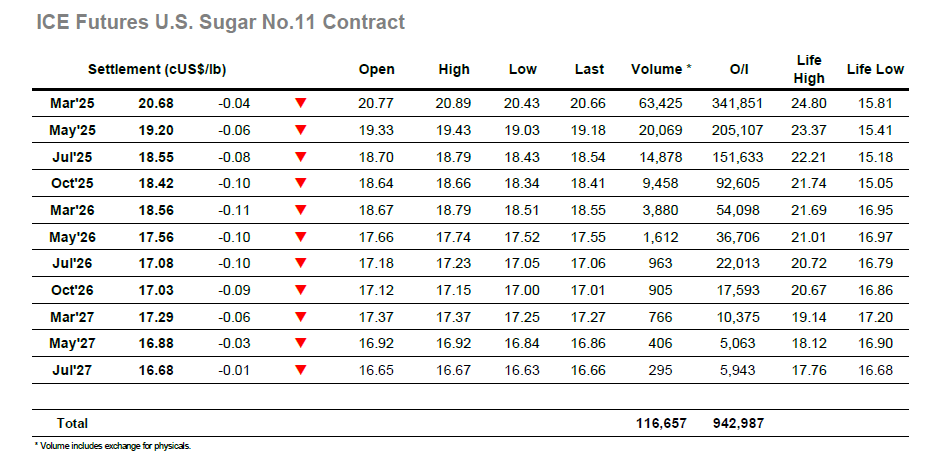

The new week brought with it some buying through the early part of the session, likely related to physical activities as buyers emerge to take advantage of the lowest prices since September. This enabled March’25 to reach a high of 20.89 before dropping back to unchanged levels, with the failure to build upon the early gains raising questions as to whether we would see additional price erosion considering Fridays movement. The COT report had shown a small net gain with the overall holding moving back to a small net long of 2,295 lots, a still neutral position which gives traders freedom to push in whichever direction presents best opportunity. This is clearly lower at present, and it did not take long for the smaller traders to kick the price down within a couple of points of 20.57 (Fridays low) and leave the picture vulnerable ahead of the busier afternoon period. In fact, the lows were broken as noon approached with assorted moderate sell stops triggered as the price spiked down to 20.43, and while a bounce into the range followed it was purely based on position covering with the struggle resuming once it had concluded. Despite flirting with the lows again midway through the afternoon the market held with short covering then providing the basis for a rally back to 20.81 through the later part of the afternoon. Some end of day long liquidation meant a close for March’25 at 20.68, not the strongest of sessions but more resilient than had seemed likely midway through the day.

The whites saw a sharp and unexpected resurgence as we opened with March’25 climbing by almost $10 to touch $537.90 with less than 20 minutes of the session having elapsed. The gains were impressive given the volume was only just more than 1,000 lots and had a significant impact upon the March/March’25 white premium by widening it out to $77.50 and reversing a good portion of last weeks losses. This was a false gain for the flat price as the market then settled down, and with the initial cover taken the March’25 contract set back and sat either side of $530 through the later morning. Still the premium value remained buoyant though as the market consolidated through the early afternoon a modicum of recovery in No.11 values narrowed this back to the $74 area. Trading was calm as the afternoon progressed, though with the morning gains long behind us there started to be some renewed selling interest from the specs which took prices towards to Friday’s $524.00 low mark. Lows were recorded at $525.40 before the market was able to turn around with the final couple of hours then seeing a steady recovery back up into the range. March’25 was sitting ahead of $530 going into the close, and while there was some late position squaring to send the price back down a close at $529.30 was away from the lows and though still vulnerable the market has at least broken its trend of daily lower lows.