Insight Focus

In 2023, biofuel consumption in Canada surged. Not only did it contribute to greenhouse gas emissions reductions, but biofuel blending impacted fuel costs, lowering gasoline prices and raising diesel prices. The increase in biofuel use was driven by the Clean Fuel Regulations and regional policies, with a notable rise in clean fuel demand.

2023 Surge in Biofuel Consumption

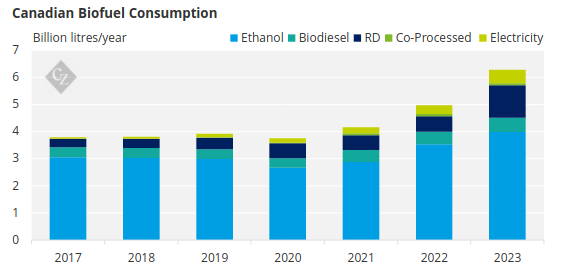

A new annual report released on November 25 by Advanced Biofuels Canada (ABFC) shows that biofuel consumption surged in 2023 with ethanol up 13% (4 billion litres) from the prior year.

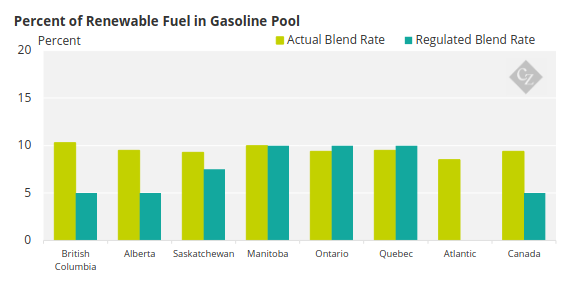

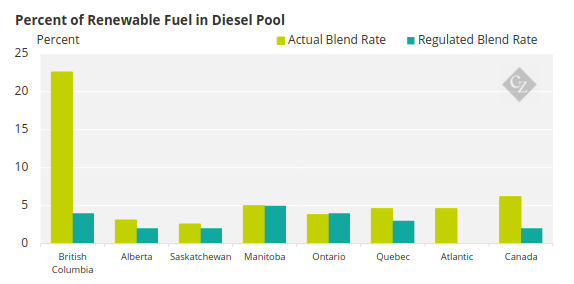

The ninth annual report, prepared by Navious Research Biofuels in Canada (BIC), also showed that renewable diesel consumption increased 14% (530 million litres) from 2022. Biofuel content in gasoline was 9.44% and 6.23% in diesel, up 10% and 68% respectively from 2022 levels.

In 2023, biofuels were responsible for 86% of Canada’s greenhouse gas emission reductions from all clean transportation fuel use, totalling 11.4 million tonnes of climate change gases. Ethanol had 55% lower carbon emissions than gasoline, and biomass-based diesel had 87% lower emissions than diesel. Electricity consumption by light-duty vehicles grew by 56% in 2023, building on a 41% increase in 2022.

Source: ABFC

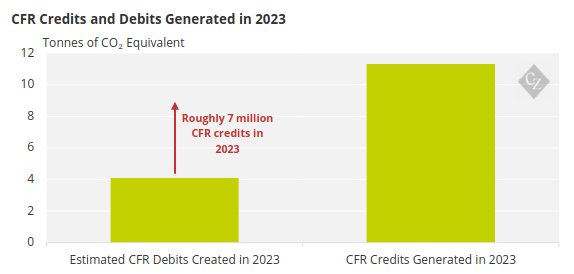

Impact of Blending and CFR

In 2023, biofuel blending lowered wholesale gasoline costs by CAD 0.055/litre and raised wholesale diesel costs by CAD 0.051/litre. Biofuel blended in gasoline (ethanol) reduced gasoline wholesale costs by almost CAD 1 billion in 2023. Since 2010, ethanol has reduced wholesale gasoline costs by CAD 10.4 billion.

Source: ABFC

Taxing biofuels based on volume instead of energy content results in overtaxing. If biofuels were taxed based on energy delivered, they would have saved consumers a total of CAD 2.5 billion, instead of costing them CAD 2.2 billion since 2010.

Canadians spent CAD 115.1 billion on gasoline and diesel fuels in 2023. Biofuel blending, which accounted for 8.1% of gasoline and diesel (on a weighted average volumetric basis), added 1% to overall fuel purchase costs. Had biofuels been taxed based on energy, costs would have increased by only 0.5%.

“After more than a decade of steady, modest growth in biofuels use, 2023 saw a 25% surge in demand for clean fuels” said Ian Thomson, ABFC President. “The federal Clean Fuel Regulations (CFR) were a big driver, aided by a 28% increase in biofuels use under BC’s Low Carbon Fuel Standard and a 52% increase in Québec’s use due to the implementation of its new low carbon fuel regulation in 2023.”

“Notably, the greatest growth in biofuel use occurred in diesel-class vehicles. There was a 21% reduction in the carbon intensity of these biofuels, highlighting the clean fuel sector’s ability to apply innovations along the whole production value chain,” Thomson said.

Thomson added that with the CFR now in effect, the report further clarifies the differences between a carbon tax and regulatory compliance credits. It highlights that “the fuel price impact of the CFR is over ten times smaller than that of a carbon tax with an equivalent dollar-per-tonne CO2 price.”

Source: ABFC