Insight Focus

Urea prices have surged significantly this past week. Processed phosphate prices are stable due to limited availability and subdued demand in Brazil and India. Potash prices in the US are expected to rise before President-elect Trump’s inauguration due to anticipated tariff increases.

Urea Rise Rapidly

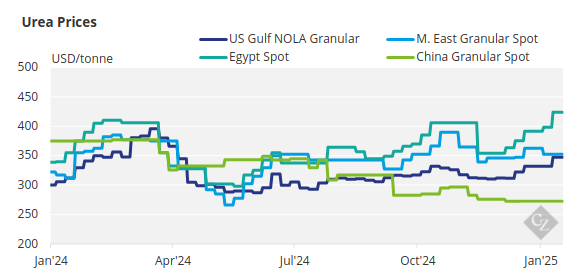

Urea prices are rising rapidly, with the most recent granular urea tender in Indonesia at USD 411.11/tonne FOB, up from USD 391/tonne just 10 days ago. The latest sale in Egypt was at USD 432/tonne FOB, an increase from USD 410/tonne in the past couple of weeks, which had already risen by USD 70/tonne from the previous few weeks.

Nigeria is closing a tender January 17 for three 30,000-tonne parcels, and it is expected to see prices close to USD 400/tonne FOB, which is up from USD 360/tonne FOB just a few weeks ago.

Middle Eastern producers are testing USD 400/tonne and above, while Brazil is now struggling to purchase below USD 400/tonne CFR. Iran is re-entering the market with a tender for 25,000 tonnes for February shipment, having been absent due to domestic gas supply issues.

In addition, all eyes are again on India, which announced a tender for 1.5 million tonnes closing on January 23 for shipment on or before March 5. India desperately needs urea.

Indian urea sales likely hit 2.3-2.4 million tonnes in the first half of this month, with domestic offtake remaining robust following record-high sales in December 2024. The latest provisional data shows that sales to end-users exceeded 2.3 million tonnes in the first half of January, suggesting that total offtake for the month could surpass 4.5 million tonnes. Urea sales were 3.54 million tonnes in January 2024.

Production is on track to reach approximately 2.5 million tonnes this month, while urea inventories have decreased to around 5.5 million tonnes as of January 16, according to the data. Stocks began the year at approximately 6.1 million tonnes.

International urea prices have surged in recent weeks, eclipsing 2024 levels, largely driven by sustained import demand from India due to its strong domestic appetite. Sales likely reached a new record-high for an individual month at 5.2 million tonnes in December. Market participants are closely awaiting the results of Indian importer and supplier RCF’s urea purchase tender, which closes on January 23.

Lurking in the background is China, which has provided zero evidence that it will be exporting anytime soon. However, market speculation is widespread, with some predicting a resumption in early March, while others believe it will happen in May, once the domestic season in China concludes.

In the meantime, the urea price is on fire, and it looks to keep going up in the immediate future.

Phosphate Prices Hold Steady Amid Weak Demand

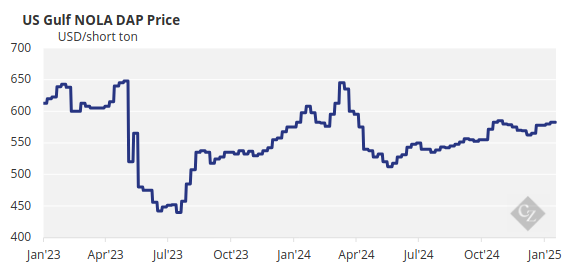

On the processed phosphate side, the most notable market activity was the settlement of phosphoric acid contracts for Q1 supply to India at USD 1,055/tonne (P2O5) CFR, down USD 5/tonne from Q4 2024. Aside from this, India is unlikely to begin buying in earnest until late February or early March.

The current DAP price is assessed at around USD 630/tonne CFR, with buyers citing affordability concerns. Similarly, off-season buying in Brazil remains muted, and there are reports that a small Russian MAP cargo was sold at USD 630/tonne CFR, which is at the lower end of the assessed price range.

The Chinese government is urging producers to keep on producing in an effort to lower prices in the domestic market. However, non-integrated producers claim that they are already at rock bottom with some MAP producers losing money. Apparently, there is ample stocks in the domestic system, thus some producers may elect to reduce production levels.

Due to lack of availability in combination with lack of demand, processed phosphate prices are expected to hold current levels in the immediate future.

Slow Demand Restricts Potash Movement

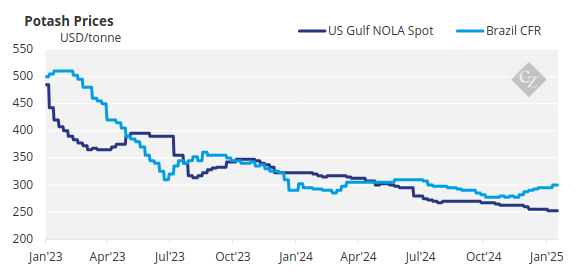

Potash prices were largely unchanged this week, as slow spot demand restricted movement.

The MOP market was focused on the US, as the long-awaited fill prices were released on January 10. Demand was strong as buyers and sellers awaited potential tariffs from the Trump administration.

Brazilian import prices held steady in the range of USD 305-310/tonne CFR this week, remaining at their highest levels since August 2024. Spot demand remains sluggish, as the market saw significant forward sales at the end of last year. Offers for February and March are ongoing, with prices ranging between USD 310-320/tonne CFR.

The Southeast Asian MOP market experienced another quiet week, as the peak of the tender season has yet to begin. Sellers continue to target prices at USD 300/tonne CFR and higher, with expectations that palm oil prices will support demand in the coming weeks.

In India, negotiations for the 180-day MOP contract for 2025 have yet to begin, with neither producers nor Indian importers engaging with one another as of January 16. In the meantime, MOP volumes are being steadily imported at the previous price of USD 283-285/tonne CFR.

Potash prices in the US are expected to rise ahead of Trump’s inauguration, as the market grows increasingly concerned about potential tariffs.

Ammonia Prices Face Pressure

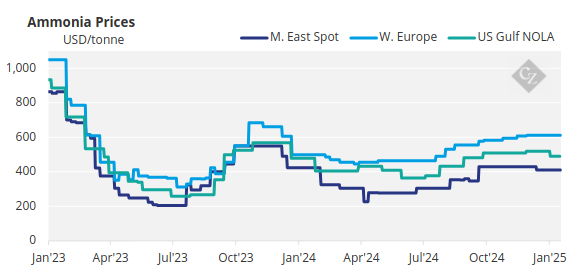

Amid healthy supply on both sides of the Suez, ammonia prices remain under varying degrees of pressure across most regions, with global demand currently almost entirely limited to Northwest Europe.

February’s Tampa settlement could see a decline of at least USD 30-40/tonne from the USD 538/tonne CFR agreed for January.

Unsubstantiated rumours suggest that the 1.3 million tonne/year Gulf Coast Ammonia (GCA) facility in Texas City may soon begin exports, which could exert significant downward pressure on prices. However, this remains just a rumour for the time being.