Insight Focus

As 2024 ends, wheat markets are characterised by volatility. Factors like Black Sea exports, strong US shipments and crop uncertainties in Russia and India are all driving sentiment. Global supply remains tight with low end stocks, and geopolitical issues and fund positions could drive price fluctuations.

As people look to the festivities of Christmas, it is worth noting that wheat markets don’t close down for the holidays. During late December, there has volatility over several years.

The main issues for 2024 that will continue to exert influence in 2025 are:

- The pace of Black Sea exports, minimum prices and export taxes

- US export inspections surpassing expectations

- A potentially larger Argentinian wheat harvest

- Uncertainty over the 2025 wheat crops in Russia and India

- Conflicts in Europe and the Middle East

- China’s economic woes

- Global supply and demand

- The fund wheat shorts

Any of the above events could spark interest in wheat markets as we enjoy the Christmas and New Year festivities. History has shown time and again that volatility is far from a rarity during this holiday period, so be prepared for whatever the market throws at you.

2024 in Review

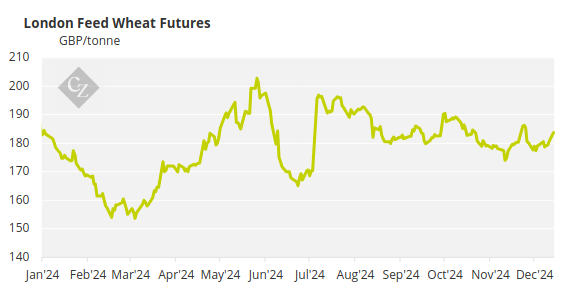

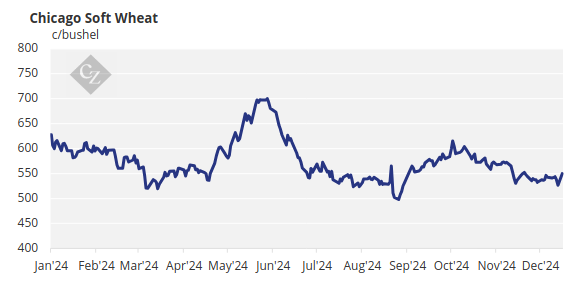

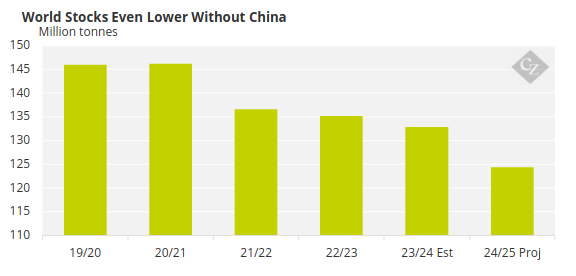

The charts below demonstrateFund positions the ups and downs of the wheat markets over the last 12 months. It is fair to say that with global end stocks predicted to be their lowest in nearly 10 years at the close of this marketing year in June 2025, there is ample opportunity for a continuation of significant moves ahead.

Let’s take a more in-depth look at the main factors that have influenced wheat in 2024.

Black Sea Exports

The EU has had a very poor harvest in 2024, with the two largest producers France and Germany having their worst wheat crops in decades. This has left the Black Sea countries, such as Bulgaria and Romania, holding up the EU wheat exports to destinations such as North Africa and the Middle East.

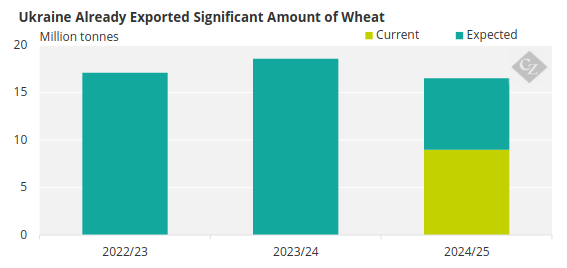

Ukraine has been very competitive shipping wheat out at a rapid pace. Exports are running at over 9 million tonnes thus far of the 16.2-million-tonne total by the end of June 2025.

Source: USDA

Russia has a smaller crop, restricting exports somewhat from the 5 million tonnes in 2023/24 to possibly as low as 43 or 44 million tonnes by the end of June ’25.

The volumes shipped to date have been so huge that quotas have been announced from February 15 – June 30, 2025, at 11 million tonnes, down from 29 million last year! The Russian government has also been ramping up export taxes over the year, currently seen at RUB 4,136.5/tonne — over USD 40/tonne.

North American Exports

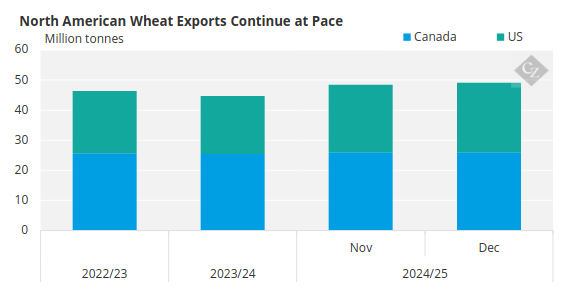

Having seen a bumper wheat crop in 2024 and encouraging exports, inspections are running at nearly 30% greater than a year ago in the US, despite forecast for a much lower 17% increase over the marketing year.

Canada is also seeing impressive exports as they look to capitalise on quality wheat sales.

Source: USDA

The Argentina & Australia Dynamic

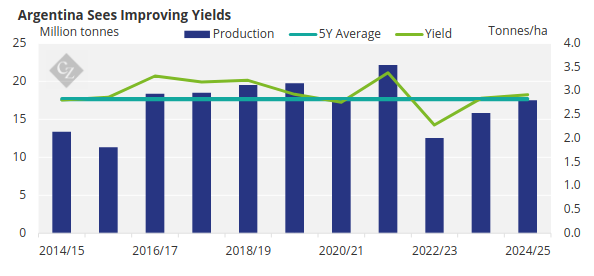

As harvests roll on in both significant Southern Hemisphere exporters, final crop numbers are still to be nailed down. Nonetheless, Argentina is reaping good yields with a recent suggestion that could see production above 19 million tonnes, versus the current USDA estimate of 17.5 million tonnes.

Source: USDA

Australia is meanwhile seeing excellent results in parts, but the final numbers are still uncertain with the USDA estimate of 32 million tonnes looking achievable.

Our 2025 Watchlist

Russia and India’s Underperformance

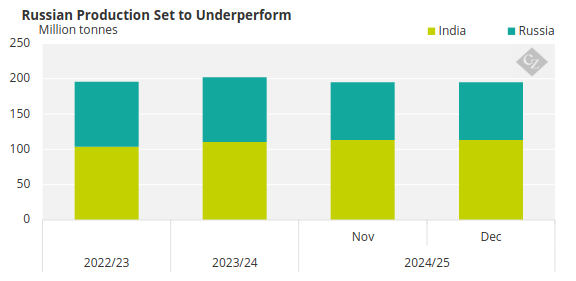

Looking ahead, Russia’s wheat crop is said to be heading into the harsh winter months in the worst condition in many years, with over a third in very poor condition, with reports suggesting a crop of less than 80 million tonnes ahead.

Source: USDA

India needs a big crop in 2025, as production struggles to replenish stocks. The monsoon rains are reported to be a concern, which could ultimately lead to a need for large imports in time.

Global Conflicts

Russia’s war in Ukraine rages on, with more and more reports hinting at possible negotiations for peace in 2025…time will tell! The impact on the world’s wheat trade either way will inevitably play an important part.

Israel’s many conflicts are cause for concern but their relevance to wheat prices is limited.

Meanwhile, the collapse of Bashar Al-Assad’s regime in Syria has prompted Russia to withdraw from wheat sales to the country, while Ukraine is reportedly open to stepping in to the void. Ramifications for the wheat market are not great for now and the political process for the future will be closely watched.

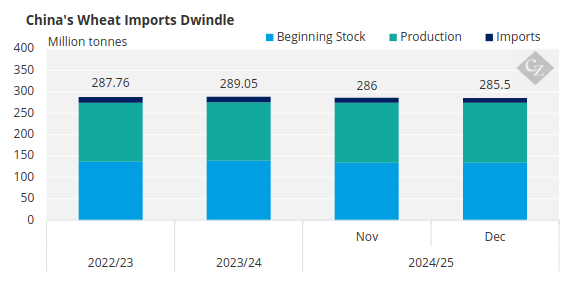

China’s Economic Woes

Reports surrounding the pressures on the Chinese economy are regular and numerous. Ultimately the repercussions for the wheat market will hinge on any trade war between the incoming US president Trump together with any Chinese economic downturn, which could reduce the country’s huge imports and hence global demand in grains and oilseeds.

Source: USDA

Global Supply and Demand

We have mentioned this on many occasions through 2024. Global wheat end stocks in June 2025 are expected to be the lowest in nearly ten years at 257.88 million tonnes, down from 267.41 million tonnes a year earlier. Anticipation of a further 10-million-tonne drop in stocks following the 2025 harvests could cause a stir, especially considering China’s enormous stocks of 133.50 million tonnes, which amount to nearly 52% of the global total!

Source: USDA

Fund positions

Investment funds are very short of both US and the Paris wheat markets. As such any major change in perception could have interesting consequences for wheat prices across the continents.

Any hint of these thoughts as we run into the end of the calendar year most certainly has the potential to see funds hastily buying in the shorts prior to the December year end.

Thank you for reading our articles in 2024, we hope that they have been interesting and useful. Wishing you all a safe and happy Christmas and start to 2025, when we will be back again!