Insight Focus

If China does suspend imports of liquid sugar and premixes from Thailand, what impact will this have on the sugar market?

Rumours Come True?

Rumours about liquid sugar control have been buzzing in the Chinese market for a month. On December 10, 2024, a new document from the General Administration of Customs of the People’s Republic of China (GACC) circulated on the market. We need to emphasise that this document is not published in official channels and therefore its authenticity cannot be verified.

It’s a notice issued by the Food Safety Bureau of GACC for the export of sugar products (liquid sugar and premix powder) from Thailand to China. Until the potential food safety risks have been fully identified and evaluated, China will suspend the registration of the Thai producers of these products, and suspend the customs declaration and import of these products from December 10, 2024.

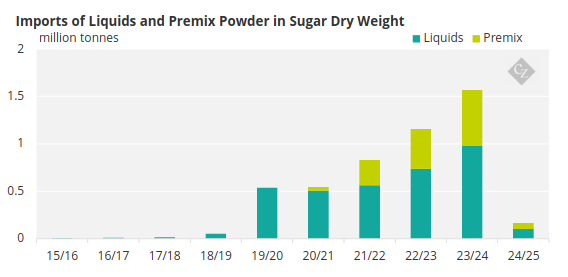

It it’s true, it will put the brakes on the fast-growing imports of liquid sugars and premixes.

Impact on the Sugar Market

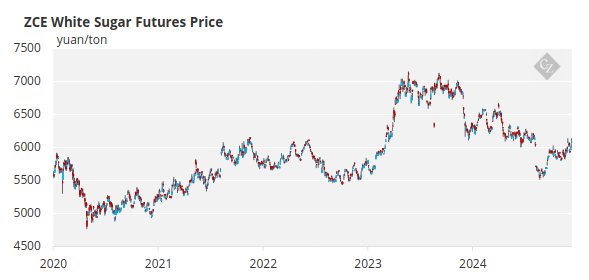

The domestic sugar futures prices seem to have illustrated a change in market expectations, and the rumour has pushed the price above 6,100 yuan/tonne.

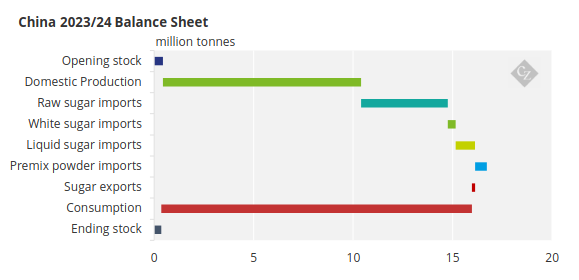

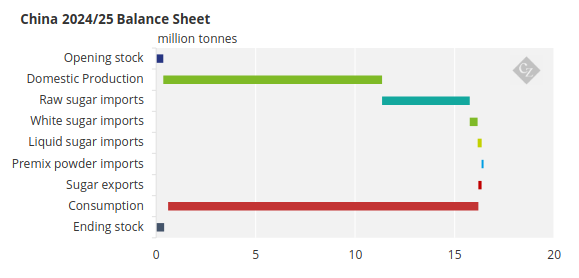

This is mainly due to the fact that liquid sugars and premixes have become an important supply source over the past few years. In the 2023/24 season, imports of liquid sugar and premixes translate into 1.6 million tonnes of white sugar by dry weight.

If imports of these products are suspended from December 2024, they will need to be replaced by other sugar sources. Fortunately, Chinese domestic sugar production is in recovery; we expect sugar production to reach between 10.7 million tonnes and 11 million tonnes this season. With this, the raw sugar that needs to be imported should be similar to the 4.4 million tonnes in the 2023/24 season.

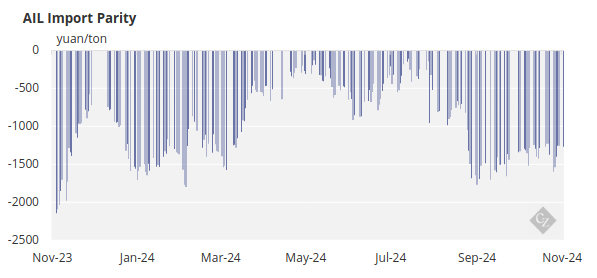

And this will require an improvement in AIL (Out Of Quota) raw sugar import parities, unless China decides to issue extra sugar import quotas, as it did last season. This will benefit China’s demand for raw sugar in the world market. Although they don’t need to rush to buy just yet.

Why Thailand?

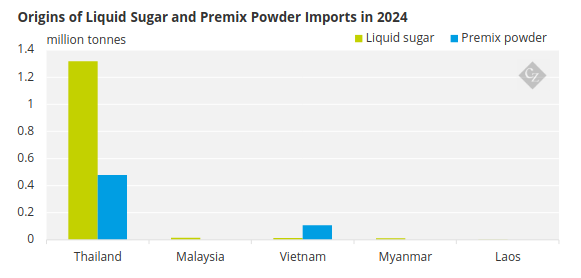

This is because Thailand is the main source of imports of liquid sugar and mix. Many of these factories are in Thailand’s CBZ, which uses sugar as a raw material to produce liquid sugars and premixes. We think these factories, as well as importers in China, will actively respond to the new regulatory requirements, but it remains to be seen how long this process will last. In addition to Thailand, other ASEAN members such as Vietnam and Malaysia are also sources of these products, but the proportion is very small.

These origins are not currently covered by the new regulatory requirements, but risks of stricter safety regulations and access regimes remain.