Insight Focus

By 2034, Brazil is on track to produce 350 million tonnes of soybeans and corn. Biofuel and food demand will drive domestic consumption. However, logistical and storage challenges must be addressed to maintain Brazil’s position as a global leader in agribusiness.

Brazil’s Record Soybean Harvest

Brazil is on track for a record soybean harvest this season, with both USDA and CONAB forecasts estimating production between 166 and 169 million tonnes for 2024/25. While planting began with some uncertainty, surpassing 160 million tonnes now seems achievable.

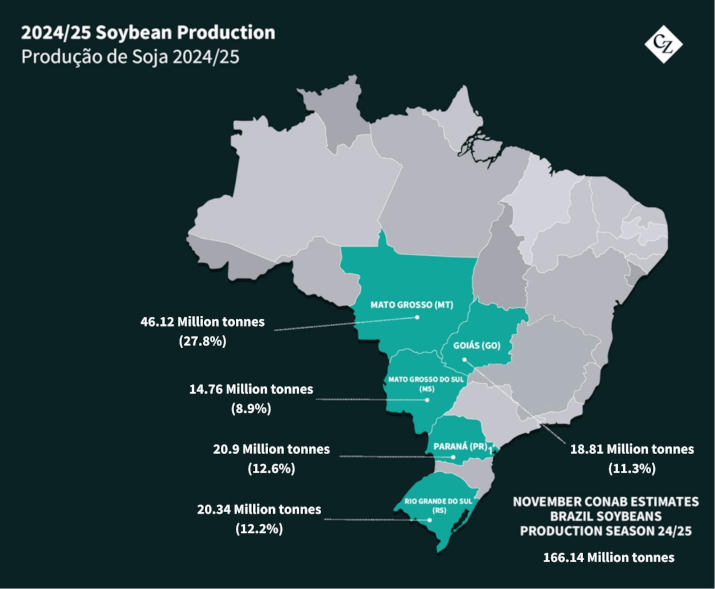

Currently, five regions account for approximately 72.8% of the country’s soybean production: Mato Grosso, Rio Grande do Sul, Paraná, Goiás and Mato Grosso do Sul. According to the latest CONAB report on November 14, these regions alone are expected to produce 120.9 million tonnes this season.

The yield of Brazilian soybeans has increased by 13.1% over the past 10 years, with a 51.6% expansion in planted area, highlighting that production growth has largely been driven by area expansion. Looking ahead to the next decade, the average yield of 3.23 tonnes/ha (53.8 60-kilo bags/ha) remains a challenge.

Growth in Brazil’s Soybean Production

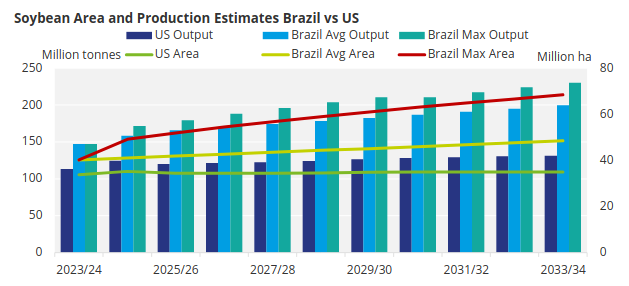

However, a recent study by the Brazilian Ministry of Agriculture, Livestock and Food Supply (MAPA) projects that by the 2033/34 season, the soybean planted area could grow by 11.5 million hectares, from 46 million ha to 57.6 million ha, representing a 25.1% increase.

This would allow Brazil to reach 20In transportation, roadways remain the primary mode, but the hydrographic system, particularly the so-called Arco Norte, is gaining importance. This corridor uses waterways to export grains from ports in Northern states like Pará and Maranhão. In 2023, Northern ports accounted for 45% of Brazil’s corn exports and 36% of its soybeans.0 million tonnes of soybeans, a 34% rise compared to the 2023/24 harvest and a 20% increase over the estimated production for the current 2024/25 season. Nonetheless, this growth rate would still fall short of the pace observed over the past decade.

The area expansion is expected to occur primarily in the MATOPIBA region (Maranhão, Tocantins, Piauí, and Bahia) and in Mato Grosso, where the IMEA (Mato Grosso Institute of Agricultural Economics) forecasts that over the next 10 years, 15.62 million hectares of pastureland will be suitable for conversion to cropland. This conversion is not expected to harm the growth of beef production in the state, as the loss of pasture will likely be offset by investments in technology and animal genetics.

The projections appear conservative compared to the current season’s estimated output of over 166 million tonnes. If we consider the upper limit of MAPA’s projections, Brazil could reach a planted area of 68.5 million ha, resulting in a potential harvest of 230 million tonnes of soybeans.

Source: MAPA/USDA

A similar study by the USDA projects only a 3.5% increase in the soybean planted area in the US, from 33.8 million ha in the recently concluded season to 35 million ha by 2034. This modest expansion would result in a production increase of just 18.6 million tonnes, from 113 million to 131.6 million tonnes. As the US is Brazil’s main competitor in terms of soybean exports, this demonstrates the scale of the production gains being made in Brazil.

Growth in Demand

Domestic consumption, currently estimated at 52.5 million tonnes for 2023/24, is projected by MAPA to reach 62.6 million tonnes by 2034 — an increase of 19.1%. In a more optimistic scenario, it could rise to 69.8 million tonnes, representing a 33.8% growth.

According to the USDA, by 2034 global trade will need to import 221.6 million tonnes of soybeans. In absolute terms, Brazil is expected to increase its exports from the current 104.6 million tonnes, per CONAB’s 2024/25 CONAB projection to 130.8 million tonnes. However, proportionally, its market share would remain stable at 59%. In the most optimistic scenario, Brazil’s share of global export sales could reach 71%, or 157.6 million tonnes.

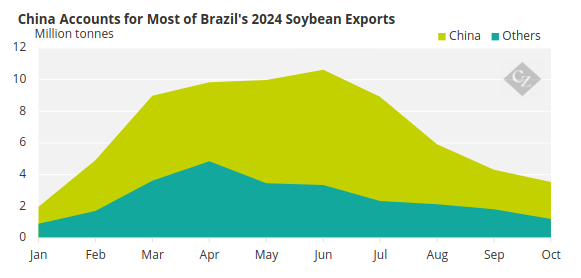

China remains the dominant buyer of soybeans. The USDA projects Chinese imports will rise from 104.3 million tonnes in 2024/25, making up 59% of the global market, to 138.3 million tonnes by 2034, increasing its share to 62.4%. As of November 2024, China had already purchased 69 million tonnes from Brazil, representing 73% of Brazil’s soybean exports, with a total value of USD 29.9 billion.

Source: Comexstat

New Future for Brazilian Corn

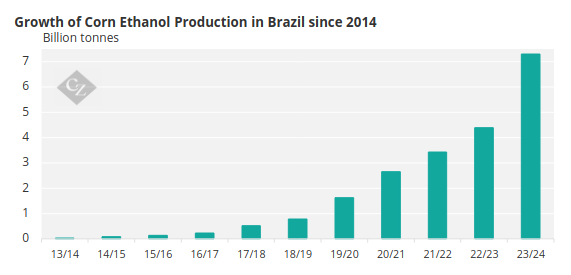

The Brazilian corn sector is also poised for significant changes, driven by domestic demand, particularly from the growing production of ethanol. While corn-based ethanol has long been standard in the US, Brazil has historically produced ethanol from sugarcane.

The first litres of corn ethanol were produced only during the 2014/2015 season, with a modest 100 million litres. However, the abundance of corn in regions like Mato Grosso and Mato Grosso do Sul, coupled with the distance of these states from the sugarcane-producing regions of the Southeast and Northeast, has significantly accelerated corn ethanol production over the past decade.

Source: UNEM

According to CONAB’s November report, of the 36.1 billion litres of ethanol projected for the 2024/25 season, 7.2 billion litres are expected to come from corn. A staggering 99.6% of this production is concentrated in plants in the Central-West region, specifically in Mato Grosso (4.9 billion litres), Mato Grosso do Sul (1.5 billion litres), and Goiás (735.5 million litres). There are also production facilities in Alagoas (Northeast), Paraná (South), and São Paulo (Southeast).

MAPA expects corn ethanol production to reach 8.7 billion litres by the 2025/26 season, requiring around 19.4 million tonnes of corn. Although MAPA and CONAB have yet to include long-term projections in their estimates, the combined impact of corn ethanol and the growth in cattle feedlots is expected by MAPA to push domestic corn consumption from 84.2 million tonnes in the 2023/2024 season to 109.8 million tonnes by 2034.

In a high-demand scenario, domestic consumption could rise to 130.3 million tonnes, representing a 54.7% increase over the 2023/2024 levels.

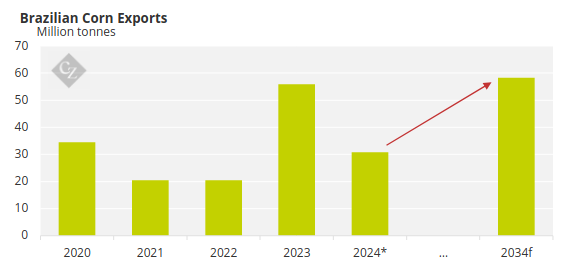

The rise in domestic demand will undoubtedly limit corn exports. Under the maximum scenario projected by MAPA, Brazilian corn exports could still reach 58.3 million tonnes over the next 10 years from 36 million tonnes from the most recent crop.

Source: Comexstat

However, this figure still falls short of surpassing its main competitor in international trade, the US, which the USDA estimates will export 63.5 million tonnes by 2033/2034.

Egypt, Vietnam, Iran, South Korea, Japan, and China are the six largest importers of Brazilian corn. Together, they purchased 16.7 million tonnes, accounting for 54.4% of the total exported by Brazil by October 2024, which amounted to 30.8 million tonnes. According to USDA data, the total demand from these countries is expected to grow by 16.2 million tonnes, increasing from 77 million to 93.3 million tonnes.

Safrinha Crop Expands Alongside Soybean Cultivation

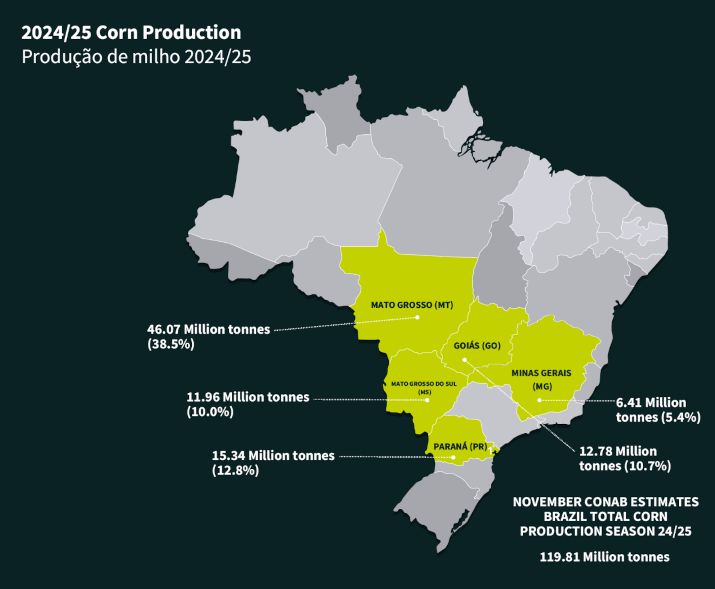

Brazil’s corn production is currently estimated at 119.81 million tonnes for the 2024/25 season, according to CONAB. Approximately 77% of this output is concentrated in the states of Mato Grosso, Paraná, Goiás, Mato Grosso do Sul and Minas Gerais.

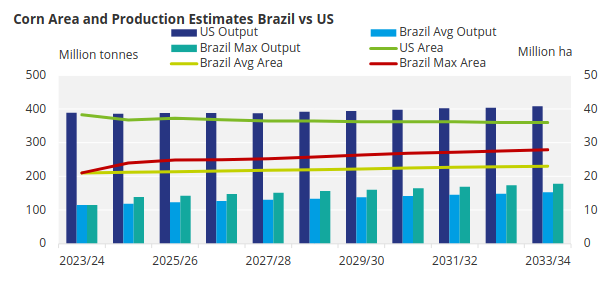

To meet the growing domestic and export demand, national production is expected to increase to 151.14 million tonnes over the next decade, potentially reaching 153.1 million tonnes at the upper limit of projections.

The growth is expected to come primarily from the expansion of the 2nd corn crop (safrinha crop), which is projected to increase by 25%, growing from 16.4 million to 20.5 million hectares. This expansion will not require new exclusive areas for corn cultivation, as soybean fields free up most of the space needed for the safrinha planting.

Source: USDA/MAPA

Challenges for Food Supply, Logistics

New areas for exploration, particularly in the MATOPIBA region, alongside the improvement and expansion of systems such as crop-livestock integration, will continue to strengthen Brazil’s position as one of the world’s leading food suppliers.

However, with the rising production of biofuels derived from soybeans and corn, an unprecedented scenario is emerging where food demand may increasingly compete with the energy sector. This dynamic is likely to exert upward pressure on prices, reshaping market forces in the years to come.

Additionally, logistics will remain a significant challenge in Brazil, both in storage and transportation. Despite improvements in the country’s grain logistics infrastructure in recent years, it has not kept pace with the rapid growth in production.

Last year, the storage capacity for corn and soybeans stood at 234.3 million tonnes, compared to a 2022/23 crop of 286.5 million tonnes for both crops combined. This resulted in a storage deficit of 52.2 million tonnes, or 18%. In Mato Grosso, the country’s largest producer, the deficit was even higher at 41%, according to CONAB.

In transportation, roadways remain the primary mode, but the hydrographic system, particularly the so-called Arco Norte, is gaining importance. This corridor uses waterways to export grains from ports in Northern states like Pará and Maranhão. In 2023, Northern ports accounted for 45% of Brazil’s corn exports and 36% of its soybeans.

However, barge navigation in these waterways is often hindered during the dry season, from July to October, forcing greater reliance on ports such as Santos in São Paulo, which increases costs.

Significant investments in Brazil’s underdeveloped railway infrastructure are essential for improving integration. Projects like the Ferrogrão railway, which aims to link key production areas in Mato Grosso to the Arco Norte, could greatly reduce transportation costs. However, despite the concession being approved, the project remains stalled due to legal challenges.