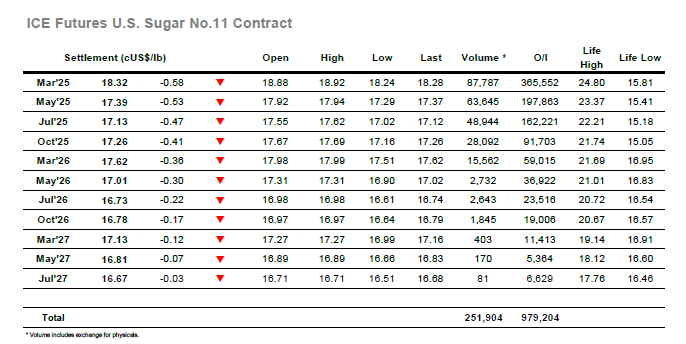

Despite briefly printing at unchanged the market was soon tracking lower once again and moving at a quicker pace than recent sessions with March’25 working beneath yesterday’s 18.70 low mark with less than 30 minutes of the session having elapsed. It was only having extended down to the upper 18.50’s that there was a pause in the movement with the market hanging on against some end user pricing, though the volumes were not great with the buying interest having reduced somewhat as traders look to see how far the move may extend and provide even better opportunity. Last nights COT report showed negligible change with the net short now standing at -59,040 lots, and with the funds clearly content to run these shorts the smaller traders are able to press lower with less concern of a sudden reversal. Through the later morning and into the afternoon the trend continued with the drive from sellers (and relative lack of buying) seeing March’25 all the way into the 18.20’s and sowing losses of more than 0.60 points. There were again losses for the spreads with March/May’25 falling to an intra-day low at 0.87 points before recovering back to the mid 0.90’s as buying arrived through the afternoon, though this did not impact the flat price which continued its struggles. Continuing at the lower end of the range March’25 reached the end of the session with a settlement value at 18.32, technically very weak with the only question being whether the levels are low enough to potentially bring out some physical interest.

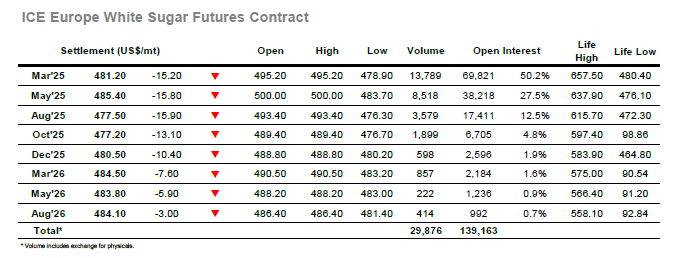

With No.11 again heading lower the market was immediately following suit with the first hour of trading bringing prices down to yet more contract lows as March’25 struggled to find any support aside from the usual light scale interest. A small pause in the movement did not bring any additional interest from the long side and so another drop to the mid $480’s followed before the morning was through to build the downside momentum yet further. With the market trading at life of contact lows there is little reason for the trend to reverse currently and so the pauses were proving t be temporary with the selling resuming intermittently and piling on the pressure. Moving into the afternoon the losses extended down to $478.90 and while this proved t be the limit for today’s efforts the price action through the final few hours was never far above this mark. Unusually for such a move the March/May’25 spread was trading slightly firmer on the day and ended at -$4.20, possibly a reflection of some pre-expiry rolling within the volume, though the white premium values were creaking a little and saw March/March’25 around $77.00 and May/May’25 at $102.00. Despite some pre close short covering the market drifted back off in the closing stages to settle at $481.20 and present another technically weak close.