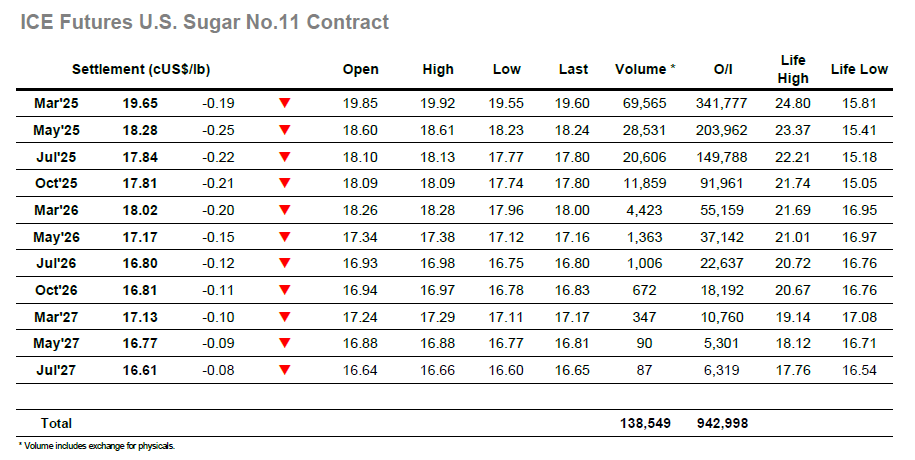

The market was being called slightly higher and March’25 traded up to 19.92 on the call, though in the context of yesterday’s market fall there was more limited physical activity than might have been expected. A short period spent holding near to unchanged did not last and before long the market was again probing lower with yesterday’s lows removed as March’24 extended the fall to 19.62 despite only seeing a modest amount of selling volume. There were pauses in the decline against intermittent pricing / small trader short covering however with the technical picture looking rather bleak the market continued to flirt with the lows and made another new mark at 19.58. The pattern continued through into the early afternoon with prices still attempting to build some kind of bottom though any moves away from the lower end proved hard to sustain. This was further tested when the market fell to a new low of 19.55. Despite flirting with the lows again midway through the afternoon the market held with short covering then providing the basis for a rally back to 19.77 through the later part of the afternoon. Some end of day long liquidation meant a close for March’25 at 19.60 with the market being down today by 24 points. Fundamentally, the global sugar supply outlook has improved, adding to the bearish sentiment in the market. From a technical perspective, the picture has deteriorated further as prices have broken below the 200-day moving average, signalling potential downside momentum. However, options activity today suggests notable positioning, with significant buying observed in the March 2025 22-cent strike call option. Nearly 8,200 lots have traded so far at an average premium of 23 points, indicating that some participants may be positioning for a recovery or hedging against upside risk.