Insight Focus

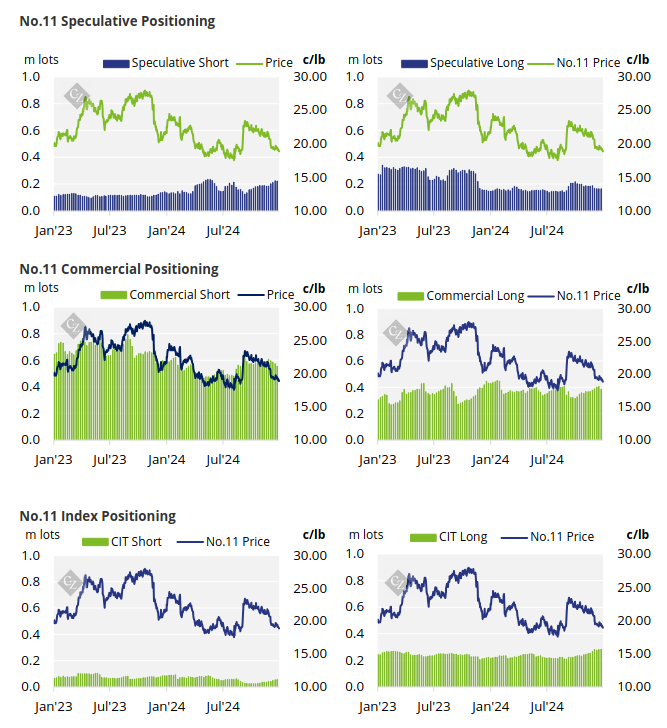

Both raw and refined sugar futures continue trading lower into the new year. Commercial participants close out significant number of positions. Speculative interest in the market remains low.

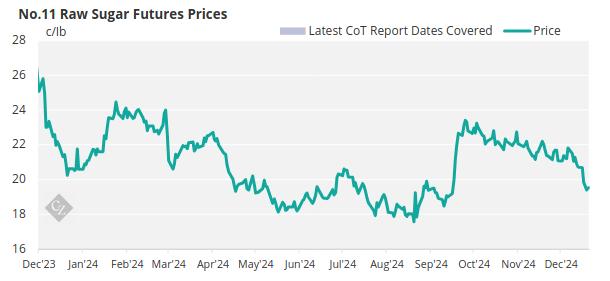

New York No.11 Raw Sugar Futures

Raw sugar futures continue trading lower in the new year, currently trading in the 18-19c/lb range.

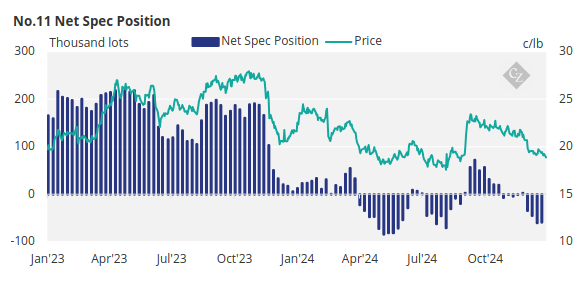

Looking at the commercial participants, both producers and end-users alike have closed out a significant number of their positions. Producers reduced their position by 16.2k lots of shorts, while end-users closed out 18.3k lots of long positions.

No.11 Commitment of Traders Report (7 January 2025)

| Commercial | Speculative | Index | ||||

|---|---|---|---|---|---|---|

| Position | Change | Position | Change | Position | Change | |

| Long | 389,348 | -18,302 | 165,242 | 177 | 286,043 | 4,421 |

| Short | 558,227 | -16,248 | 224,282 | -1,219 | 58,124 | 3,763 |

| Net | -168,879 | -2,054 | -59,040 | 1,396 | 227,919 | 658 |

There was minimal action from speculators over the last week as they closed out 1.2k lots of short positions and opened just 177 lots of long positions. As such the net short position currently stands at -59k lots.

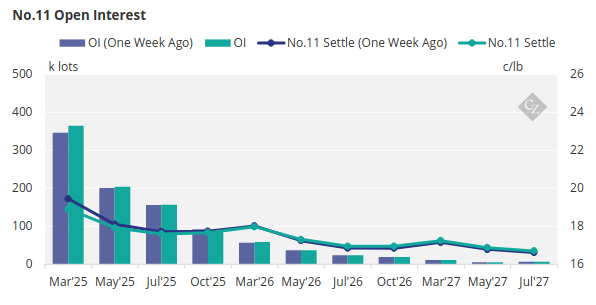

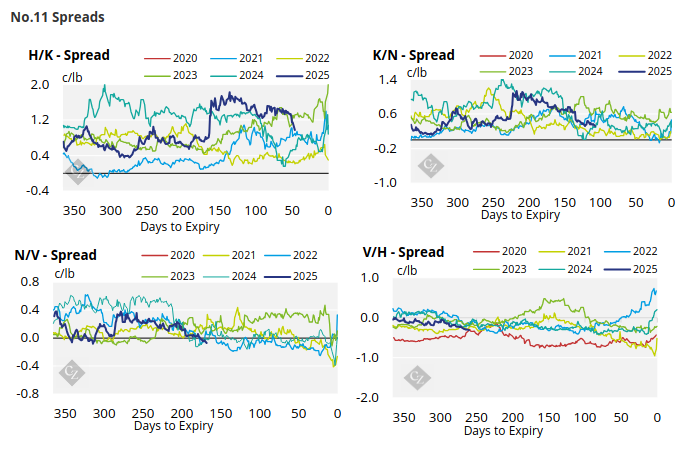

The No. 11 forward curve has weakened towards the front and remains backwardated across the board.

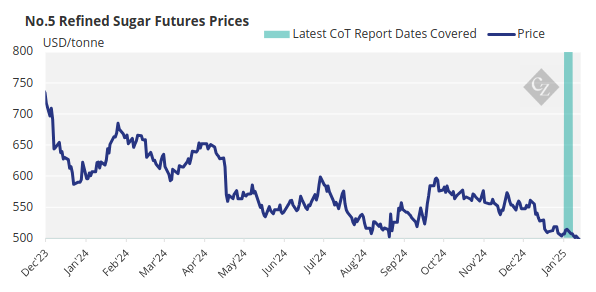

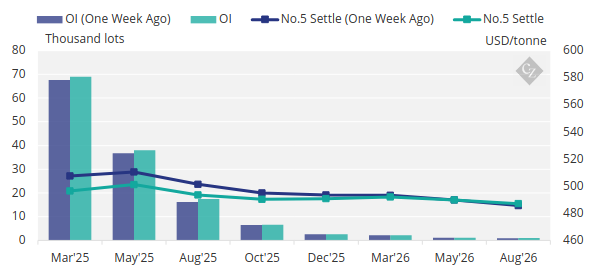

London No.5 Refined Sugar Futures

The No. 5 refined sugar futures have also weakened and traded between USD 501-507/tonne over the past week.

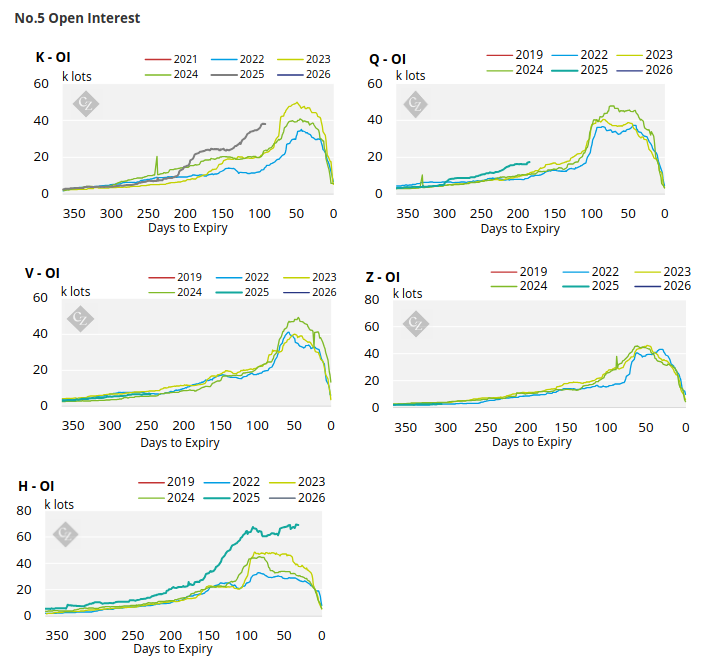

No.5 Open Interest

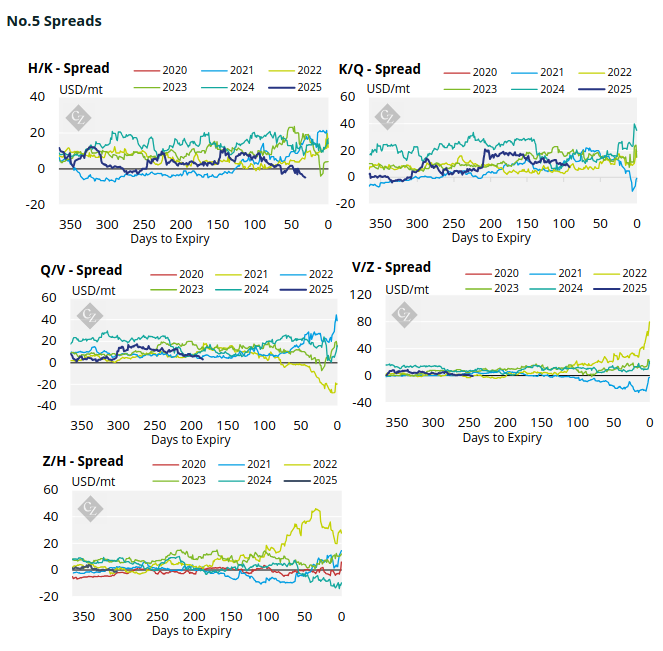

The No.5 refined sugar futures curve has weakened between Mar’25 and Dec’25.

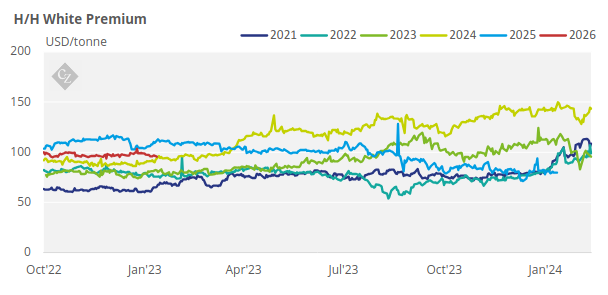

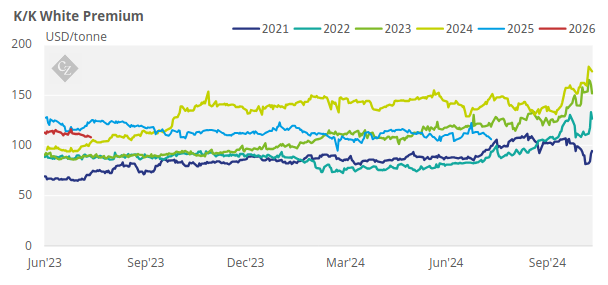

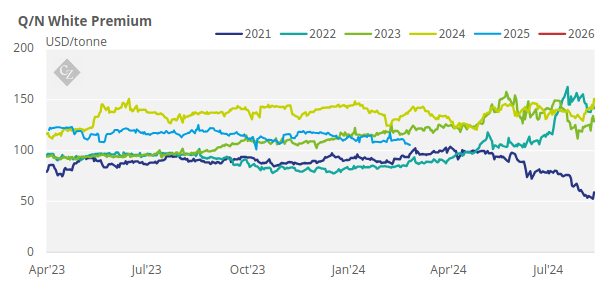

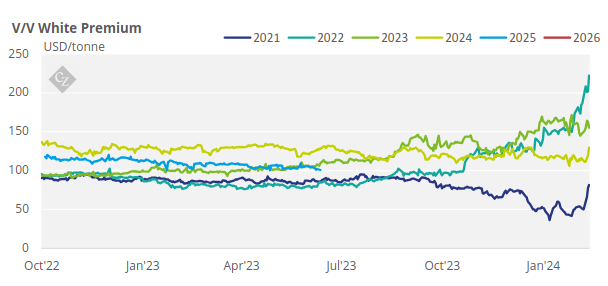

White Premium (Arbitrage)

The H/H white premium has continued trading around USD 80/tonne.

This is below the level at which many of the world’s re-export refiners can operate profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

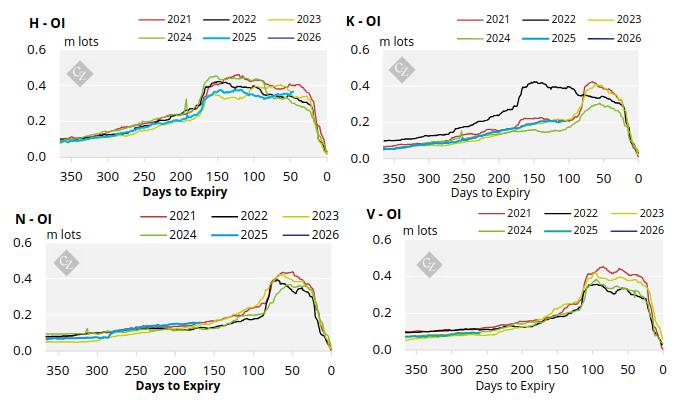

No.11 (Raw Sugar) Appendix

No.11 Open Interest

No.5 (White Sugar) Appendix

White Premium Appendix