Insight Focus

Strong New Zealand supply continues; FMD disrupting German exports and intra-EU pricing dynamics. Warm weather and supplements boost New Zealand flows. German milk accounts for 22% of EU output, with ripple effects likely to boost non-German EU prices. Butter pricing remains under scrutiny as global shifts unfold.

New Zealand Supply Remains Strong

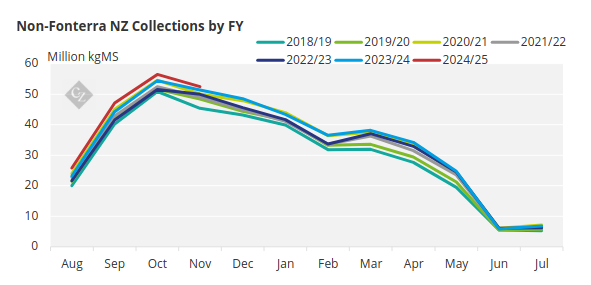

New Zealand October milk collections rose 2.7% YoY to 245.8 million kgMS, placing the season in fourth in all-time year-to-date collections.

Based on Fonterra’s 1,498 million kgMS we believe that it was up 2.9% year on year in November, probably with North Island collections driving these gains. The non-Fonterra group are then up 2.1% year over year, continuing its solid growth, and holding a 21.3% market share for the Fonterra financial year to date.

Competition is intensifying, with one processor touting a rival’s product to multinational clients, hinting at an expected asset acquisition this year.

Rainfall was high across the South Island and eastern North Island, while the central and western North Island remained drier. This is reflected in the NIWA Soil Moisture data, highlighting that Waikato remains the “risk region” this season. Ironically this is also the main center for competition for milk supply.

Temperatures in December 2024 continued to be on the warmer side in New Zealand, 1.5°C above the 30-year average. Warm conditions, generally good rainfall and high milk prices (resulting in high supplement purchases) are easy culprits for the strength of milk flows that are being observed.

Putting all of this together, my expectation is that we should see the December 2024 milk production print nearer to +2.6% year over year for a total of approximately 231 million kgMS. There should be plenty of Whole Milk Powder available soon.

German Foot and Mouth Disease (“FMD”) Outbreak

Following the first FMD case detected in Germany on January 10, the UK, South Korea and Mexico were swift to enact a ban on German dairy product imports. What is more important to note is that Veterinary Certificates for non-EU exports are suspended until Germany regains its ‘free from foot and mouth disease’ status from the World Organization for Animal Health (see Chapter 8.8 here for specific details on timelines for German to regain this status).

Will this affect all EU pricing negatively or just German products? It is most likely to be bearish for German pricing only. The outlook for other-EU origin products is less clear. I would argue that it is probably bullish these other-EU origins.

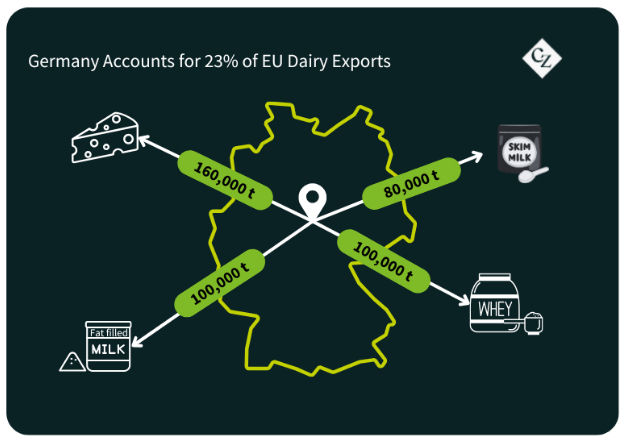

Why would this be bullish? Well, Germany accounts for a full 22% of all EU milk production, so if it is unable to export then we must assume that its share of intra-EU trade will increase substantially, while the other member states pick up the slack on exports. The immediate transition period from German to alternate-EU origins is where a market tightening and thus price spike is most likely to be felt – provided buyers of non-German EU product remain confident that the virus does not spread beyond Germany’s borders.

Germany accounts for approximately 23% of all EU dairy exports. Outside of the EU, Germany usually exports about 160,000 tonnes of cheese (to the UK and Japan especially), 80,000 tonnes of SMP (to Egypt, Vietnam, Saudi Arabia, and Oman especially), 100,000 tonnes of FFMP (to the UK and Nigeria especially), and 100,000 tonnes of whey powder and WPC (to China, Indonesia, and Malaysia especially).

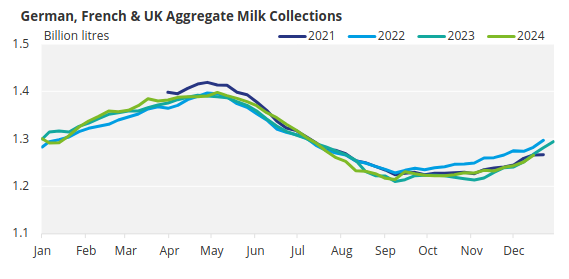

Fears around German products within the EU could lead to increased processing of German milk into storable commodities while the market awaits clarity. If these goods cannot be exported, then it will create a glut within Germany and essentially remove milk production from the global system. This all at a time when German milk flows are ramping up quickly toward peak, having finally caught up to prior year from about week 50 in 2024.

Last month we were already noting that German milk fat content and herd size were both down significantly in 2024, directly impacting butter availability. We had asked if the expected price cliff for butter was going to be quite so steep/soon? The FMD outbreak could unexpectedly stabilize German butter prices, with potential ripple effects across the broader EU butter market.

Milk collections in the major producing countries Germany, UK and France close the year a cumulative 0.19% up in 2024 according to our calculations. Week 51 aggregate collections were down just 0.15% across the group. UK collections took off from September and have driven the relatively flat result for the group.

The wider EU was up 0.6% on milk collections through to November 2024.

Elsewhere in the Dairy Market

Trump takes office next week and the world will be watching his first moves closely. Any tariffs implemented are likely to further disrupt the dairy market.

Fonterra added 2,395 tonnes of AMF to its 12-month GDT offer volumes, with historically significant offer volumes coming in February, March and April events. On the contrary, as we have pointed out several times already, the March butter offer volumes are tiny, SGX-NZX Open Interest is already over 90% of this. I am somewhat contrarian to the global view and think that we might see sustained strength in global butter pricing to come.

The EU/New Zealand SMP spread is currently at the 29th percentile, with EU origin product at a discount to New Zealand. The dotted line in the chart below represents the change to the spreads post-COVID which we have discussed previously. Given the EEX settlement includes German SMP pricing I would expect a short-term widening of this spread (even with strong New Zealand production).