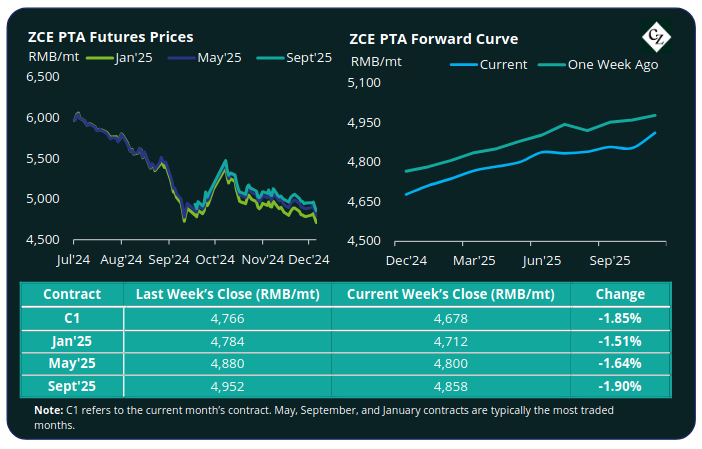

PTA Futures and Forward Curve

After remaining relatively steady through much of last week, Friday’s slump in crude oil prices led the Jan’25 PTA futures contract to drop a further 1.85%.

The fall in crude oil prices followed OPEC+’s decision to postpone the rollback of its oil production cuts giving traders the perception of weak oil demand. By Friday, Brent Crude oil prices were around USD 71.50/bbl.

PX-N showed some marginal improvement due to an easing of operating rates and some plant maintenance, returning to levels last seen mid-October. Meanwhile, few changes in the PTA landscape meant that the PTA-PX CFR spread kept relatively steady at USD 77/tonne.

A potential easing of polyester operating rates may place modest additional pressure on PTA demand going into Q1’25, as PTA production remains relatively high.

The PTA forward curve kept a slight contango, with the May’25 contract at a RMB 88/tonne premium over the Jan’25 contract. The Sept’25 had a RMB 146/tonne premium.

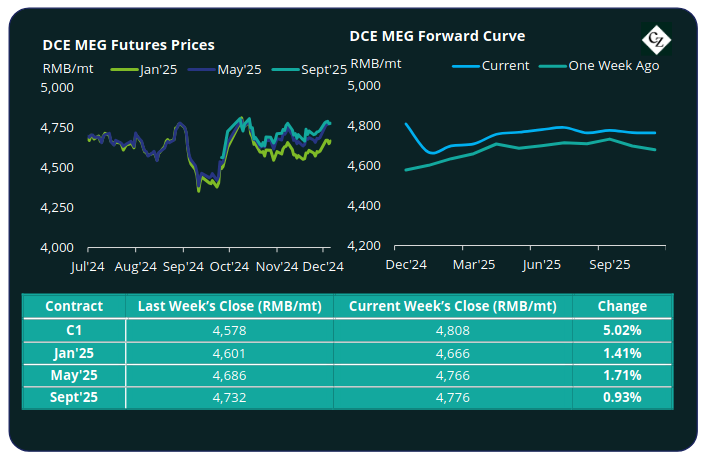

MEG Futures and Forward Curve

MEG futures bucked the general weak global commodity trend with main month contracts rising by around 1.5% last week.

East China main port inventories continued to shrink on limited deep seas arrivals, decreasing 6% to just 480,000 tonnes by Friday. Upcoming domestic maintenance turnarounds are also likely to keep inventory growth in check as MEG market sentiment continues to be buoyed by tight spot liquidity.

The MEG Futures forward curve remained flat to a slight carry, with only a modest upward curve through the next 12 months.

The May’25 contract held a RMB 100/tonne premium over the main Jan’25 contract. The Sept’25 contract was at a RMB 110/tonne premium.

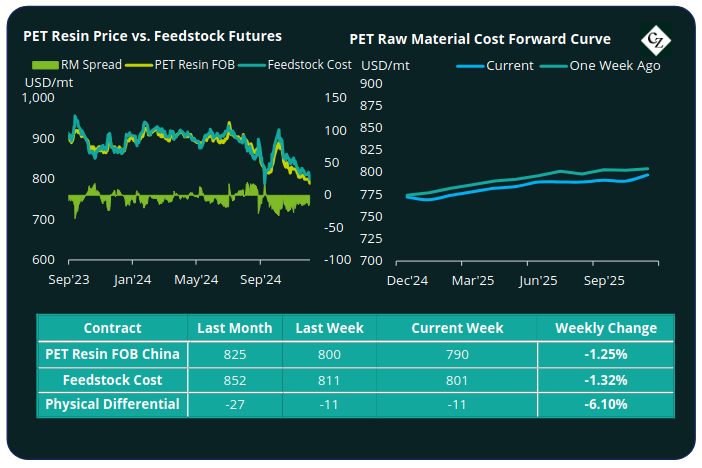

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices kept relatively flat through the week, before coming under renewed pressure. By Friday, the average China FOB price was around USD 790/tonne, down USD 10/tonne from the previous week.

The average weekly PET resin physical differential against raw material future costs stayed relatively flat at negative USD 11/tonne last week. By Friday, the daily differential was also steady at negative USD 11/tonne.

The raw material cost forward curve has kept a slight contango through 2025 with May’25 holding a USD 15/tonne premium over Jan’25, and Sept’25 USD 22/tonne, with little change versus the previous week.

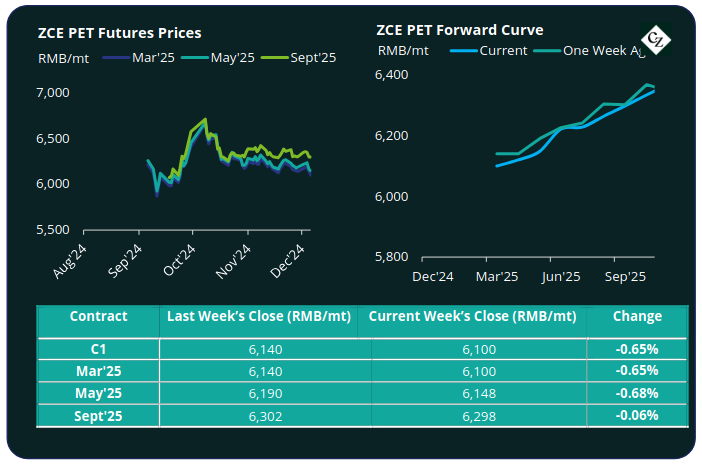

PET Resin Futures and Forward Curve

PET Resin Futures also fell by just over half a percent, with the Mar’25 contract, the first contract month of these new futures, down to RMB 6100/tonne (USD 839/tonne), equating to an FX adjusted loss of USD 9/tonne for the week.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures increased slightly to USD 28/tonne, up USD 1/tonne. By Friday, the daily premium was USD 29/tonne.

The PET Resin Futures forward curve remains in contango. May’25 holds a RMB 48/tonne (USD 7/tonne) premium over the main Mar’25 contract. Sept’25 holds a RMB 198/tonne (USD 27/tonne) premium.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

PET resin export prices continued to track softening raw materials and the underlying crude oil basis, weakened by OPEC+’s latest round of discussions.

The fall of the Assad region within Syria will only add to geopolitical volatility in the Middle East. However, latest diplomacy from the incoming Trump administration has increased the probability of a ceasefire in Ukraine in 2025.

The physical differential to raw material futures remains pinned deep in negative territory and is expected to remain suppressed through Q1’25.

Although capacity growth is expected slow in 2025, following two years of significant expansion, the market could still see another 2.5-3 million tonnes of annual capacity potentially added in 2025.

Looking ahead, both raw materials and PET resin forward curves show limited upside to PET resin export pricing through to next summer, with just a USD 15/tonne premium on the forward curves to May’25.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.