This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

US sugar sales remain sluggish, with competition from imports and unchanged prices. Market uncertainty, driven by GLP-1 drugs and potential tariffs, has slowed 2025-26 contract negotiations. Despite steady production, concerns over crop conditions and delayed contracts persist.

Sugar Sales Struggle Amid Import Competition

Traders returned to their offices after the holiday break, but the lull in refined sugar sales persisted, and prices remained unchanged during the week ending January 10.

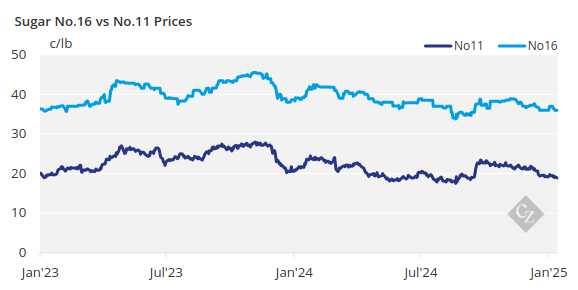

Most beet processors still had old-crop (2023) sugar to sell. Since some 2024-25 sugar was contracted early at prices supported by higher 2023-24 levels, some users found lower-priced alternatives from high-tier imports in 2024, leading to a poor draw on contracted sugar in some cases.

Trade sources indicated that competition from some of these imported sugars has continued into 2025, making domestic sugar sales challenging. Buyers see little reason to complete 2025 coverage if they haven’t already as they hope for lower prices amid adequate to ample supplies. Most would typically have current-year needs covered well before the start of the calendar year).

Further reluctance to increase contracted levels was fuelled by uncertainty among food manufacturers about demand for their own products. Recent reports indicated that increased use of GLP-1 weight-loss drugs was beginning to reduce consumer spending on food, with sugar likely to be affected.

Sugar sellers noted “a lot of demand confusion” in the current market, citing factors such as the impact of GLP-1 drugs, potential tariffs, still-available high-tier imports and other variables.

Beet Production on Track, Sugar Negotiations Slow

Most beet processing plants were running smoothly, and 2024-25 sugar production from the 2024 crop was on schedule. However, concerns persisted about the situation in Michigan, where a dry fall contributed to poor outdoor pile conditions. Michigan’s new molasses desugarization facility is expected to contribute additional sugar supply.

Sugar cane planting and harvesting “progressed well” in Florida, with planting expected to be complete by January 31, according to the USDA.

Negotiations for 2025-26 were slow to gain traction after the start of the year. Sellers said buyers were “poking around” for price indications, but few, if any, have committed to buying sugar for next year. Many buyers hope for lower sugar prices following the large drop over the past two years and improved supplies available for import from Mexico. However, sellers have been reluctant to drop prices, citing uncertainty about the 2025 sugar beet and cane crops as well as refined sugar production for 2025-26.

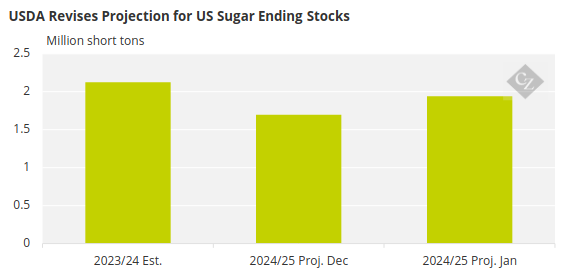

The USDA’s January 10 World Agricultural Supply and Demand Estimates report forecast the 2024-25 US sugar carry at 1.9 million short tons (1.8 million tonnes), a 14% increase from the December forecast, but a 9% decrease from the 2023-24 stocks of 2.1 million short tons. The increase was attributed to higher beginning stocks, domestic beet sugar production and high-tier imports, with no changes in 2024-25 deliveries.

Source: USDA

With the year-end corn sweetener contracting period in the books, the market has settled into routine production. Severe winter weather across much of the central US brought some logistical challenges.