Insight Focus

The International Cocoa Association (ICCO) has increased the global cocoa deficit to almost 480,000 tonnes. This is due to a variety of factors, including crop failures in Ivory Coast and Ghana, driven by El Niño and other factors. Confectionary company Hershey’s reported purchase signals tight supply and raises questions about future prices and demand.

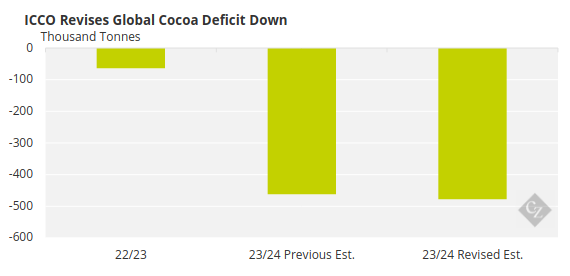

The International Cocoa Association (ICCO) has raised its 2023/24 global cocoa deficit estimate to -478,000 tonnes from May’s -462,000 tonnes, the largest deficit in over 60 years. All pictures being painted were bullish.

Source: ICCO

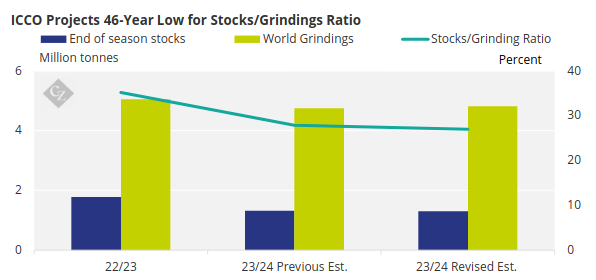

This comes following the ICCO’s latest quarterly report, published in November 2024. After the revised numbers, the ICCO now estimates a 2023/24 global cocoa stocks/grindings ratio of 27%, a 46-year low. A further deficit could push this even lower.

Source: ICCO

Hershey Moves to Shore Up Supply

Hershey has recently asked for CFTC approval to buy a large amount of cocoa through the ICE Futures Exchange due to tight global supplies. It has been reported that Hershey wants to take a position allowing it to purchase more than 90,000 tonnes of cocoa on ICE Futures US.

This move is not new in the case of Hershey but is a good indication that offtaking cocoa from the exchange is a viable proposition in the current market, with physical differentials at the highest levels in history and global stocks at the lowest level for decades.

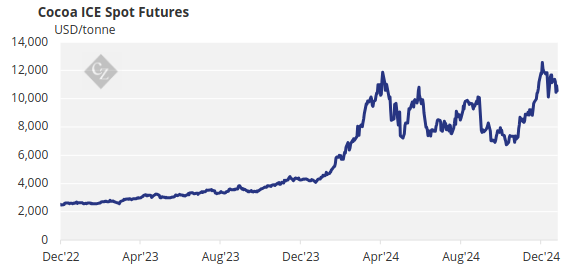

All this contributed to ICE London futures spiking again for the fourth time since April. The questions that most in the market are asking now is whether we have entered a new era.

Are the low prices of the last 50 years over for the foreseeable future?

Are the Ivory Coast and Ghana crops in structural decline?

Will the high prices impact consumption?

You cannot answer the price question without tackling the points relating supply and demand.

Cocoa Market Continues to Surprise

The cocoa market achieved its highest levels in recorded history in April last year, a level in London of GBP 9,980/tonne. The rally in the price was driven by a collapse in the 2023/24 crops in Ivory Coast and Ghana in particular, but also poor crops across all the growing regions.

The market largely attributed the phenomenon to El Niño. However, other significant contributors include disease, particularly Cocoa Swollen Shoot Virus (CSSV), illegal gold mining in Ghana and the long-standing impact of low farmgate prices.

As we started to enter the period where the forecasts for the 2024/25 crops could reasonably be predicted, participants became divided, with some predicting that the crops would rebound to previous levels. They believed a mild La Niña weather pattern would counterbalance the effects of the El Niño impact on the previous crops.

Others predicted that there would not be a full recovery because there were more factors contributing than just the weather phenomenon.

Even so, the market took a significant step back by October 2024. The key question now was whether the crops were going to recover to the previous levels and if the market would fall back to the levels of GBP 2,000/tonne before the global crop collapse.

Then the reality started to bite.

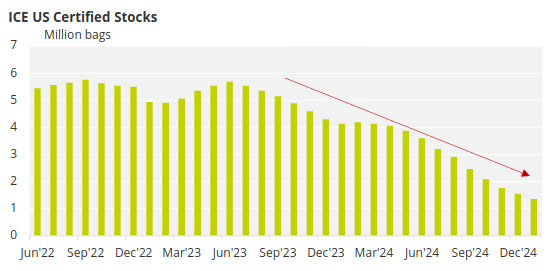

ICE certified stocks were at their lowest level in two decades. While arrivals at ports in Ivory Coast and Ghana showed improvement compared to the disastrous previous year, they were still not strong enough to suggest a full crop recovery.

Source: ICE

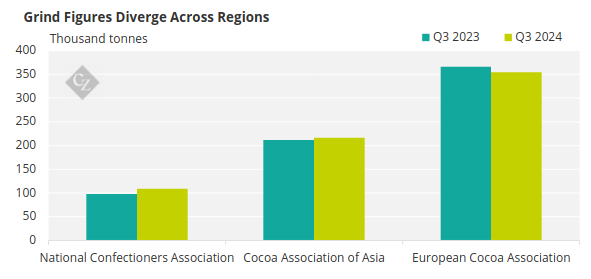

Grind figures have provided mixed signals, but there has certainly not been the sharp decline in demand that some had anticipated. Once again, weather conditions have played a significant role.

Initial wet weather, which led to flooding in the Ivory Coast, was followed by dry conditions, raising concerns about the mid-crops in both the Ivory Coast and Ghana. The Harmattan, a dry, dust-laden wind from the Sahara, typically strongest between November and March, has further exacerbated these worries. As a result, Ghana has revised its 2024/25 crop forecast downward twice in the past six months.

Key Crops in Structural Decline

The historically low prices have meant that there have been minimal investments at farm level over the last 20 years.

Estimates of the extent of Cocoa Swollen Shoot Virus (CSSV) infection in Ivory Coast cocoa farms have ranged as high as 65%. The understanding of the virus’ impact has evolved; it was once believed to kill trees within two years, but it is now understood that while CSSV severely affects trees, it can take more than 10 years to ultimately kill them. Infected trees are also more vulnerable to the effects of adverse weather, leading to slower recovery.

The extent of illegal gold mining in Ghana, which has either displaced cocoa farms or contaminated nearby ones, is difficult to estimate, but anecdotal evidence indicates it is widespread. Furthermore, local authorities in the affected communities appear to show little interest in addressing the problem.

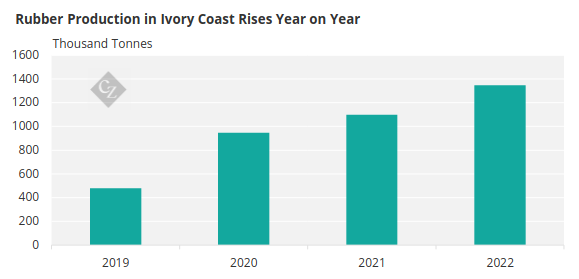

Ivory Coast is now the fourth largest global rubber producer with huge growth in production in the last 20 years, which might suggest that some cocoa has been replaced by rubber.

Source: CEIC

Uncertainty Over Grind Figures

Grind figures have been difficult to interpret because of the lack of supply to local factories and the poor understanding of the stock draw downs in Europe, the US and Asia. The Q3 figures showed US figures rose 12%, Asia rose by 2.6% and Europe declined by 3.3%.

There have been reports of price increases of 3-4% from brands, suggesting that they are preparing for a longer period of higher prices.

We are in a cocoa market that is looking more and more likely to be in a new higher range, breaking out of the suppressed prices of the last 50 years. The market has historically traded in five- to 10-year cycles as higher prices bring on lower demand. More planting and lower prices move the market in the opposite direction.

We are now entering a cycle that may take longer than the historical precedent might suggest. This is due to the huge influence Ivory Coast and Ghana have on production. Their pricing systems have meant that their farmers are not getting the real benefits of the price rises in the global markets.

The industry will closely monitor grind figures, the 2025 mid-crops in Ivory Coast and Ghana, and the forecasts for the 2025/26 main crops to assess whether they believe we are entering a new, higher price range for the foreseeable future.