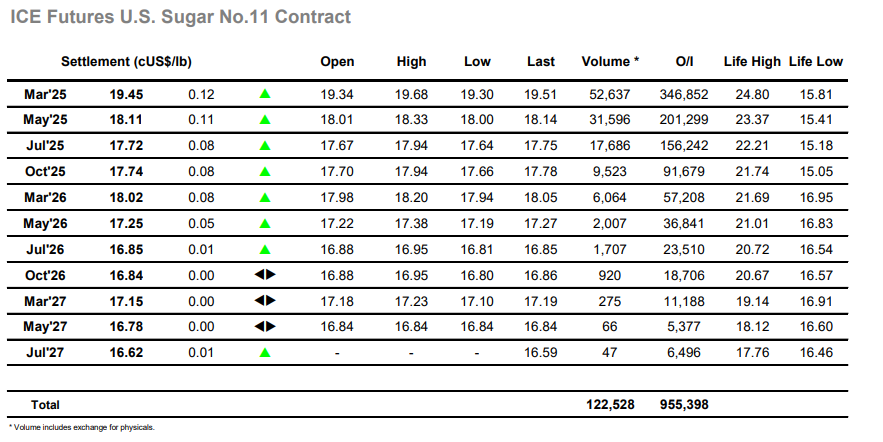

Though a modest opening bounce to 19.45 did not lead to larger gains, the market was generally steady across the first couple of hours as March’25 pivoted around 19.40 on light volumes. This then provided the basis for additional gains to be made either side of noon which extended the range up to 19.66, shy of the 19.80 mark seen yesterday but positive in the context of a market still trying to establish a meaningful bottom. The delayed COT report last night showed another increase in the net short position held by the speculative sector, standing at -60,436 lots and this may go some way to explaining the firmer values through the morning with some traders possibly of the view that the short holding may not grow significantly more in the near term. That did not stop some swings in the market through the afternoon with a sharp fall back to 19.30 following against day trader liquidation before the upside resumed with a move to a new daily high at 19.68 later in the afternoon. As with the earlier move there was no hint that 19.80 would be challenged, a reflection that shorts were mostly holding on to positions with the buying driven by day traders, and their position squaring through the final hour once more drew values back from the highs and left the market mid-range through the final stages. A March’25 close at 19.45 changes little and with news continuing to be limited a continuation of recent parameters may prove to be the way forward in the coming days.

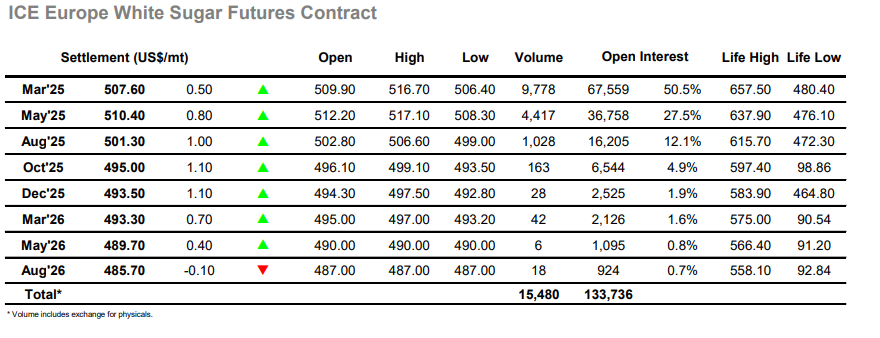

March’25 started higher as it looked to match No.11 gains but soon dipped beneath overnight levels and saw a low at $506.40 before stabilising. The price returned to sit in the $510.00 area once again and in turn used this area as a platform from which it could nudge back up into the teens by the early afternoon and sit positively as traders joined from the Americas. Highs were recorded at $516.70 before a correction tipped the day trader longs back out of their positions and sent the market rapidly back towards the early low, and for a short period the market again looked vulnerable before pulling back to the middle of the range. All this movement created some pricing opportunity for the white premiums as the swung around with March/March’24 trading between the high $70’s and lower $80’s during the day, though by late afternoon it was established at the lower end of this range. This situation was cemented by some late selling which sent March’25 back to settle just 0.50c higher at $507.60, as March/March’25 closed the day at $78.80. This changes nothing with the lows still in focus, although the nature of today’s activity points to additional “sideways” trading as more likely in the immediate future.