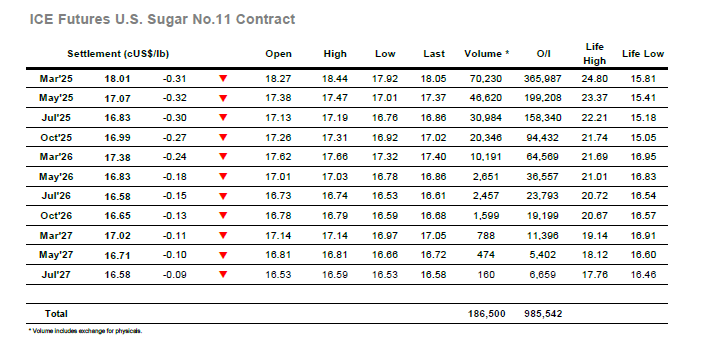

There was no sign of any significant physical activity emerging despite the latest drop in values and the market was quickly trading down again. The initial dip was then gathered up and a slow morning ensued with March’25 tracking along near to overnight levels, with highs at 18.44 recorded along the way as small traders dominated. Heading into the afternoon the price softened once again to sit in the upper teens and rest upon the morning lows and for a period this area held up despite its impact on the technical picture. Along the way we saw publication of the UNICA numbers for the second half of December which showed cane at 1.73 mmt / Sugar 0.064 mmt / Mix 31.7% / ATR 121.58 kg/t / Ethanol 0.486 mlt, all of which had no impact upon the flat price given the small scale of numbers in the tail. The picture became more interesting during the final two hours as fresh pressure was applied by shorts to drive to more new lows, working the price down beneath 18.00 during the final hour to a low at 17.92, only just above the last August 17.88 low which is providing a modicum of support. Some late short covering provided a settlement at 18.01 though this does little to enthuse a very negative technical picture with the market remaining under pressure.

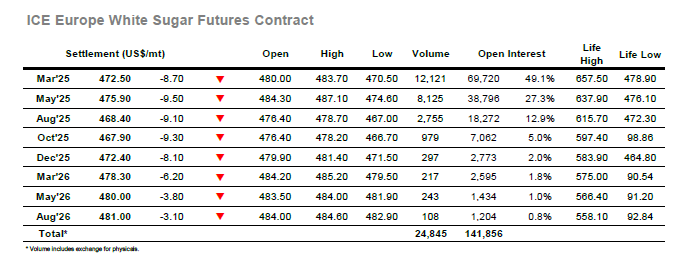

The market started the day a little lower again and though some pricing interest was being seen to then hold March’25 in the low $480’s through the rest of the morning it did little to allay concerns that further contract lows may follow. Movement tightened ahead of the Americas morning but when the shackles were removed it was the downside which again saw the movement with the latest array of selling extending the lows ever further. Across the afternoon the price fell steadily down through the $470’s to an eventual daily low at $470.50, placing the charts into further negative ground and making it hard to see where the current trend reverses. This factor is no doubt deterring some buyers who are increasingly nervous to try and pick the bottom and creating a self-fulfilling sense about the current movements. White premiums were further impacted with March/March’25 touching below $75 later in the afternoon, though as yesterday the nearby spreads were more robust and showed little change. The usual end of day position squaring pulled March’25 back by a couple of dollars late on to settle at $472.50 but the overall trend continues unabated for another day.