Insight Focus

Wheat markets in 2024 were volatile due to weather, geopolitics, and economic factors. Russia and the EU faced reduced exports, while the US, Argentina and Australia helped fill supply gaps. In 2025, attention shifts to weather risks, dwindling stocks and global trade dynamics.

Looking to 2025

The calendar change from 2024 to 2025 shifts much of the focus away from the last harvest and on to the prospects for the next.

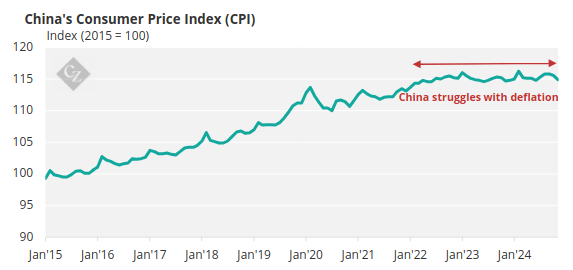

News from China relates more to the economic situation than it does the wheat crop. With ample stocks, amounting to over 50% of the global total, the Chinese will not run out of wheat. Nonetheless, reports of economic woes for the Chinese population could lead to lower demand for grains.

Source: St Louis Fed

The US will see the imminent return of President Donald Trump, with the prospects of trade tariffs on everyone outside of the US. The resurrection of a trade war between the US and China will be of particular interest to the grains and oilseeds markets, which could impact exports and pricing on a global scale.

Further potential for big news out of the US will be the impact of the plethora of USDA reports out on January 10. The usual monthly WASDE report, crop numbers, stocks and 2025 winter wheat acreage estimates will all be carefully watched for their price impact.

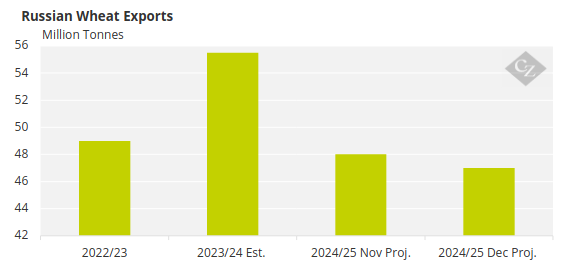

Russia has held extraordinary strong in its desire to ship wheat out in the latter stages of 2024, despite having over 10 million tonnes less wheat to sell. The result is that quotas of 11 million tonnes have been put in place to limit export levels from February to June. This is significant, given last year it was 29 million tonnes!

Source: USDA

Black Sea shipping in general will therefore be of utmost interest in the coming months. Add to this the prospect of a further reduction in Russia’s 2025 wheat crop to 78 million tonnes, as recently reported, and Russia will remain a critical focus, but for less available wheat, rather than more.

The extreme weather concerns remain around Europe, but the anticipated return to a more normal crop size for 2025 will be a relief to many buyers in the region.

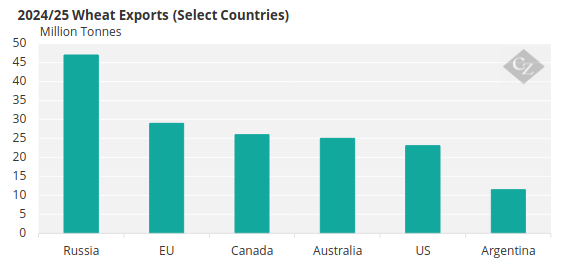

With an estimated 18-million-tonne drop in exports this season from Europe and Russia, it will be a scramble to see who the most active sellers in the first half of 2025 will be. With Canada, the US, Argentina and Australia all with enthusiasm to be top of the list, the hole will need filling to keep the price Bulls at bay.

Source: USDA

India is a country to put on the 2025 watchlist — a huge country, with big needs. We have mentioned it previously in relation to stocks, use and potential imports. Its 2025 wheat crop is currently under threat from the weather and disease.

Any further concerns for 2025 could push the government to reignite thoughts of imports — the last rumour was of up to 9 million tonnes from Russia. That would be assured of waking the Bulls!

Volatile Prices in 2024

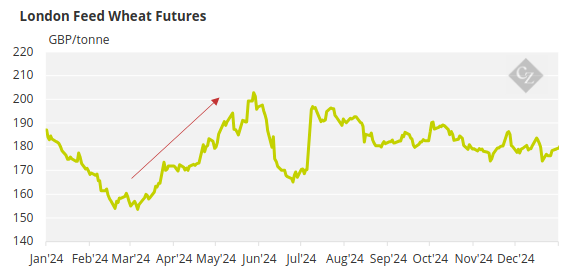

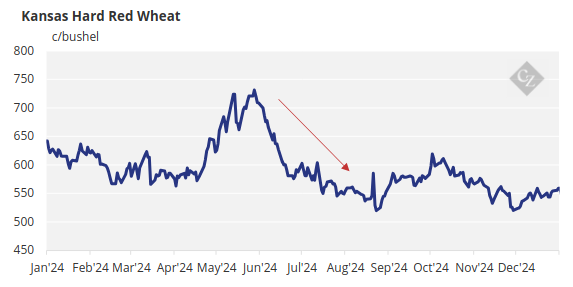

The charts below demonstrate the volatility of prices throughout 2024 in the main wheat markets. The early part of the year was subdued, as willing sellers were on hand for the hand to mouth purchases of buyers.

The weather concerns across Europe and the Black Sea, in particular large growing regions of Russia, sparked a rally in March, April and May. With excessive rains in the western and northern parts of Europe, crops were struggling, while in Russia late frosts were raising concerns of winterkill.

The forecasts for a continued decline in global wheat end stocks to a near 10-year low was ample reason to support the rally. Time duly confirmed, with both the EU and Black Sea regions suffering as combines rolled and production numbers declined.

Despite this dwindling stock situation, Northern Hemisphere harvests progressed. Increasing optimism for large North American wheat crops pressured the markets as exporters from the US, Canada and Black Sea all began a race to the bottom in order to be the most price competitive in the global export trade.

The willingness of sellers allowed the second half of 2024 to be calmer than the first, particularly as Argentina and Australia looked to be on track for encouraging harvests.

The 2024 (and 2025) Fundamentals

Wheat prices certainly saw volatility in 2024, driven by conflict, weather, geopolitics and more.

- China, the largest producer, consumer and stockholder, maintained its unique standing.

- Russia, the largest exporter, continued to wage war with neighbouring Ukraine, while perhaps losing some influence in the Middle East with the fall of Assad in Syria. Its weather concerns in early 2024 sparked the major wheat rally of the year. The harvest that followed reduced exports by over 10 million tonnes to the world’s most in need destinations. President Putin may feel more politically isolated, but Russia’s influence on wheat prices is not in doubt.

- Ukraine continued to surprise with its resilience to Russia’s war of aggression, remaining critical to global trade, shipping out large volumes throughout 2024.

- The EU had some of the worst harvests on record, with the largest producers, Germany and France, reaping their poorest crops in 20 & 40 years, respectively. Fortunately, the Black Sea exporters, such as Bulgaria and Romania fared much better in 2024, shipping out good volumes in the latter half of 2024 to keep EU exports alive.

- The US saw a much-improved 2024 crop, nearly 10% more than in 2023. Exports are forecast to rise for this season by nearly 4 million tonnes from last year while still increasing end stocks by over 2.5 million, to 21.63 million tonnes.

- The main Southern hemisphere exporters of Argentina and Australia have reassured the world’s big importers that they are well positioned to fulfil their part in sales where Russia and the EU are seeing smaller export volumes.

Looking back on another year ended, 2024 saw its fair share of surprises, with price and market prediction always fascinatingly tricky. Weather, geopolitics, conflict, economics and much more will ensure that 2025 is no less captivating than the last.

A continuation of global end stocks dwindling could be the biggest story, unless world economic troubles reduce demand.

Wishing you all a prosperous 2025!