Insight Focus

PTA and PET Futures surged on higher crude prices, as Brent oil pushed past USD 82/bbl. PET resin export prices gained steadily but failed to keep in touch with raw material costs. Futures forward curves continued to show minimal forward premiums through to Sept’25.

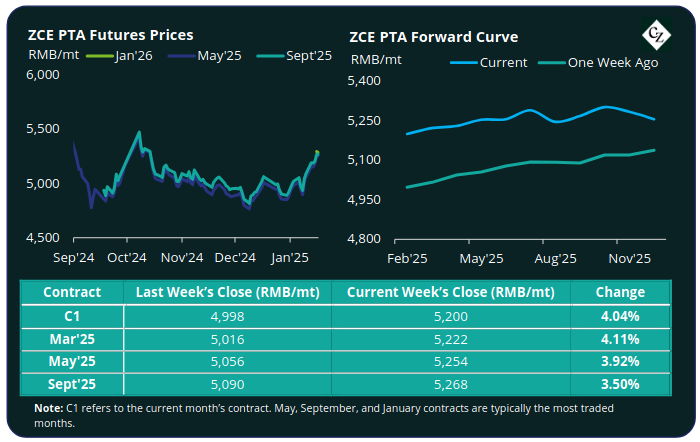

PTA Futures and Forward Curve

PTA Futures surged by over 4%, driven higher by the continued crude rally and its trickle-down effect on upstream pricing.

Crude oil prices saw further increases last week, extending to a three-week stretch of gains. A combination between supply concerns from US sanctions on Russian oil and expected US demand recovery on interest rate cuts supported the buoyant sentiment.

The PX-N CFR spread continued to improved strongly, widening to over USD 190/tonne by Friday. Whilst the PTA-PX CFR spread kept relatively steady, with the weekly average dropping just USD 1/tonne to USD 79/tonne.

PTA operating rates remained relatively unchanged as the market saw a balance of both restarts and shutdowns. However, polyester production continued to ease, as a result PTA inventories are expected to build into Chinese New Year and through early February.

The PTA forward curve flattened somewhat, with the May’25 contract narrowing to RMB 54/tonne premium over the Jan’25 contract; Sept’25 with a RMB 68/tonne premium.

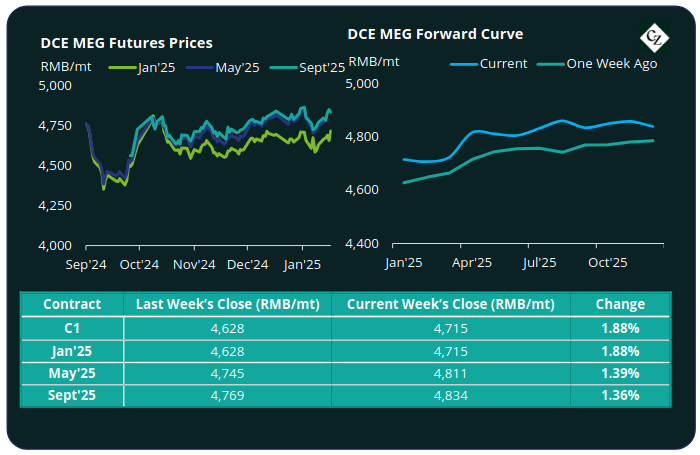

MEG Futures and Forward Curve

MEG futures increased modestly supported by higher crude prices, with main contract months up by an average of around 1.5%.

East China main port inventories steadied last week following the previous increase, up just 0.2% to 503,000 tonnes by Friday, kept at bay by increased daily offtake.

In the immediate term the MEG market faces a slowdown in offtake over CNY, whilst arrivals continue at pace leading to potential inventory accumulation on lower polyester operating rates. Post-CNY, renewed offtake will keep the market strong.

The MEG Futures forward curve also flattened slightly, still with only a modest carry through the next 12 months.

The May’25 contract held a RMB 96/tonne premium over the main Jan’25 contract; Sept’25 at a RMB 119/tonne premium.

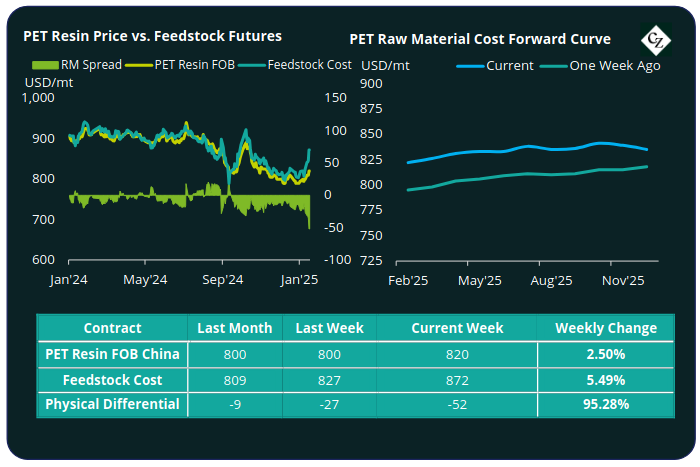

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices firmed through the back half of last week on higher raw material costs. By Friday, the China PET resin export price averaged USD 820/tonne, up USD 20/tonne from the previous week.

The average weekly PET resin physical differential against raw material future costs plummeted to negative USD 40/tonne last week, as Chinese PET producers were unable to push prices higher to recoup the large increase in raw material futures, USD 21/tonne lower than the previous week.

By Friday, the daily differential had fallen further to negative USD 52/tonne.

The raw material cost forward curve has kept a slight contango through 2025 with May’25 holding a USD 11/tonne premium over the current month’s contract, and Sept’25 holding a USD 14/tonne premium.

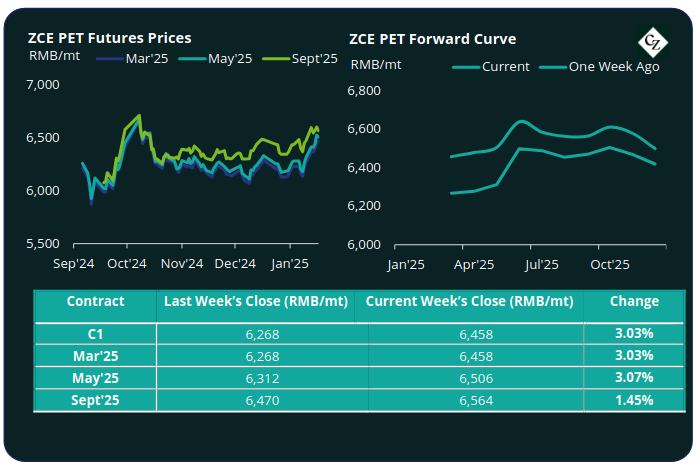

PET Resin Futures and Forward Curve

PET Resin Futures also performed strongly last week, with main contracts up by over 5%, although still some way off their Oct’24 highs.

The Mar’25 contract, the first contract month of these new futures, increased to RMB 6,458/tonne (USD 883/tonne), equating to an FX adjusted gain of USD 28/tonne versus the previous week.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures had fallen to around USD 17/tonne, down from USD 4/tonne. By Friday, the daily premium was USD 16/tonne.

The PET Resin Futures forward curve flattened moderately across the main contract months; May’25 holds just a USD 6/tonne premium over the main Mar’25 contract; Sept’25 a USD 14/tonne premium.

Concluding Thoughts

Chinese and Asian PET resin export prices failed to keep pace with the rapid rise in raw material costs last week, resulting in a significant squeeze in producer profitability.

Weak PET resin market fundamentals, brought by overcapacity and off-peak seasonality, has led to producers struggling to push resin prices higher due to a combination of greater competition, FX challenges, and a slowdown in many Asian markets ahead of New Year celebrations.

Post-CNY container freight rates are expected to ease further supporting additional export activity in the run up to the March/April buying season, which may help producer recover somewhat.

However, forward curves for both PET resin and the raw material futures show minimal carry through to May’25, meaning producers may face continued buyer resistance to higher resin values.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.