Insight Focus

Urea prices have risen following India’s tender announcement. Processed phosphate prices are bearish due to weak demand, though limited availability could support prices. Potash prices are stable, with demand increasing in Brazil. The ammonia market remains subdued, with a bearish outlook for the rest of the year.

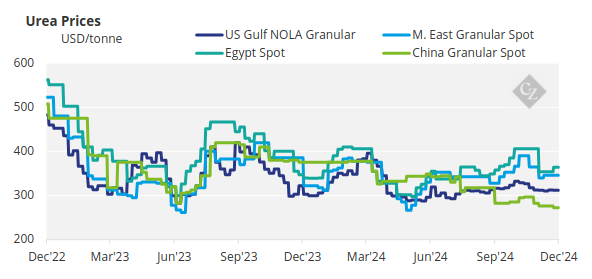

Urea Prices Rise Across the Board

Following the announcement of the urea tender in India, which closes on December 19 and calls for shipments by the end of January 2025 for up to 1.5 million tonnes, urea prices have increased across the board. Additionally, gas issues in Iran are substantially reducing urea production, which is having a material impact on two of its primary destinations: Brazil and Turkey.

Prices in Brazil have risen, with values now just above USD 355/tonne CFR. However, with Brazil having imported record volumes of urea in 2024, warehouses are full, and only the northern ports are attracting interest, where prices typically carry a premium of around USD 10/tonne.

Egyptian producers have also seized the opportunity, achieving prices as high as USD 380/tonne FOB, with most products destined for Europe and Turkey.

In the NOLA/US market, prices reached their highest levels since October, with an increase of approximately USD 15/tonne week-on-week. January barges have been trading as high as USD 335/short ton, equivalent to a CFR price of USD 364/tonne. Middle Eastern producers are taking a back seat, awaiting the results of the Indian tender and busy fulfilling contracts from the previous tender. Price offers are being reported at above USD 350/tonne FOB.

East of Suez, activity has been slow. Brunei is rumoured to have sold a second-half January cargo to Australia at a price above USD 350/tonne FOB, with some reports indicating prices as high as USD 360/tonne. China remains on the sidelines, though there are renewed rumours that it may come into the export market in early 2025.

The outlook for urea prices is bullish, driven by India’s large tender and production challenges in Iran, while Europe appears to be contributing additional demand.

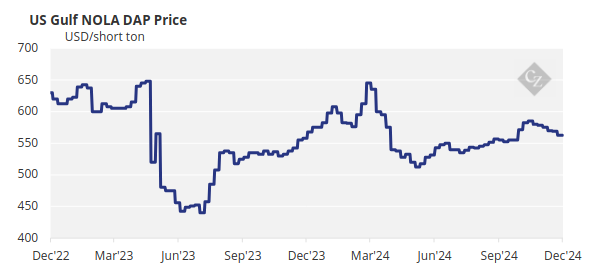

Phosphate Market Subdued

The processed phosphate market showed little activity this week, with buyers showing little appetite for current prices due to the off-season in major markets and poor affordability. MAP prices have remained steady at around USD 635/tonne CFR for the fifth consecutive month.

Spot prices for DAP to India also held steady, just shy of USD 635/tonne CFR. Indian demand is expected to stay subdued over the next few weeks as the Rabi sowing season concludes, with urea top dressing taking focus.

No new export sales from China have been made due to the government’s December restrictions on exports. As a result, domestic prices are coming under pressure. China’s January-October production of DAP/MAP rose by 12% year-on-year to 25.4 million tonnes, up from 22.7 million tonnes. DAP production for the same period increased by 10% to 12.8 million tonnes, whilst MAP production rose by 15% to 12.6 million tonnes.

The outlook for processed phosphate products appears slightly bearish in terms of demand, while prices may remain steady due to limited availability.

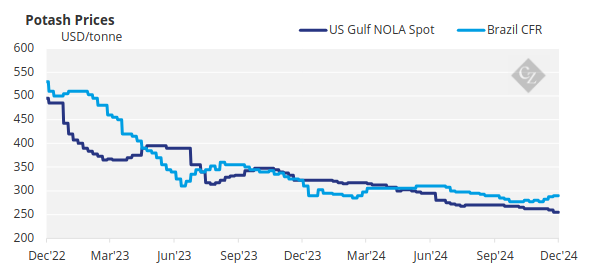

Potash Market Remains Stable

Global potash prices outside China remained broadly stable, although sentiment in Brazil is positive, with some expecting prices there to strengthen further in the coming weeks. Brazil’s price held steady after two weeks of gains, and imports are forecast to reach a record high this year, with January-November MOP volumes climbing to 13.2 million tonnes, up 7% year-on-year.

Some market participants suggest that high stock turnover could dampen demand during the Q1 period. The FAI conference held last week spurred market speculation about China’s 180-day potash contract price, with many anticipating a USD 10-15/tonne increase on a CFR basis, reflecting the broader bullish outlook. The Southeast Asian MOP market remained stable and quiet this week, with limited business activity.

The focus has shifted to the first quarter, and some producers are now expecting no less than USD 300/tonne CFR for sMOP. However, Malaysian MOP prices continue to lag behind as old stock is sold at discounted rates.

Potash spot prices are forecast to increase gradually in the coming week as demand picks up in key global markets. The high stock levels, coupled with a less favourable agricultural outlook, may constrain significant upside potential.

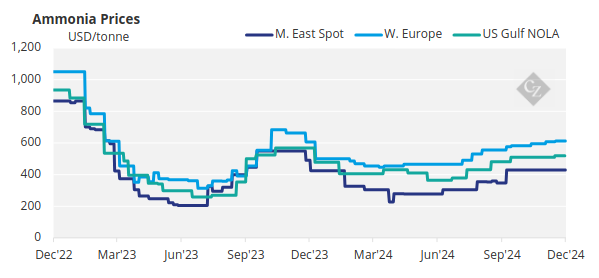

Ammonia Market Quiet, Prices Softening

Fresh spot business for ammonia was again lacking this week, despite indications that the market may weaken further as the year draws to a close. Supply remains reasonably healthy, while demand is limited across almost every region.

Prices are expected to remain flat-to-soft across the board, with most buyers adopting a cautious, back seat approach to purchasing for the time being.